Home / Intelligence / Blog / France Pilots Opportunity to Increase Speed to Reimbursement for Select Innovative Products

Published March 29, 2022

Executive Summary

- French president Emmanuel Macron announced a two-year trial that will allow pharmaceutical products that receive an ‘Amélioration du Service Médical Rendu’ (ASMR) rating of IV or better to get reimbursement immediately after the evaluation by the Transparency Committee (TC)

- In these cases, price negotiations will start while the new therapies are already on the market

- This new reform started in January 2022 as part of a two-year pilot project and is expected to significantly reduce the average time from marketing authorization to patient access to innovative drugs

- However, only 32% of all new products assessed in 2019 received an ASMR IV or better after evaluation by the HAS; thus, in practice, most of the new treatments will not go through this new direct reimbursement pathway

- The new market access system also includes other reforms such as an extension of the criteria for reimbursement of high-priced hospital treatments through the liste en sus when an improvement in medical service (ASMR IV or better) is recognized by the HAS

Introduction to France’s New Market Access Reforms

In June 2021, the French president Emmanuel Macron introduced the “Healthcare Innovation 2030” plan, which includes new market access measures with the objectives to enable an accelerated and simplified market access framework for innovative drugs, reduce market access delays, and offer broader access to high-costing drugs and medical devices in hospitals.

This new strategy has been prepared over a period of five months by key experts and was based on discussions with more than 500 stakeholders such public administrations and agencies, research institutions, patient associations, hospitals, and health experts.

One of the major reforms included in this new plan enables patient access to new treatments that receive an ASMR of I to IV right after receiving the evaluation by the French National Health Authority (HAS). This new reform has already been included in the Social Security Financing Bill (PLFSS) for 2022 and started in January as part of a two-year pilot project that is expected to significantly reduce the average time from marketing authorization to patient access to innovative drugs deemed to have robust evidence in the eyes of French authorities.

Additionally, the new market access strategy also includes other measures such as the extension of the criteria for reimbursement of pharmaceutical products in hospitals. Originally, only drugs that received an ASMR III would be included in the “liste-en-sus”, unless treatments receiving an ASMR IV or V had a clinical comparator that was already included in this list. However, from now on, all drugs receiving an ASMR IV will be able to gain access to this funding.

Structure and Expected Changes from the New Direct Market Access Framework

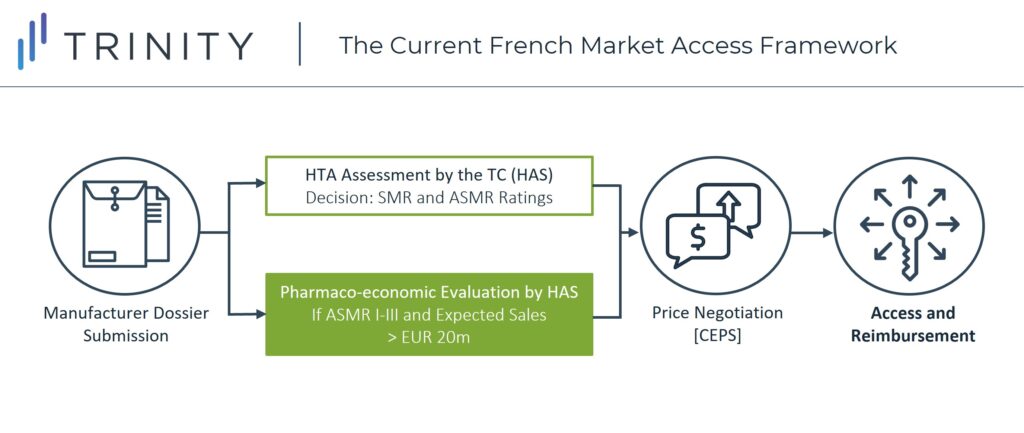

Up until now, innovative medicines in France would only be granted access once price negotiations with the Economic Committee of Health Products (CEPS) were completed, following the HTA benefit rating evaluation by the TC (Figure 1).

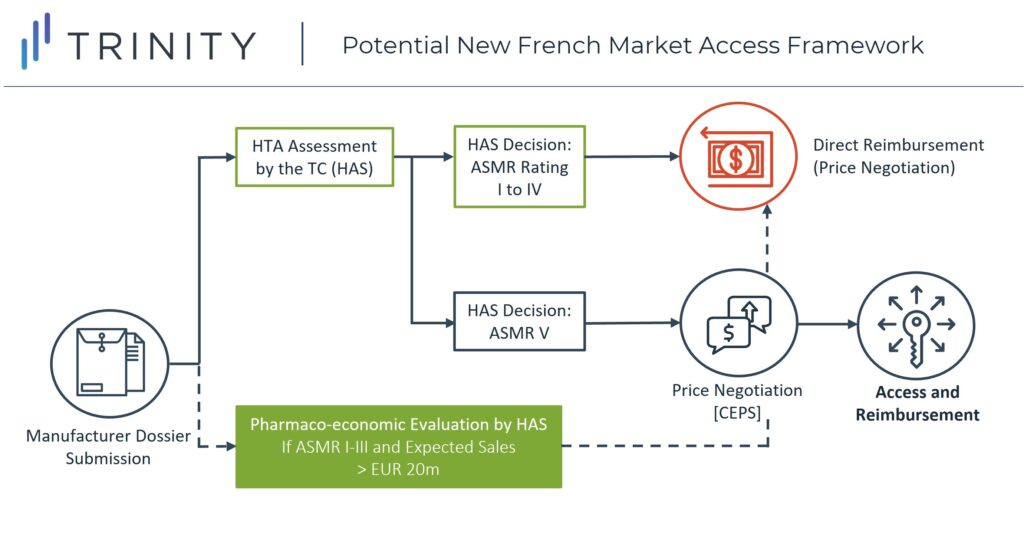

However, with the new reform, the first part of the reimbursement procedure of new pharmaceuticals will remain the same (HTA assessment by the HAS), but the following changes can be expected:

- If a new drug receives an ASMR rating of I to IV after evaluation by the TC, it will receive direct reimbursement and market access without having to wait for price negotiations with CEPS

- Further evaluation of the value-based price and negotiations with the pricing committee are expected to be undertaken after launch

- Still, if a drug receives an ASMR of V (no therapeutic improvement), it can be expected to go through the original process in which the manufacturer will need to negotiate a price with CEPS before launch, after receiving the SMR and ASMR ratings from the TC (Figure 2)

It is important to note that only 32% of all new products assessed by the TC in 2019 received an ASMR I-IV; thus, in practice, most of the new treatments will not go through this new direct reimbursement pathway. The assessment of the ASMR rating by the HAS is based on clinical added value provided by the new drug in terms of efficacy and tolerance as compared to existing therapies. To achieve an ASMR IV or better, the new treatment needs to demonstrate at least a minor superiority in terms of therapeutic evidence compared to existing products, taking into account clinical pertinence of the main criteria of the trial, the evidence, and the clinical significance of the benefit observed.

Additionally, while the new French direct market access model drew upon the German market access systems in terms of providing access prior to price negotiations, a few distinctions need to be taken into account. For example, Germany allows manufacturers to launch a therapy at an unnegotiated free price for 12 months as soon as the new product receives marketing authorization by the EMA, while the HTA and price negotiation processes begin after this launch. In comparison, new treatments in France will still need to be evaluated by the HAS and receive an ASMR rating before gaining reimbursement, a process which usually lasts approximately three months.

Additional Market Access Measures from this Reform – Broader Access to the liste en sus

One of the additional measures included in the new French Healthcare Innovation 2030 strategy is the extension of the criteria for reimbursement of high-priced drugs. The French liste en sus consists of a funding system including innovative drugs that are usually too expensive to be included within the T2A system of hospitals, and thus receive temporary funding from the social security (“Assurance Maladie”) for easier inclusion in hospital formularies.

Until recently, only drugs that received an ASMR of I-III were eligible for inclusion in the liste en sus, unless a drug receiving an ASMR IV or V had a direct comparator that was already included in this list. However, from now on, all drugs receiving an ASMR of IV will also be able to access this list and benefit from direct reimbursement from the “Assurance Maladie”, allowing broader and easier access to high-priced hospital treatments.

Uncertainties and Challenges from the New Measures

While some major benefits are expected from these new reforms in terms of faster and easier access to new treatments, a lot of uncertainties and challenges remain.

For example, it is currently unclear the extent of the flexibility that the manufacturer has to set the price during this period before the negotiations are complete. The new direct market access reform indicates that pharmaceutical manufacturers will be expected to have one year from launch to negotiate a price with CEPS, but it remains to be seen whether paybacks for the expenditure above the negotiated price in the interim period will be applied, such as the ones that are required following an “Autorisation Temporaire d’Utilisation” (ATU) early access pathway. Additionally, the application of paybacks following the 12 months unnegotiated free pricing period in Germany has also been a key discussion point for future market access reforms. It will be critical to track next steps and updates from the HAS during the two-year pilot phase and confirm whether any additional requirements or processes will be needed for the updated negotiation process after receiving direct reimbursement.

Finally, it remains to be seen how much impact these reforms will have on reducing market access delays and simplifying patient access to innovative drugs, as the majority of new treatments assessed by the TC usually receive an ASMR V rating (68% in 2019), and therefore cannot go through this new direct reimbursement framework.

France’s New Market Access System – So What?

The original market access framework in France had been described as a cause for delays in patient access to innovative treatments. In 2020, due to delays in pharmaco-economic evaluation and price negotiations, the average time from marketing authorization of new drugs to reimbursement was 527 days, one of the highest numbers within EU markets (compared to just 120 days for Germany).

This direct market access reform will allow to shorten the average time from marketing authorization to access to new treatments, and highly benefit patients to receive potentially life-saving treatments as soon as possible. Additionally, the broader inclusion of drugs to the T2A exclusion list will reinforce this advantage by allowing faster access to expensive hospital treatments as well.

Benefits are also clear for manufacturers of these innovative medicines: faster market access could provide increased commercial success and potential for price premiums, which were traditionally only accessible to drugs that received an ASMR of I-III but could now include a significantly higher proportion of drugs (10% of assessed treatments received an ASMR IV in 2020). Furthermore, these new regulations might also facilitate access to some innovative treatments that come to market with surrogate endpoints, which usually faced challenges in achieving an ASMR III and thus had limited access.

Even if uncertain for now, manufacturers should expect the reform to be mostly beneficial in terms of faster access to market for new medicines. But only time will tell the real reduction in time from marketing authorization to access and reimbursement, as well as unveil additional details on how the pricing negotiations with CEPS will be undertaken.

Author: Salomé Monreal Louly

Related Intelligence

Blog

NRDL 2024: Rare Diseases Deep Dive

China’s pharmaceutical landscape is not only vast in scale but also rapidly evolving with an emphasis on balancing access with affordability. This year’s NRDL update stands out. The introduction of the value rating system continues to raise the bar for clinical innovation, rewarding innovation that truly addresses unmet needs and demonstrates clear differentiation. The National […]

Read More

Blog

Joint Clinical Assessment in the EU: What Life Sciences Companies Need to Know

March 2025 marked a pivotal moment for pharmaceutical and biotech companies operating in the European Union (EU) as the first two molecules began to proceed through the Joint Clinical Assessment (JCA) process. At a recent seminar hosted by Trinity Life Sciences, stakeholders gathered to explore the implications of this new regulatory framework and how to […]

Read More

Blog

Pricing and Access in Germany: Innovation and Strong Evidence Rewarded

Germany’s Medical Research Act (Medizinforschungsgesetz or MFG), which came into force on October 30, 2024, is a major legislative reform aimed at strengthening Germany’s position as an attractive environment for medical innovation and pharmaceutical development. The act provides for confidential negotiated drug pricing, incentives for local clinical trials, simplified clinical trial approvals and harmonization of […]

Read More