Home / Intelligence / Blog / What Market Access Opportunities Exist for Oncology Products in China? An Analysis of Oncology Product Inclusion in the 2020 NRDL

Published August 16, 2021

Executive Summary

- Recent updates in the National Drug Reimbursement List (NRDL) have increasingly focused on the expansion of oncology products and highlighted the improving market access environment for innovative oncology therapies in China

- This effort first came under the spotlight in 2018 as the National Health Security Administration (NHSA) announced the inclusion of 17 novel oncology agents on the NRDL with discounts averaging ~60%. Subsequent NRDL updates saw comparable levels of price discounts and selection of products targeting the most prevalent cancer types in China

- An increasing number of domestic manufacturers succeeding in NRDL negotiations have placed significant pressure on multinational products. This is particularly prominent in the PD-(L)1 inhibitor space, where intense in-class competition has created significant pricing pressure, culminating in no overseas PD-(L)1 brands being listed on the NRDL

Trinity’s Take: While the NRDL presents increasing reimbursement opportunities for oncology products in China, pricing restrictions will remain as a key challenge. In order to defend pricing in NRDL negotiations, manufacturers should consider targeting indications with high unmet needs and low competition from domestic brands, as well as investing in therapies that are truly differentiated on the basis of clinical value.

2020 NRDL Oncology Drug Inclusion – Key Features & Trends

Fourteen oncology drugs were successfully negotiated and included on the 2020 NRDL. As the new prices became effective from March 01, 2021, the following key features and trends are observed:

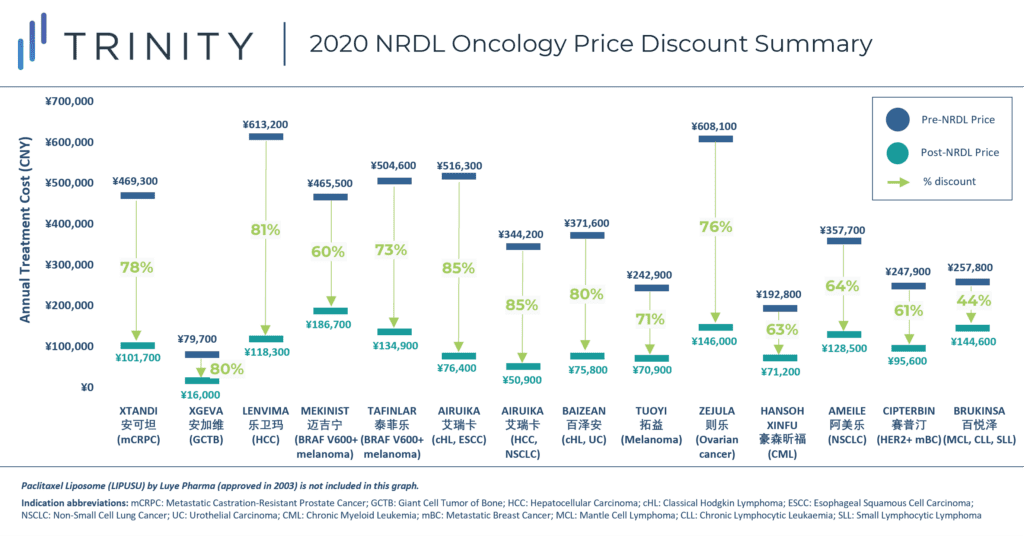

- Oncology discounts higher than the average NRDL products discounts: The average price discount for the 14 negotiated oncology drugs was ~70%, which was higher than the average price discount for all products included in the 2020 NRDL update (50%). The highest price discounts (above 80%) were seen with BeiGene and Hengrui’s PD-L(1) inhibitors (BAIZEAN and AIRUIKA, respectively), Amgen’s XGEVA and Eisai’s LENVIMA.

- Annual treatment costs fell within CNY 200k: The annual treatment costs (based on the negotiated prices) of all new oncology products were within CNY 200k / year (FIGURE 1), indicating a potential annual price cap considered for novel oncology treatments.

FIGURE 1

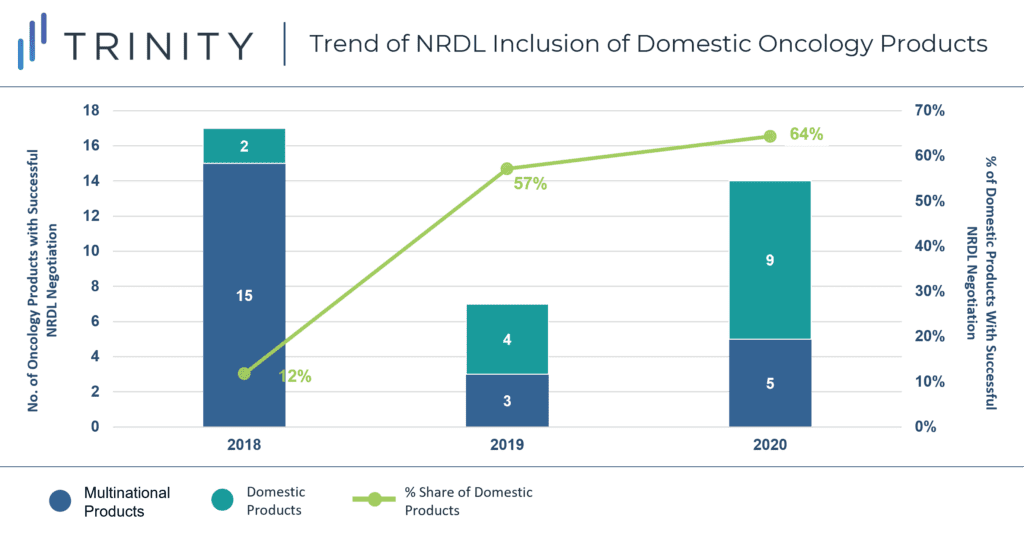

- Growing presence of domestic products in NRDL negotiations: 9 out of the 14 negotiated oncology products (64%) were from domestic manufacturers. Compared with the % share in previous years (57% in 2019 and 12% in 2018), the 2020 update showed an increasing role of domestic players in NRDL negotiations (FIGURE 2).

FIGURE 2

- Reduced time-lag between regulatory approval and NRDL inclusion: In line with previous NRDL rounds, the 2020 update again saw new products achieving NRDL inclusion shortly after regulatory approval, enabling manufacturers to maximize market penetration as early as possible. Among the 14 negotiated products, three (AMEILE, CIPTERBIN, BRUKINSA) were approved in 2020. The trend also suggests an opportunity for manufacturers to prepare early for NRDL negotiations (e.g., preparing dossier submission and seeking KOL advocacy in advance of, or in parallel to regulatory filing for approval).

- Improved sales performance following NRDL inclusion: BeiGene reported in its Q1 2021 earnings that the NRDL inclusion of BAIZEAN (tislelizumab), BRUKINSA, and XGEVA has led to significant increases in the number of hospital formulary listings to approximately 4x, 8x, and 6x their respective levels prior to NRDL inclusion, and product revenue grew sequentially as volume offset the effect of price reduction. In the same quarter, Zai Lab also highlighted revenue growth partly due to an increased volume sale of ZEJULA following NRDL inclusion. These examples continue to demonstrate the importance of NRDL as a major market access pathway in China, which can help to boost product commercial opportunity significantly.

Deep Dive into PD-(L)1 Coverage and Pricing Dynamics

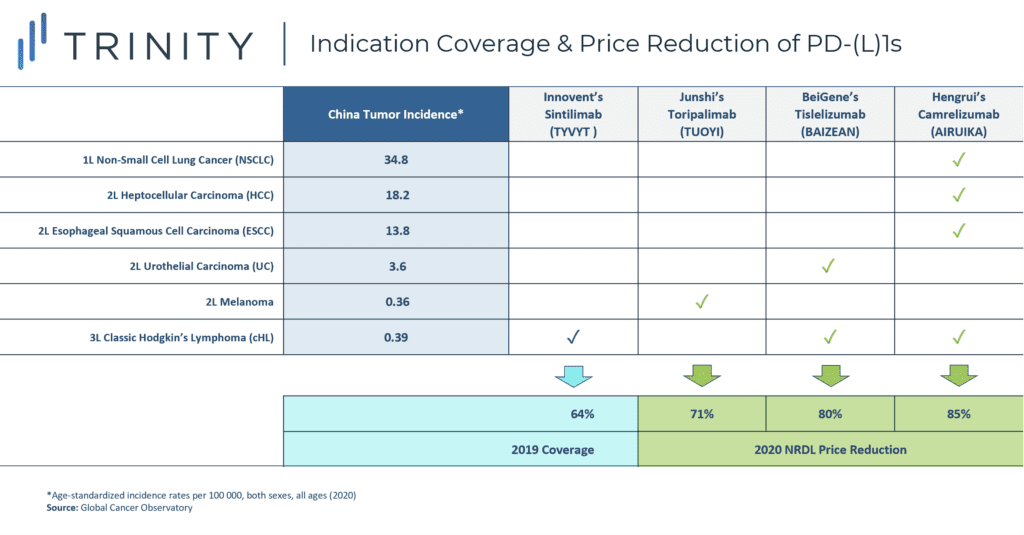

PD-L(1) coverage of the 2020 NRDL was characterized by the complete dominance of domestic manufacturers over multinational companies (MNCs). In addition to Innovent’s sintilimab, which was already included on the NRDL in 2019 for classical Hodgkin’s lymphoma, the 2020 NRDL saw three new domestic PD-(L)1 entrants, all of which offered steeper price discounts than sintilimab in 2019. The magnitude of discount varies by the indications covered as well as the associated budget impact (FIGURE 3).

Hengrui’s camrelizumab obtained the broadest coverage across four indications, and these include some of China’s most prevalent tumor malignancies such as liver cancer, non-small cell lung cancer, and esophageal cancer. First-line use in NSCLC also implied a higher utilization and budget impact. As a result, Hengrui offered the steepest price discount amongst all listed PD-(L)1s at 85%. BeiGene’s tislelizumab was included for two indications with lower incidence rates (urothelial carcinoma and classical Hodgkin’s lymphoma) and hence had a slightly lower price discount of 80%. Junshi’s toripalimab offered a 71% price discount for coverage of a single indication, melanoma.

FIGURE 3

Remaining multinational PD-(L)1 brands, including Merck & Co.’s KEYTRUDA, Bristol-Myers Squibb’s OPDIVO, Roche’s TECENTRIQ and AstraZeneca’s IMFINZI have all failed to enter the 2020 NRDL. Exclusions are likely due to:

- Low manufacturer willingness to discount due to the global pricing impact ramifications

- Inability to match domestic PD-(L)1 price points due to higher overseas manufacturing cost

- Significant price discounts expected by the NHSA for drugs with high budget impact and multiple approved indications (e.g., KEYTRUDA is approved for six indications, including three for the first line use in various types of lung cancer)

What are the Alternative Market Access Options Outside of the NRDL?

Given the uncertainties and challenges around NRDL negotiation, manufacturers may focus on alternative routes to support patient access should their oncology products fail to gain national reimbursement.

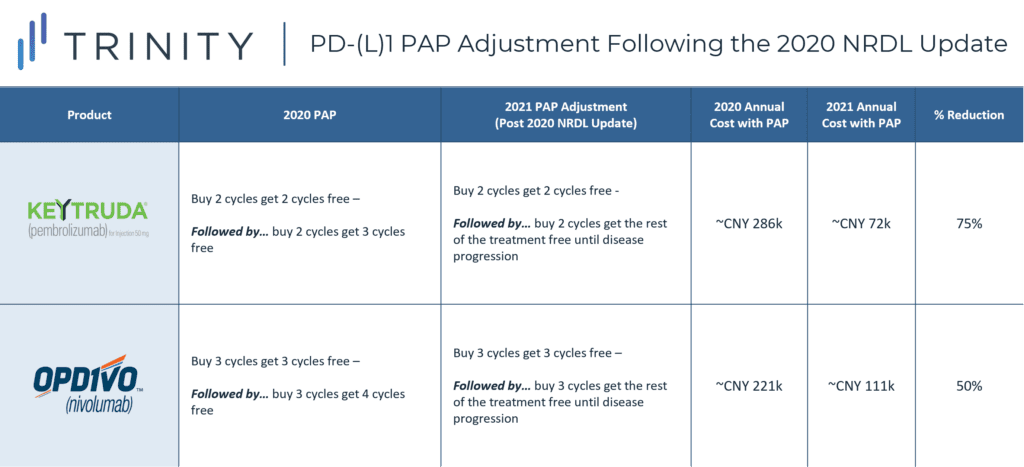

In the self-pay market, manufacturers (especially MNCs) often engage in patient assistance program (PAP) to reduce patient out-of-pocket costs while maintaining a high list price. These PAPs are typically offered in the form of “Buy X cycles, Get Y cycles free” and all PD-(L)1s licensed in China have engaged in PAPs upon product launch.

Following the 2020 NRDL update, Merck and BMS both expanded their PAPs to remain competitive against domestic players (TABLE 1). KEYTRUDA’s PAP was upgraded to allow patients to receive free KEYTRUDA treatment until disease progression following 4 initial out-of-pocket treatment cycles. This has essentially reduced the annual cost of KEYTRUDA by 75% from CNY 286k to CNY 72k, reducing the gap between MNC and domestic products (annual cost ~CNY 51k-67k). Through PAPs, manufacturers can continue to build market presence and awareness in the self-pay market and will be better positioned to succeed in future NRDL negotiations.

TABLE 1

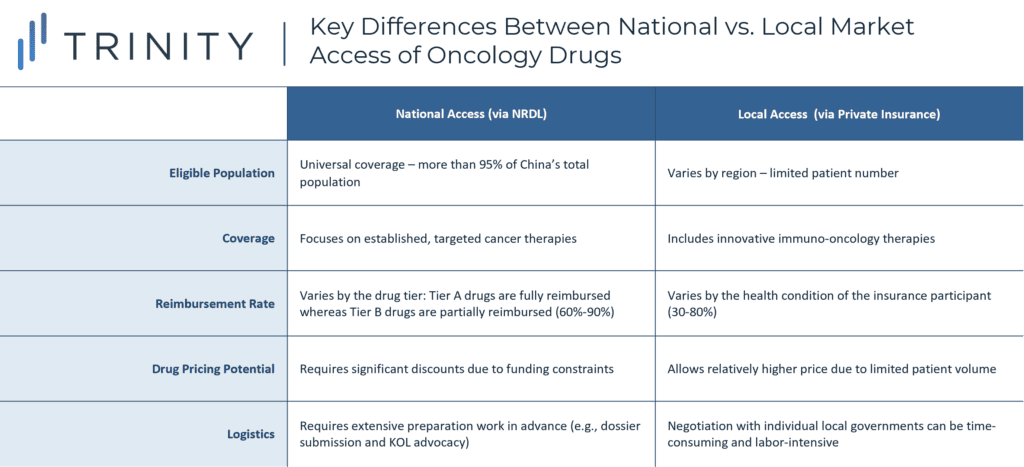

In addition to PAP offering, manufacturers may also leverage China’s growing commercial insurance market to gain regional or local access. “Hui Min Bao (惠民保)” is a tailored, low-premium commercial insurance scheme that is led by local governments and underwritten by private insurance companies to supplement patients’ medical expenses beyond the basic medical insurance. This type of commercial insurance has gained widespread popularity since 2020 and is now available in 179 cities across the 23 provinces in China. It is particularly relevant for high-cost disease areas such as oncology, as patients with pre-exiting conditions can enroll and gain access to drugs that are not included on the NRDL. For example, Hangzhou’s Hui Min Bao covers all eight PD-(L)1s that are licensed in China, and with a low premium of CNY 150 per year, Hangzhou citizens can receive of up to CNY 3 million coverage for medical and drug expenses. TABLE 2 outlines some of the key differences between national vs. local access of oncology drugs.

TABLE 2

What Does the Future Access Landscape Look Like for Oncology Products in China?

As China continues to push for domestic innovation in the biopharmaceuticals sector, additional innovative oncology therapies are likely to emerge from domestic manufacturers to compete with MNCs for NRDL inclusion. In drug classes and indications with entrenched competition, manufacturer willingness to discount will continue to serve as the most critical success factor for NRDL inclusion. While alternative pathways to secure patient access outside of the NRDL exist, in the long run, manufacturers are better positioned to defend their pricing by targeting indications with limited competition from domestic brands, as well as investing in therapies that are truly innovative and differentiated on the basis of clinical value.

Written by: Flora Chung, Wenting Zhang, PhD

Related Intelligence

Blog

Rise with the Waves: UK – Now and Beyond – Four Policy Trends That May Shape Pharma’s Future

Executive Summary The global payer landscape is rapidly evolving and is expected to continuously impact manufacturers’ decisions about new launches, portfolio management, trial design and importantly, pricing and market access strategy. In the UK, several policy reforms have been introduced which are expected to improve patient access while balancing financial healthcare sustainability and overall market […]

Read More

Blog

Japan Pricing Policy Reform 2024

Executive Summary The Central Social Insurance Medical Council, the key Japanese reimbursement policy panel known as Chuikyo, introduced the 2024 drug pricing reform in April 2024. Some key features of the reform plan include: The reform outlines a suite of measures aimed at driving innovation while also addressing drug lags (delay in manufacturers launching drugs in Japan […]

Read More

Webinars

HTA Vision—Implications Beyond the Rating

Available On Demand

A number of critical manufacturer activities are informed by understanding health technology assessment (HTA) agency behavior across geographies and therapeutic areas—from pipeline, business development and licensing to launch planning preparation through to lifecycle management strategy. Join Max Hunt, a Partner in Trinity Life Sciences’ Evidence, Value, Access & Pricing Practice, as he hosts a lively […]

Watch Now