Rise with the Waves: State of the Global Policy Landscape

Home / Intelligence / Blog / Rise with the Waves: Germany – A Tale of Two High Impact Policies Shaping Pharma’s Future

Published February 26, 2024

Executive Summary

Multiple cost-containment reforms, such as the introduction of a 20% rebate on brand-brand combinations and a temporary increase in the mandatory rebate on drugs to 12%, were implemented under Germany’s ‘Financial Stabilization of Statutory Health Insurance System’ Act (GKV-Finanzstabilisierungsgesetz) in 2023. The evaluation report of these strategies showed that the actual savings for the year fell short of the proposed target (25% deficit, €1.4 Bn vs. target of €1.9 Bn) for all such reforms except 30% higher savings with the increased mandatory rebates (€1.3 Bn vs. expected target of €1 Bn). The review of the measures under this Act will be continued into 2024, however, it is expected that the predicted savings are unlikely to be achieved.

This may prompt revisions to the reforms in the future amidst scrutiny from pharma manufacturers as well.

This blog focuses on two high-impact policies in Germany and the opportunities and challenges they present which companies will have to consider when optimizing the pricing and market access potential for their assets.

Key Policy Updates

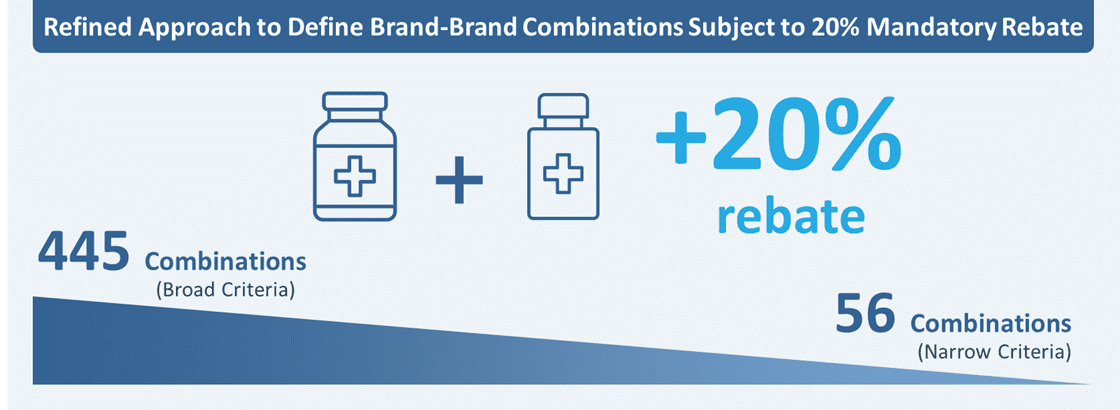

Refined Approach to Define Brand-Brand Combinations Subject to 20% Mandatory Rebate

One of the most controversial reforms proposed in the GKV-Finanzstabilisierungsgesetz was the introduction of a 20% rebate in the AMNOG rebate negotiation for brand-brand combination products (excluding combination therapies that receive a major or considerable added benefit rating), potentially impacting for the first time the combination backbone which is currently not taking a price cut unless their label is updated.

The first list (445 combinations) proposed by the G-BA in August 2023 comprised of theoretically all possible combinations wherein the drugs were assigned to specified, unspecified and open combinations.* The pharmaceutical industry, however, strongly objected to the G-BA proposal because of how broadly these combinations were defined. This prompted the G-BA to refine the eligibility criteria in October 2023 to focus on a drug’s combination use within the EPAR or SmPC. These criteria resulted in a significant reduction in the listed combinations from 445 to 56. This list is expected to continuously evolve while negotiations are still ongoing between manufacturers and statutory payer representatives regarding the framework agreement.

HIGH PRICING AND MARKET ACCESS IMPACT: Manufacturers can expect a decrease in the price margin for drug sales linked to eligible brand-brand combinations to the mandatory rebate, with a reduction in the net-to-gross profit. Manufacturers can learn from and better understand how revenue recognition will evolve for the refined list of combinations and accordingly, devise launch strategies for their pipeline assets.

FUTURE OUTLOOK: Continuously review updates/revisions to the list of eligible brand-brand combinations and the resulting framework agreement between the manufacturers and statutory payer representatives.

Introduction of confidential discounts

In December 2023, the German Cabinet approved a ‘Strategic Paper’ proposing several measures including the introduction of confidential discounts within the price agreements established through the AMNOG procedure. This implies that instead of publicly disclosing the negotiated reimbursement prices, the negotiated (net) prices would now remain confidential (as is the case in most EU markets). This is not the first time that confidential discounts were proposed in a draft bill, the last failed attempt was in 2017.

Under this current proposal, as a key measure within the draft Medical Research Act distributed to stakeholders in January 2024, the confidential price must still be disclosed to public and private payers, hospitals, and the GKV-SV. Confidentiality of the negotiated prices (with confidential discounts accounted for without considering prices in other European countries) would apply until the expiry of the product’s regulatory data exclusivity (i.e., currently limited to 10 – 11 years in Europe). Additionally, the request to keep the negotiated prices confidential can be made by a pharmaceutical company during the first price negotiation of a new drug. While the negotiations are ongoing, the drugs will be sold at the

list price.^

HIGH PRICING AND MARKET ACCESS IMPACT: In a clear attempt to make the German market more attractive to pharma, the introduction of confidential discounts marks a seismic shift in protecting drug prices and avoiding drug withdrawals in Germany by maintaining a higher visible price. Moreover, given IRP considerations, this measure may also help protect revenue outside of Germany. However, manufacturers can expect a downside impact on the net revenues due to lower negotiated prices (potentially more aggressive discounts at the net price level). Further, this reform is expected to result in a significantly increased bureaucratic and administrative burden for all the involved stakeholders including health insurance companies.

FUTURE OUTLOOK: It is yet to be clarified when this proposal would come into effect. However, there is a high likelihood that it may be introduced alongside one of the other bills proposed by the Health Ministry early in 2024. Manufacturers should monitor the possibility of public viewing of negotiated prices in case of price arbitrations (when price negotiations with the GKV-SV fail) in-line with the current process which allows for the visibility of negotiated prices. Further, it would be interesting to monitor the potential impact of such a provision on the AMNOG process timelines which are otherwise strictly regulated.

Conclusions

Recent policy trends in Germany such as the ones herein discussed clearly reflect the focus in cost-containment efforts which are likely to impact pharmaceutical manufacturers future assets’ commercial potential with stronger pricing headwinds. However, amidst the industry criticism and a wave of product withdrawals from the German market, latest policies are being shaped with the parallel goal of maintaining Germany’s attractiveness to pharma.

It is imperative for manufacturers to closely monitor further development of these trends and any additional cost-saving measures that may be introduced in future. Further, they should assess the potential impact of these policies given significant landscape shifts and actively strategize to optimize future assets’ pricing and market access potential.

Further Impactful Policy Changes

UPCOMING: Introduction of biosimilar substitution law by 15 March 2024 for parenteral preparations (to be expanded to other formulations in the next couple of years) to increase patient access to more cost-effective biologic options at the point of dispensation.

ONGOING: Reversal of the mandatory rebate on patented drugs back to 7% for 2024 vs. 12% for 2023 (the impact on overall healthcare savings in 2024 compared to 2023 will likely determine the future target).

Acronyms: GKV-Finanzstabilisierungsgesetz: Germany’s ‘Financial Stabilization of Statutory Health Insurance System’ Act; GKV-SV: Financial Stabilization Act; AMNOG: Pharmaceuticals Market Reorganisation Act; G-BA: The Federal Joint Committee; EPAR: European Public Assessment Report; SmPC: Summary of Product Characteristics; IRP: International Reference Pricing

Notes:

*Specified combinations (33): one or more individual active substances are specifically named that can be used in combination with an evaluated medicinal product; Unspecified combinations (138): information is available on a combination therapy, but no specific active substances are named; Open combinations (274): the SmPC does not contain any information that would normally prevent a combination therapy with an evaluated drug

^The pharmaceutical company will cover the price differential between list price and the negotiated price, including the corresponding wholesaler and pharmacy margins

AUTHORS: Nikhil Taxak, Andreia Ribeiro, Harshmani Sapra, Karla SanchezGonzalez, Salome Monreal Louly, Maximilian Hunt

Related Intelligence

White Papers

2023 NRDL Pricing Implementation and Market Access Outcomes Update

The National Reimbursement Drug List (NRDL) negotiations are expected to conclude by November 2024, with pricing outcomes gradually being revealed starting in January 2025. The Trinity Life Sciences team has reviewed the 2023 NRDL inclusion and pricing results, drawing some key learnings.

Read More

Webinars

Innovation in Value Strategy: Disrupting the Value Communication Landscape

Available On Demand

Working at the cutting edge of pricing and market access for innovative therapies launched over the last decade, Trinity Life Sciences has seen new diseases, technologies and decision drivers emerge. These have demanded the innovation and testing of new methods and concepts for communicating value to healthcare payers. In this webinar, we will briefly review the core, timeless principles […]

Watch Now

White Papers

Solving a Pervasive Challenge: Breaking Down Silos in Life Sciences

Experts at Trinity Life Sciences interact with the inner workings of pharma from many perspectives as they engage with teams across life sciences organizations. A common observation is that teams are working in silos: often unaware of what other teams are doing, sometimes pulling in different directions and frequently experiencing frustrations. Internally, siloed working can […]

Read More