Home / Intelligence / Blog / Highlights of the 2022 National Reimbursement Drug List (NRDL) Negotiation Outcome

Published March 10, 2023

Executive summary

- 83 non-traditional Chinese medicines successfully entered the National Reimbursement Drug List (NRDL) for the first time. This is a >20% increase from the 2021 and 2020 NRDL updates, indicating the growing interest of both manufacturers and payers to ensure reimbursement for novel therapies in China.

- The percentage of products achieving NRDL inclusion within one year of regulatory approval continues to increase steadily, from 24% in 2020 to 53% in the 2022 update, keeping up the strong momentum of securing NRDL reimbursement for innovative therapies soon after National Medical Products Administration (NMPA) approval.

- The NRDL inclusion failure of the domestic CAR-T therapy Relma-cel suggests that payers in China are less willing to compromise on annual price ceiling, even for high-value products and that manufacturers should set realistic pricing expectations entering NRDL negotiations.

- Oncology and rare disease remain the therapeutic areas of focus, with more rare disease therapies listed and higher negotiation success rates in the 2022 NRDL update compared to the previous.

Highlight 1: Increased presence of multinational corporations in newly listed products from the 2022 NRDL negotiations

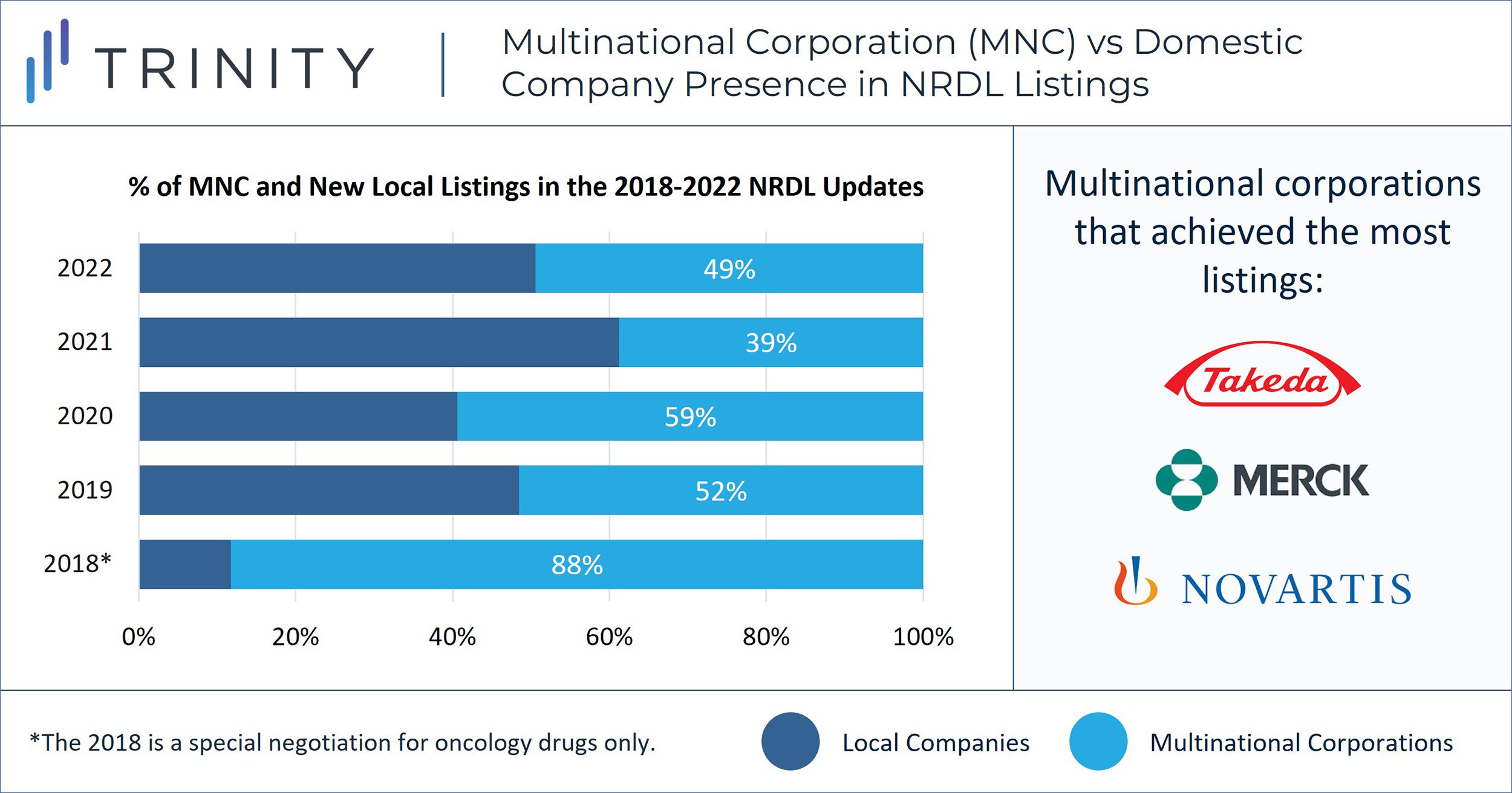

The 2022 NRDL negotiations finished immediately before the week-long Chinese New Year holidays in January 2023, adding 83 novel non-traditional Chinese medicines to the NRDL for public reimbursement. This is a significant increase (>20%) from the 66 novel non-traditional Chinese medicines listed after the 2020 NRDL negotiations and the 67 listed after the 2021 NRDL negotiations. Of the 83 newly listed products, ~50% are from multinational corporation (MNC) companies. While the percentage of MNC products that are successfully listed through negotiations fluctuates every year, we have observed a trend of consistent MNC efforts in achieving innovative therapies listed on NRDL despite competition from domestic / local companies (FIGURE 1).

Takeda, Merck and Novartis achieved successful NRDL listing of four products each, followed by Roche and Pfizer with two listings each. Takeda’s oncology products, Alunbrig® and Adcetris®, as well as rare disease product, Takhzyro® for hereditary angioedema (HAE), were among the products successfully included this year.

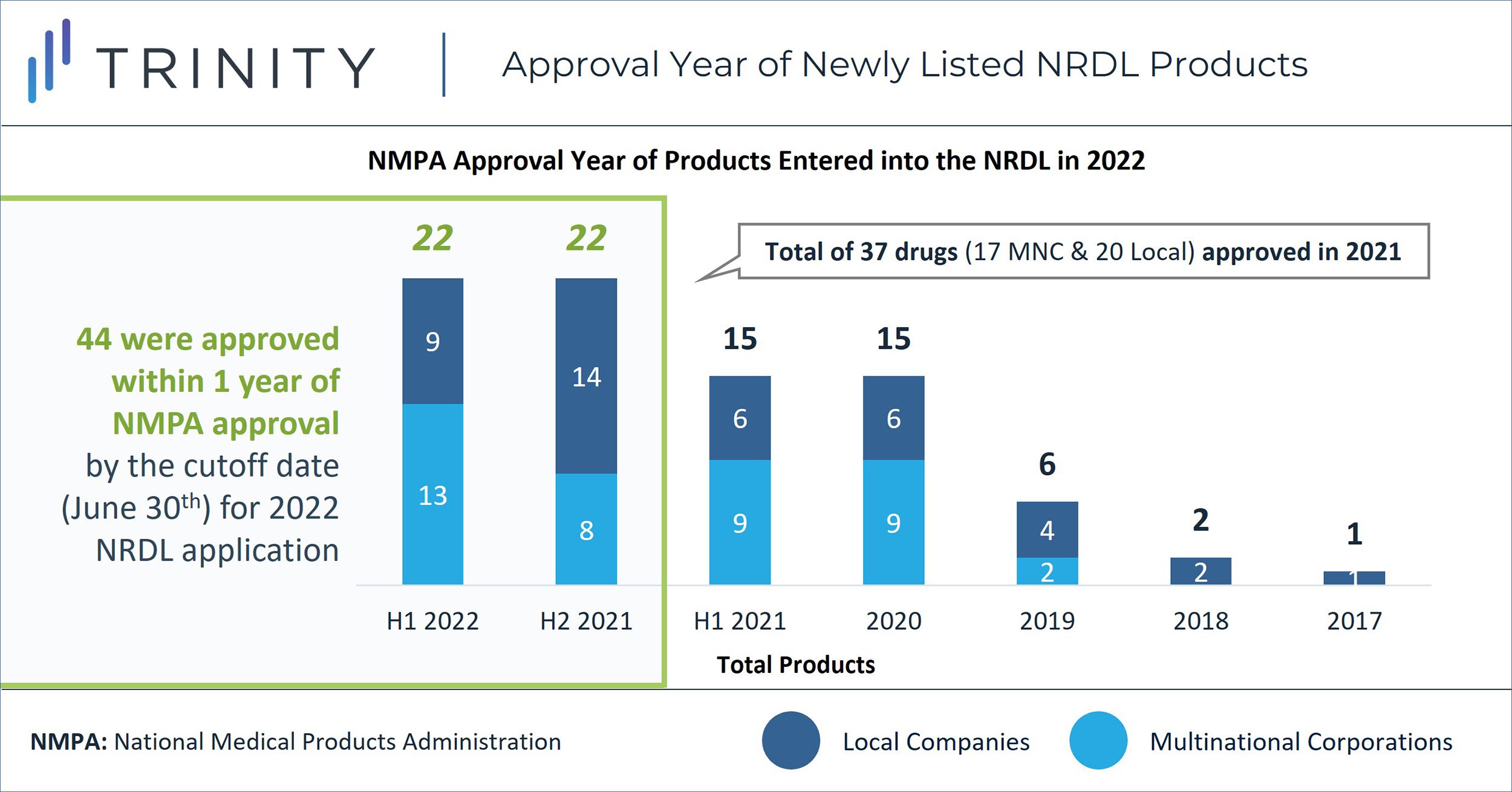

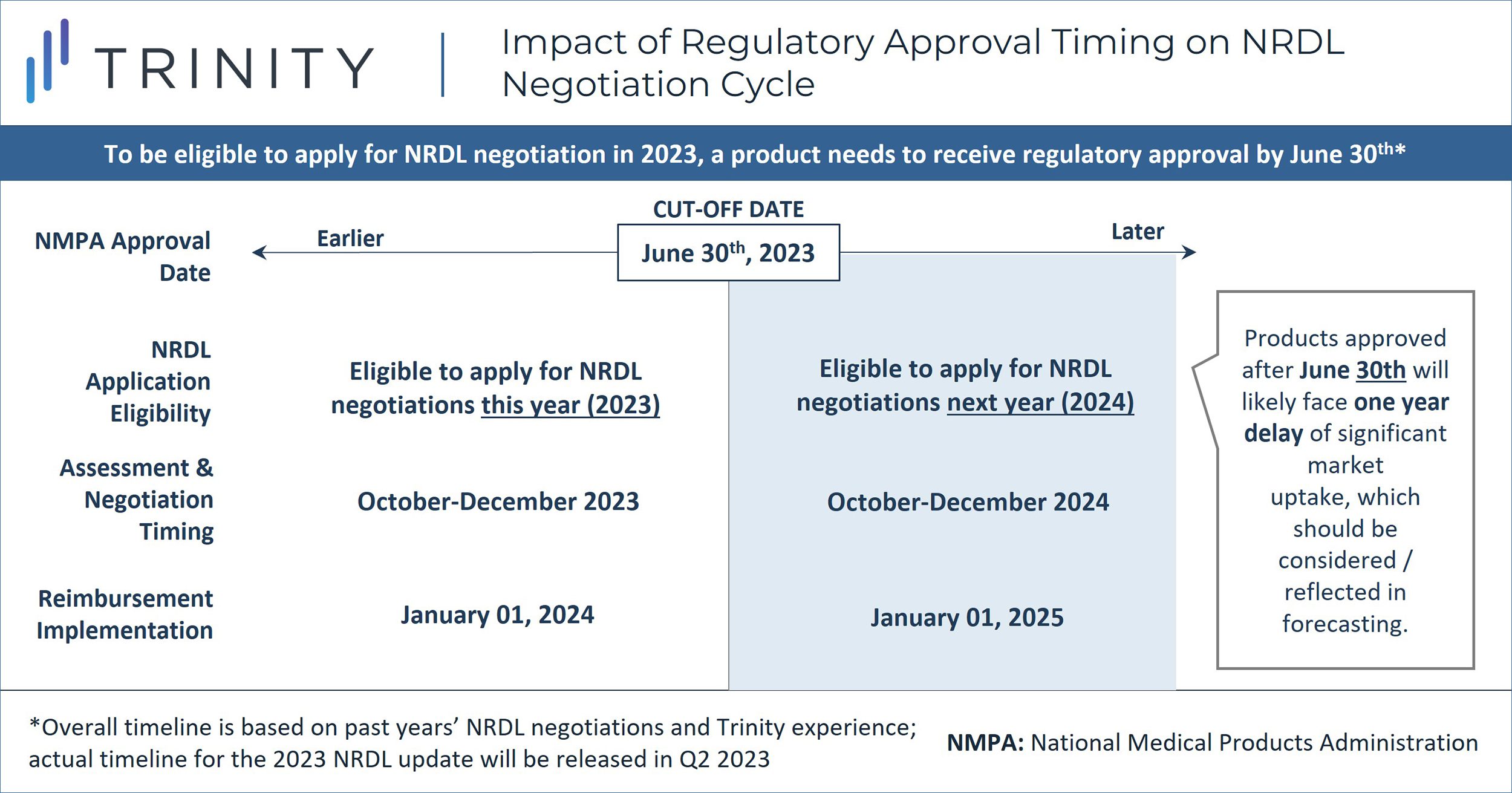

Highlight 2: The interest and momentum of securing NRDL reimbursement for innovative therapies soon after regulatory approval remains strong

Similar to the 2021 NRDL update, we observed strong interest in getting innovative therapies listed on NRDL soon after approval in an effort to maximize access in China. 44 (53%) of the 83 newly listed products were approved within one year of NMPA approval by the cutoff date for the 2022 NRDL application. Among these, 23 products were approved in 2022. The percentage of products achieving NRDL inclusion within one year of regulatory approval has been steadily increasing, from 24% in 2020, to 40% in 2021, and 53% in 2022. These statistics suggest that manufacturers have become more conscious about the NRDL timeline (FIGURE 3) and strategically timed their clinical trials to achieve early patient access.

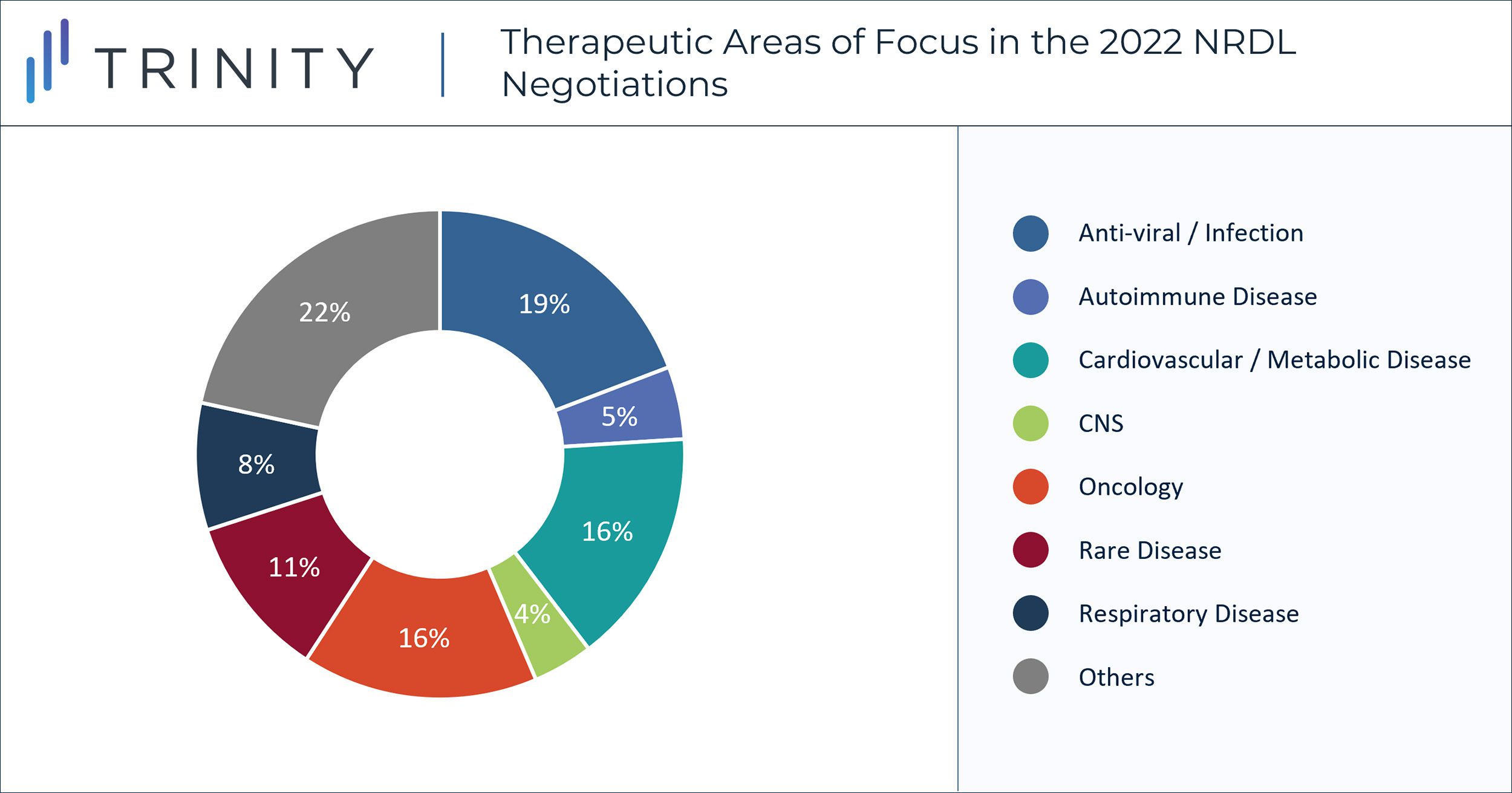

Highlight 3: Oncology and rare disease continue to remain the therapeutic areas of focus, with chronic disease and infectious disease also receiving increased attention

A total of 13 oncology drugs were successfully negotiated this year, accounting for 16% of newly listed products in the 2022 NRDL update (TABLE 1). Eight of them are from MNC companies, including two ALK+ NSCLC therapies (Alunbrig® and Lorbrena®) and three hematological oncology therapies (Adcetris®, Venclexta®, and Kyprolis®).

The high-profile JW Therapeutics’ CAR-T product, Relma-Cel, unfortunately did not get listed this year. According to Trinity Life Sciences’ primary market research, despite having fulfilled the NRDL submission/screening criteria, Relma-Cel has a prohibitively high upfront cost (USD 0.17M / RMB 1.2M), which took away the manufacturers’ opportunity to negotiate this year. Payers in China are still discussing how to best address the payment and reimbursement challenges associated with CAR-T therapies but are reluctant to change the annual price ceiling (USD 44K / RMB 300K) for NRDL reimbursement. We expect that, fueled by private insurance coverage, CAR-T therapies will remain in the private/self-pay market in the near-term, with its customers primarily from the affluent populations. It is uncertain whether the public payers would have the appetite for innovative payment agreements for CAR-Ts, similar as the agreements implemented in the United States.

Significant downward pricing pressure can also be observed in rare disease product negotiations. Out of the 19 rare disease products invited to the 2022 negotiations, only nine were successfully listed (TABLE 2). The indications for two of the listed products, Romiplate®/Nplate® (for idiopathic thrombocytopenic purpura [ITP]) and Reblozyl® (for beta thalassemia), are not officially considered as “rare diseases” in China yet based on the latest list of rare diseases published by the National Health Committee. This confirms our expectation that orphan drugs can still obtain NRDL listing even if the indication is not included in the official list of rare diseases in China. Some of the high-profile therapies not listed include Myozyme® for Pompe disease, Cerezyme® and Vpriv® for Gaucher disease, Fabrazyme® for Fabry disease, Elaprase® for Hunter Syndrome, Aldurazyme® for Mucopolysaccharidosis I, Sylvant® for Castleman disease and Crysvita® for X-linked hypophosphatemia. Trinity Life Sciences’ primary market research reported that the key reason for failing the negotiations was disagreement on pricing between manufacturers and the payers in China.

On a more positive note, compared to the 2021 NRDL negotiations where only seven out of the 22 invited rare disease products were listed (32% success rate), the 2022 negotiations for rare disease products had a better success rate (47%) and also included more therapies (nine vs seven in 2021). We expect the NRDL focus on rare disease treatment will continue in the coming years, given the healthcare policy focus and the payer mission to provide life-saving treatment to patients with high clinical unmet needs. With the potential of accessing a significant patient base and the high public priority, the attractiveness for innovative rare disease treatments to enter China is high.

Two other therapeutic areas with major wins from the 2022 NRDL negotiations are chronic disease and infectious disease. 13 products indicated for cardiovascular/metabolic disease (including diabetes) were successfully listed. 19 products for infectious disease (anti-viral and antibiotics etc.) were included in NRDL for the first time, including one COVID-19 treatment (azvudine). These inclusions echo the central government’s focus on improving population health and dedication to eliminating COVID-19.

| Product | Manufacturer | Reimbursed Indication | NMPA Approval |

|---|---|---|---|

| Lorbrena® | Pfizer | Adult ALK+ locally advanced or metastatic NSCLC | Apr 2022 |

| Alunbrig® | Takeda | Adult ALK+ locally advanced or metastatic NSCLC | Mar 2022 |

| Kyprolis® | Onyx Pharmaceuticals | Adult R/R multiple myeloma | Jul 2021 |

| Qinlock® | Deciphera Pharmaceuticals | Adult advanced GIST | Mar 2021 |

| Venclexta® | AbbVie | Adult AML | Dec 2020 |

| Adcetris® | Takeda | Adult CD30+ R/R anaplastic large cell lymphoma or classical Hodgkin lymphoma | May 2020 |

| Kadcyla® | Roche | HER2+ adjuvant, locally advanced, unresectable, or metastatic breast cancer | Jan 2020 |

| Firmagon® | Ferring Pharmaceuticals | Prostate cancer needing androgen deprivation therapy | Jul 2019 |

| Rezvilutamide | Jiangsu Hengrui Pharmaceuticals | Metastatic hormone-sensitive prostate cancer | Jun 2022 |

| Dalpiciclib | Jiangsu Hengrui Pharmaceuticals | HR+ / HER2- recurrent or metastatic breast cancer | Dec 2021 |

| Olverembatinib | Guangzhou Shunjian Biomedical Technology | Adult CML with T315I mutation | Nov 2021 |

| Savolitinib | HUTCHMED | Adult locally advanced or metastatic NSCLC with MET exon 14 skipping mutation | Jun 2021 |

| Utidelone | Chengdu Huahao Zhongtian Pharmaceutical | Locally advanced or metastatic breast cancer | Mar 2021 |

| Product | Manufacturer | Reimbursed Indication | NMPA Approval |

|---|---|---|---|

| Tiglutik™ | ITALFARMACO | Amyotrophic lateral sclerosis (ALS) | May 2022 |

| Uplizna® | Horizon | Neuromyelitis optica spectrum disorder (NMOSD) | Mar 2022 |

| Romiplate® / Nplate® | Kyowa Kirin | Adult idiopathic thrombocytopenic purpura (ITP)* | Jan 2022 |

| Reblozyl® | Celgene | Beta thalassemia* | Jan 2022 |

| Kesimpta® | Novartis | Adult relapsing multiple sclerosis (RMS) | Dec 2021 |

| Evrysdi® | Roche | Spinal muscular atrophy (SMA) in patients aged 2 months and older | Jun 2021 |

| Tecfidera® | Biogen | Adult relapsing multiple sclerosis (RMS) | Apr 2021 |

| Takhzyro® | Takeda | Hereditary angioedema (HAE) | Dec 2020 |

| Remodulin | Zhaoke Pharmaceutical | Pulmonary arterial hypertension (PAH) | Mar 2020 |

TABLE 2 | List of Rare Disease Products Successfully Included in the 2022 NRDL Update

Looking Forward

While the details of reimbursed price for successfully listed products have not been fully released to the public, we are seeing an overall encouraging outcome of the 2022 NRDL negotiations – more non-traditional Chinese medicines have been successfully listed, and there is an increased MNC presence, a shorter time gap between regulatory approval and NRDL listing and a continued focus on oncology and rare disease. The 2022 NRDL update will take effect from March 1st, 2023, and reimbursement prices will become visible afterwards. We will provide further insights on the 2022 NRDL negotiations surrounding pricing pressure in the upcoming months.

Authors: Yitong Li, PhD, Rya Zhang, Tony Xu, PhD, Wenting Zhang, PhD, Maximilian Hunt

With special thanks to Yunpeng Feng, PhD, Peter Law, Anna Chen for their valuable contributions.

Related Intelligence

Blog

Rise with the Waves: UK – Now and Beyond – Four Policy Trends That May Shape Pharma’s Future

Executive Summary The global payer landscape is rapidly evolving and is expected to continuously impact manufacturers’ decisions about new launches, portfolio management, trial design and importantly, pricing and market access strategy. In the UK, several policy reforms have been introduced which are expected to improve patient access while balancing financial healthcare sustainability and overall market […]

Read More

Blog

Japan Pricing Policy Reform 2024

Executive Summary The Central Social Insurance Medical Council, the key Japanese reimbursement policy panel known as Chuikyo, introduced the 2024 drug pricing reform in April 2024. Some key features of the reform plan include: The reform outlines a suite of measures aimed at driving innovation while also addressing drug lags (delay in manufacturers launching drugs in Japan […]

Read More

Webinars

HTA Vision—Implications Beyond the Rating

Available On Demand

A number of critical manufacturer activities are informed by understanding health technology assessment (HTA) agency behavior across geographies and therapeutic areas—from pipeline, business development and licensing to launch planning preparation through to lifecycle management strategy. Join Max Hunt, a Partner in Trinity Life Sciences’ Evidence, Value, Access & Pricing Practice, as he hosts a lively […]

Watch Now