Rise with the Waves: State of the Global Policy Landscape

Home / Intelligence / Blog / Rise with the Waves: France – Accelerating Pricing and Market Access: Two Policies Shaping Pharma’s Future

Published April 22, 2024

Executive Summary

The latest publication of new reimbursement regulations in the French Social Security Financing Act (PLFSS 2024), coupled with the recent approval of HEMGENIX® through the direct access scheme in France this past December, underline continued efforts in France to innovate its healthcare system.

The 2024 PLFSS emphasizes:

- Drug access and cost containment, with a higher payback trigger aimed at reducing the government’s payback collections

- Temporary reimbursement to ensure continuous treatment of patients with medicines benefitting from the early access scheme

- Clawbacks aimed at reducing drug supply shortages and environmental waste by medical packaging

- Biosimilar substitution to increase patient access to more cost-effective bioequivalent options

The direct access scheme is expected to accelerate patient access to specific treatments with a period of free pricing and 100% reimbursement. The manufacturer must ensure a consistent supply of the treatment and will be under significant pressure to finalize pricing negotiations within a set timeframe. Failure to meet these requirements would result in clawback penalties.

As the impacts of these recent developments are still unfolding, it will be critical to monitor their progress, particularly as it relates to new clawback clause changes, the maintenance of mature medicines of major therapeutic interest and environmental waste.

This blog highlights the aforementioned high-impact policies recently adopted in France, and the opportunities and challenges that pharmaceutical manufacturers will have to consider to optimize the pricing and market access potential for their assets.

Key Policy Updates

Reforms within PLFSS 2024—The Changing French Pricing & Market Access Environment

Among other key changes detailed within the published PLFSS 2024 (officially released in December 2023), this blog is focused on the following major reforms potentially impacting pricing and market access (P&MA) of future assets: adjustment of the safeguard clause, new provisions to encourage biosimilar substitution, the new temporary reimbursement scheme, the maintenance of mature medicines of major therapeutic interest (MMTI) and the introduction of a clawback related to environmental waste caused by medical packaging.

1. Clawback Clause Changes

The clawback clause (i.e., le montant M or safeguard clause triggering clawback payment), which refers to the regulated net revenue threshold above which manufacturers are subject to a clawback, was updated retroactively for 2023 by €300 million (from €24.6 billion to €24.9 billion). For 2024, there will be a further increase by 6% to €26.4 billion to reduce tax burdens on pharmaceutical companies.

The clawback clause is expected to lead to roughly €1 billion in price cuts along with creating efficiencies and reducing administrative burden. To offset these financial commitments from the French government, price reductions of €850 million are expected from pharmaceutical manufacturers. It is important to note that separate calculations were established specifically for generic manufacturers, including a 2% ceiling on clawbacks for generic medications.

Starting in 2026, paybacks will be based on drug reimbursements (i.e., the amount that France’s health insurance pays for reimbursed drugs) instead of industry sales. This is expected to reduce the administrative burden on manufacturers by simplifying the procedure given that data on drug reimbursement amounts are easily available through already integrated IT systems. Variations in reimbursement rates for that new clawback calculations will be applicable, however, the clause’s total sum is still expected to be fixed in a way to guarantee equivalence despite the change.

2. Biosimilar Substitution Regulation Updates

The PLFSS 2024 includes a new provision wherein the list of substitutable biosimilars will be automatically authorized for substitution by pharmacists two years after the publication of reimbursement listing of first biosimilars in any given biologic group. This is subject to alignment from the French National Agency for Safety of Medicines and Health Products (ANSM).

To support this provision, a temporary scientific committee consisting of representatives of patients and healthcare professionals (HCPs) was established by the ANSM in February 2024 to advise on the conditions under which pharmacists should substitute biosimilars for their originators. A preliminary list of reference biological drugs and associated biosimilar drugs has been published on the ANSM website. The full list of reimbursed biosimilar drugs is set to be available before December 31, 2024 and will additionally be created in consultation with ANSM as well as patient/HCP associations.

3. New Temporary Reimbursement Scheme

Another change in the PLFSS 2024 includes the provision of a temporary reimbursement scheme to ensure continuity of treatment for therapies transitioning from the early access program whose reimbursement period has ended, but do not currently meet eligibility criteria for the liste en sus (i.e., clinical value (SMR) major or important and clinical added value (ASMR) level I to IV) and have a commitment to submission of additional evidence. Under the temporary reimbursement scheme, products must satisfy three conditions:

- Product is reserved for hospital use

- Product is not included in the liste en sus for the indication considered

- The transparency committee considers the product to present a certain level of SMR and ASMR in the indication and a development plan is likely to provide the data needed to update the product’s evaluation within the deadline set by the committee

One additional change to the early access program includes a mandate requiring companies to ensure an appropriate and adequate supply in France during the early access period. Penalties for non-compliance with this new mandate include potential clawbacks.

4. Strengthening Measures Against Drug Shortages and Environmental Waste

In an effort to fight supply shortages, new legislation related to MMTI was also introduced in the PLFSS for 2024. Marketing authorization holders of MMTI whose patent has expired will now be required to find a successor to take over commercialization if insufficient therapeutic alternatives are available. Otherwise, without a successor, a new marketing authorization to a competitor product will be granted free of charge. Penalties for non-compliance include a fine of up to €1 million and a 30% annual turnover during the last year of commercialization if the product is withdrawn from the French market.

Another new clawback has also been established for manufacturers whose packaging is deemed to have a negative impact on the environment, due to unsuitable packaging or significant package waste generation, and is anticipated to produce around €10 million for the French government in additional revenue annually in the first few years.

HIGH PRICING AND MARKET ACCESS IMPACT: New reimbursement regulations detailed in the PLFSS for 2024 highlights France’s commitment to increasing and accelerating patient access to new innovative technologies and more cost-effective bioequivalent options while also underlining France’s focus on addressing drug supply issues. While additional guidance is still pending for some regulations, including the assignment of specific clawback scales, initial public feedback and the approval of the legislation by bypassing the French National Assembly underscores the mounting difficulties to this goal. Increases in the clawback clause and new funding for certain hospital drugs at the end of the early access scheme are positive signs of France’s continued investment in this space and mark progress towards broader access to treatments and increased profitability for pharmaceutical manufacturers.

FUTURE OUTLOOK: Manufacturers should monitor for any additional information on clawbacks, including the 2026 clawback calculation shift to drug reimbursements given variations in reimbursement rates based on clinical value and disease type, as well as any other changes to the aforementioned updates, including biosimilar substitution and other PLFSS policies.

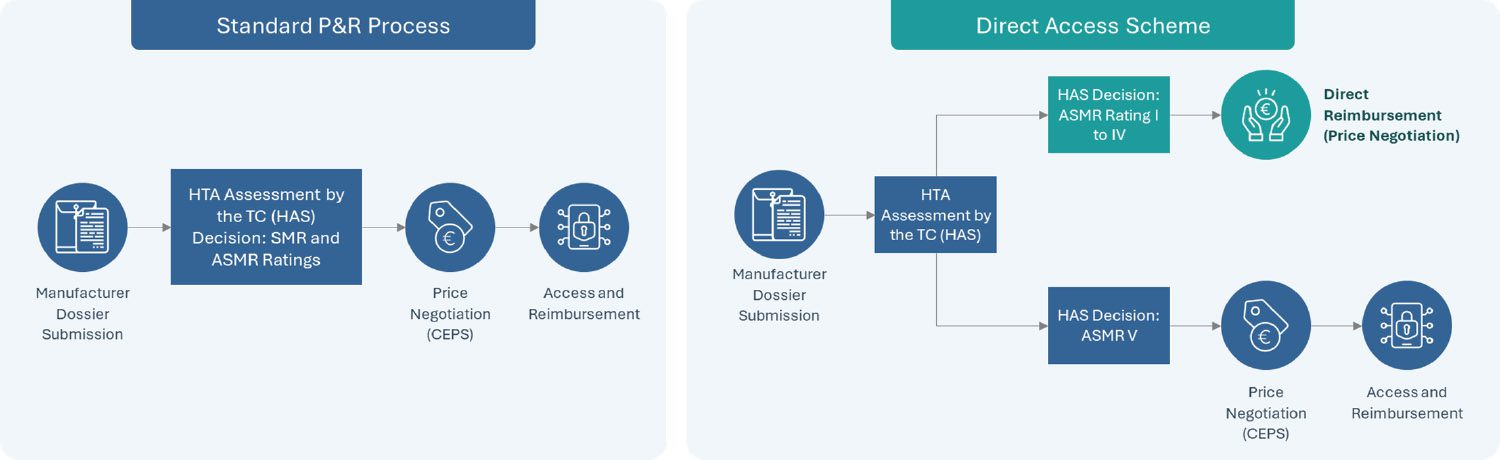

Actualizing Impact of the Direct Access Scheme: A Step Forward for Pharmaceutical Innovations

Announced in the Healthcare Innovation 2030 plan as part of a series of new market access measures in France in June 2021 and established officially by the French Social Security Financing Act (PLFSS 2022), the direct access program is a new experimental measure which seeks to provide accelerated access to new treatments receiving an SMR Major or Important and ASMR of I to IV. Currently under a two-year trial, this “direct access” program enables therapies which receive the eligible HTA outcome from the French National Health Authority (HAS) to receive direct access by avoiding the need to wait until after price negotiations with the Economic Committee of Health Products (CEPS) review to receive reimbursement approval.

Upon receiving direct access, a guaranteed 1-year free pricing period begins with the product fully reimbursed by the Social Security while price negotiations continue through CEPS. It is important to note that either rebates or additional benefits can be mandated when CEPS’ review completes if the final price is higher or lower than that set during the one-year free pricing period, respectively. This direct access program further complements the early access program in France, which covers innovative drugs in severe, rare or incapacitating diseases without current suitable treatments.

In December 2023, HEMGENIX (etranacogene dezaparvovec), the first-ever gene therapy for hemophilia B patients, became the first product to receive access through France’s direct access program only 2 months after submitting its request for direct access and 10 months after receiving European market authorization.

HIGH PRICING AND MARKET ACCESS IMPACT: Two years after its introduction, the impact of the direct access program still largely remains to be seen. HEMGENIX’s reimbursement via the direct access scheme indicates a first step towards France’s goals of accelerating access to innovative technologies through the direct access program. However, the speed to approval still falls behind that of countries such as Germany, where drugs can receive approval immediately upon receiving marketing authorization instead of needing to go through another initial appraisal period. In addition to monitoring other potential therapies that will be approved through the program, it will be critical to monitor announcements on the scales for rebates upon conclusion of the 1-year free pricing period.

FUTURE OUTLOOK: Manufacturers should monitor HEMGENIX’s pricing negotiations and ultimate pricing outcomes as it relates to the potential discounting or additional benefit as well as publication of official rebate scales.

Conclusions

Reforms within the PLFSS 2024 mark France’s commitment to incentivizing innovation and access to pharmaceuticals with the reduced clawback clause, new temporary reimbursement scheme and biosimilar substitution regulation updates. Coupled with new measures against reducing pharmaceutical supply shortages and environmental waste from medical packaging, the PLFSS 2024 signifies France’s strides towards resolving supply issues among others experienced over the past few years as it relates to the pharmaceutical industry.

As part of the Healthcare Innovation 2030 plan, the experimental direct access scheme provides accelerated access to therapies with promising benefits. As this pathway continues to be utilized in its 2-year trial period, with HEMGENIX setting precedent, its use aims to provide key learnings for France in its mission to optimize drug assessment and approval processes.

Impacts of the policies outlined in this blog remain to be seen. However, manufacturers should closely monitor further development of these trends and any additional cost-saving measures that may be introduced in the future. Manufacturers should further assess the potential evolution of these policies and actively strategize to optimize future assets’ pricing and market access potential in France in light of new regulations.

Further Impactful Policy Changes

UPCOMING: From January 1, 2026, the tax base of the safeguard clause will be based on expenses actually reimbursed by the French health insurance system and no longer on the turnover declared by companies. The maximum contribution payable under the safeguard clause for other medicines remains at 10% of the turnover (excluding VAT), reduced by conventional clawbacks. From January 1, 2026, this limit will be equal to 2% of the amount reimbursed by the French health insurance for these medicines.

ONGOING: Current community biosimilar substitution policy reforms are aiming to provide cost containment for institutions while also reducing costs for patients who benefit from more economic biosimilar options.

Acronyms: ANSM: Agence nationale de sécurité du médicament et des produits de santé; CEPS: Comité Économique des Produits de Santé; HAS: Haute Authorité de Santé; MMTI: Medicines of Major Therapeutic Interest; PLFSS: Projet de loi de financement de la Sécurité sociale

AUTHORS: Mila Ho, Salomé Monreal Louly, Nikhil Taxak, Andreia Ribeiro, Harshmani Sapra, Karla Sanchez Gonzalez, Maximilian Hunt

Related Intelligence

Webinars

Part D in Peril: The Inconvenient Math of IRA Part D Redesign

August 14, 2025 | 12:00 – 12:45 PM ET

Medicare Part D is undergoing its most significant transformation in decades largely driven by the IRA. What does this mean for pharmaceutical manufacturers? Join us for an engaging discussion with Max Hunt, Partner at Trinity, and special guest Dan Simenc, clinical and actuarial expert at Milliman, as they provide perspectives on recent developments and future expectations for Medicare Part D and Medicare Advantage.

Sign Up Now

Blog

NRDL 2024: Rare Diseases Deep Dive

China’s pharmaceutical landscape is not only vast in scale but also rapidly evolving with an emphasis on balancing access with affordability. This year’s NRDL update stands out. The introduction of the value rating system continues to raise the bar for clinical innovation, rewarding innovation that truly addresses unmet needs and demonstrates clear differentiation. The National […]

Read More

Blog

Joint Clinical Assessment in the EU: What Life Sciences Companies Need to Know

March 2025 marked a pivotal moment for pharmaceutical and biotech companies operating in the European Union (EU) as the first two molecules began to proceed through the Joint Clinical Assessment (JCA) process. At a recent seminar hosted by Trinity Life Sciences, stakeholders gathered to explore the implications of this new regulatory framework and how to […]

Read More