Home / Intelligence / Blog / The Implementation Game: The Inflation Reduction Act Medicare Drug Price Negotiation Program Guidance

Published July 27, 2023

Trinity’s Take

- Recent guidance for the Inflation Reduction Act (IRA) Medicare Drug Price Negotiation Program released by CMS retains all major provisions of the program as written in the IRA

- The guidance details negotiation methodology, including that CMS will not leverage any type of formulaic mechanism to determine the offered Maximum Fair Price (MFP) but rather leverage the nine negotiation factors published in the IRA as a platform for negotiation

- Although CMS will offer a public explanation for each final MFP, the qualitative nature of the negotiation methodology may leave the public and industry unclear of how the initial offer translated to the finalized MFP

- MFP negotiations will remain confidential unless manufacturers voluntarily disclose any of the discussion with the public, subsequently releasing CMS from their confidentiality requirement

- Moving forward, ongoing litigation against the IRA’s MFP program may derail implementation, but otherwise CMS plans to publish the first ten therapies selected for negotiation in September 2023

Introduction

Since the Inflation Reduction Act (IRA) was signed into law in August 2022, biopharma stakeholders have noted the high likelihood of the legislation being challenged in court alongside many questions about how some of the new CMS programs would function. The Medicare Drug Price Negotiation Program is one IRA program expected to heavily impact the life sciences landscape through the introduction of Medicare reimbursement caps for therapies that have been on the market without generic or biosimilar competition for at least 9 (small molecules) or 13 years (biologics). While it remains unclear how impending lawsuits will affect the program, many of the initial questions about the program’s implementation have been answered in a recent guidance published by CMS on June 30, 2023 detailing how the first year of negotiations will occur as well as other details about the agency’s interpretation of the law. The guidance includes clarifications and updates to the program as well as responses to all communications received during the public commenting period.

Eligibility

Several clarifications have been provided about conditions for eligibility for a product to be selected for negotiation. The main eligibility criteria remains that a small molecule therapy must have been on the market for at least 9 years (7 at time of selection) and a biologic must have been on the market for at least 13 years (11 at time of selection). While the CMS guidance acknowledges commenters advocating to extend the small molecule timeline to match the 13 years for the biologics, this adjustment was not made due to the specific language used in the IRA law, thus setting up a new dynamic for the life sciences pipeline where manufacturers can essentially ensure longer market exclusivity if they are able to prioritize biologics over small molecules.

Defining a Single Therapy

Additional clarification has been provided about what is considered a single therapy. All dosage forms and strengths of a drug with the same active moiety and same holder(s) of the NDA or BLA(s) will be considered within a single negotiation. CMS has clarified that negotiations will not be limited to a single NDA or BLA but can apply across multiple where appropriate. CMS notes that this interpretation may be leveraged to disincentivize “product hopping” or the practice of manufacturers shifting patients to a similar product to avoid price concessions.

In the situation that a fixed combination drug consists of two or more active ingredients / moieties, CMS will only consider two products as the same single source drug where the products contain all of the same active ingredients / moieties. This specification limits the cases in which a fixed combination drug would be considered as a single therapy by IRA rules.

Single Source

In order to be eligible for MFP negotiations, therapies must be single source without generic or biosimilar competitors currently marketed. Biosimilar competitors also must be unlikely to be marketed within 2 years after the publication of the negotiation drug selection list. If biosimilar launch is expected to interfere with this timeline, biosimilar manufacturers may submit an Initial Delay Request illustrating that they will launch by detailing patents and operational preparedness. If a selected biologic is found to have an imminently launching biosimilar, it will be deselected from the negotiation list.

For products to be eligible for the multi-source exemption, generic or biosimilar manufacturers must not have any agreement with the branded therapy’s manufacturer limiting sales. The exemption conditions are structured to prevent manufacturers from leveraging authorized generics to game the MFP negotiation exemption rules. Only true generic or biosimilar competition renders therapies ineligible. Manufacturers may re-think tactics to retain single sources status as they approach the end of their exclusivity period and weight the impact of facing multi-source competition versus being subject to MFP discounts.

Orphan Drug Designation (ODD) Exemption

Acknowledging advocacy efforts and comments urging for an expansion of the ODD exemption criteria, CMS has noted that they will retain the single ODD indication exemption rules that only provide the exemption if a therapy is marketed in a single indication and that indication has ODD. In a situation where a therapy is indicated in multiple sub-category rare diseases within a broader ODD landscape, CMS will consult with the FDA to determine if the indications should be considered as multiple diseases or as subcategories that retain the ODD classification. This will thus be settled on a case-by-case basis.

Low Spend Exemption

Therapies are only eligible for MFP negotiation selection if they have over $200M in annual Medicare revenue, a threshold that will be adjusted annually based on the CPI. The guidance clarifies that this low-spend exemption will consider revenue inclusive of beneficiary cost sharing. However, spending for therapies that are bundled or packaged into the payment for another service are excluded from the calculation of total allowed charges under Part B. CMS will utilize Prescription Drug Event (PDE) data to obtain expenditure.

Rules of Negotiation

The guidance emphasizes the role of the 9 negotiation factors that will drive negotiations. These factors are R&D costs, current unit costs (production and distribution), prior Federal funding (for R&D), FDA approvals (pending and approved patent applications), revenue and sales data, therapeutic alternatives, prescribing information, comparative effectiveness, and unmet need. While the manufacturer of a selected therapy is required to share some of this information, competitors and even the public (including patients and caregivers) are invited to supply relevant information where applicable (i.e., noting specific aspects of unmet need or sharing relevant context about therapeutic alternatives). CMS will set the starting MFP offer based on factors related to clinical benefit and then make any adjustments to this clinical benefit price based on other data, including RWE when applicable.

2026 Therapy Selection

Although expected, CMS has clarified that for the first negotiation period of 2026 they will select the ten top-spend eligible Part D therapies. This clarification provides some transparency about the selection process focusing on spending rather than specific disease states, patient volume, or other potential priorities. With this update, manufacturers will likely be able to anticipate whether their therapies will be selected prior to the release of the official list, removing some of the guess work involved.

Negotiation Parties

Additionally, CMS has clarified that the manufacturer listed on the NDA or BLA is considered the primary manufacturer and is responsible for negotiation. In a situation where multiple manufacturers have licenses, marketing agreements, or other collaborations for a therapy, only the primary manufacturer will participate in the negotiation and any secondary manufacturers may not participate in negotiation meetings. Primary manufacturers will also be responsible for ensuring that any secondary manufacturers adhere to MFP conditions at the close of the negotiation process.

Negotiation Process and Factors

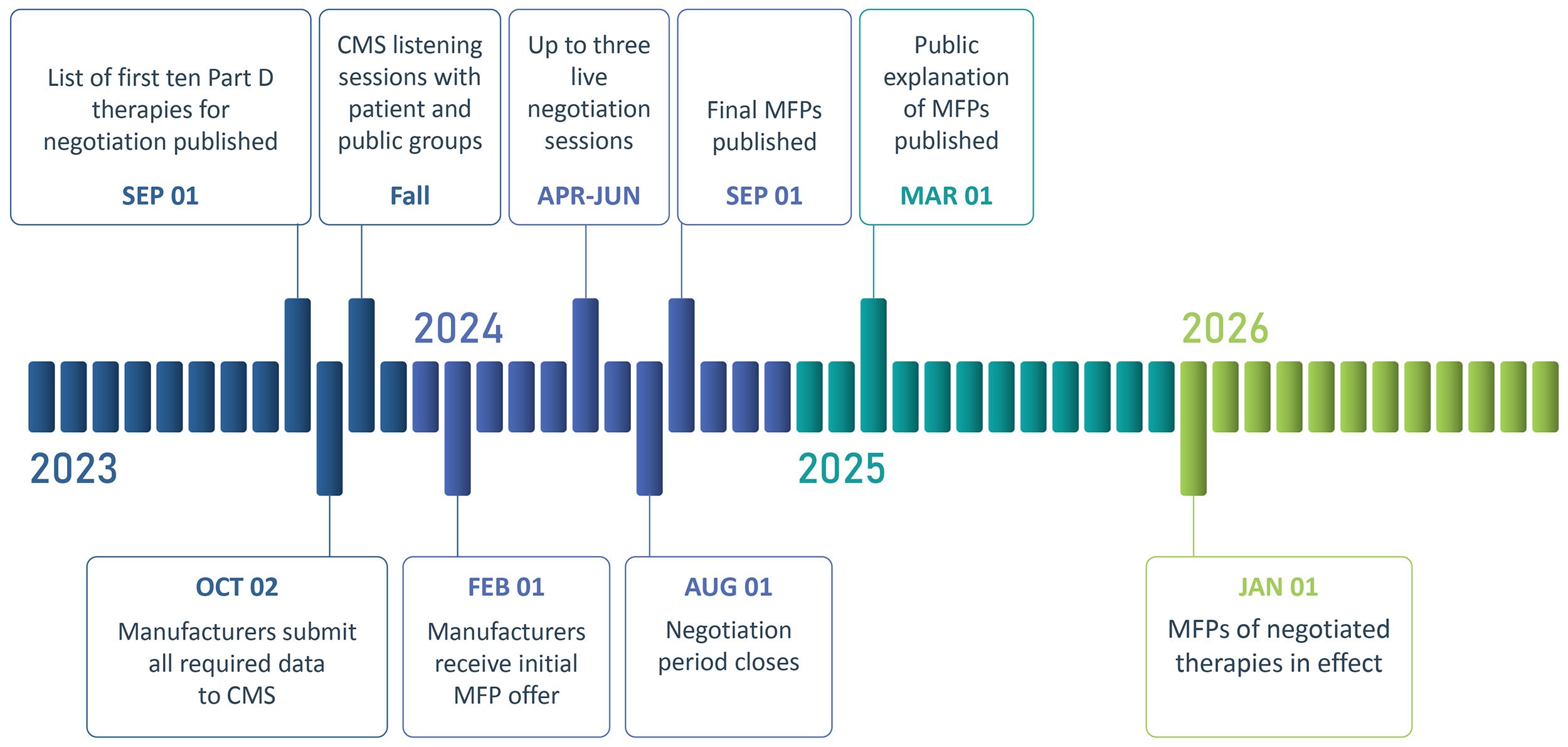

On September 1, 2023, CMS will publish the list of the first ten selected therapies for the negotiation program. Manufacturers of the selected therapies will be required to submit all required data by October 2, 2023. In parallel, CMS will hold listening sessions in Fall 2023 with patients and others interested in providing input about the selected therapies. The manufacturer will receive their initial MFP offers by February 1, 2025 along with information on how CMS considered all 9 factors, which will be the foundation for negotiation. Manufacturers of the selected therapies will have the opportunity to participate in up to three negotiation sessions with CMS, which will occur from April to June in 2024.

The guidance clarifies that CMS will not leverage any quantitative or formulaic system for setting the MFP offers for therapies. Instead, the 9 negotiation factors will be considered qualitatively, based on information supplied by the manufacturer and public. The negotiation period will close on August 1st and the final MFPs will be published on September 1st, 2024. A public explanation of the MFP, potentially with redacted relevant supporting information, will be published on March 1, 2025 and the MFP will become the Medicare Part D reimbursement price for the ten therapies starting on January 1, 2026, which the MFP adjusted annually based on CPI.

Financial Components (R&D Costs, Current Unit Costs, Prior Federal Funding, Revenue and Sales Data)

Despite some public comments urging for this, CMS will not use manufacturing costs as a starting point to set CMS’ initial MFP offer. Instead, as noted above, CMS will first evaluate a therapy’s clinical benefit to establish a draft MFP offer and then adjust this price based on the other criteria included within the 9 negotiation factors, including unit manufacturing costs. CMS notes the example that if significant public funding was utilized to support a therapy’s R&D, CMS may adjust the MFP offer down. Once the MFP has been adjusted by CMS for these factors, it will be shared with the manufacturer as the initial offer and the negotiation will begin.

FDA Approvals

CMS will consider data on a therapy’s pending and approved patents and FDA exclusivities. CMS has clarified that withdrawn submissions and approvals will not be considered for MFP purposes.

Therapeutic Alternatives

Within the guidance, CMS clarifies that they will identify therapeutic alternatives for a therapy based on clinical guidelines, peer-reviewed literature, drug compendia and data submitted by both manufacturers and the public. In response to public comments, CMS has clarified that they will not consider cost when identifying appropriate therapeutic alternatives (i.e., they will not select only the lowest priced alternatives). CMS notes that they may consider off label use if it is nationally recognized and supported via evidence-based guidelines or Part D compendia (American Hospital Formulary Service Drug Information and DRUGDEX Information System).

Although price will not be considered when selecting therapeutic alternatives, it will play a role in negotiations once the alternatives are selected. Part D net prices or the Average Sales Price (ASP) of therapeutic alternatives, including generics or biosimilars when applicable, will inform CMS’ initial MFP offer. In a situation where a therapy has no therapeutic alternative, CMS will consider the Federal Supply Schedule (FSS) or Big Four price of the therapy (maximum price a drug manufacturer is allowed to charge the Department of Veterans Affairs, Department of Defense, Public Health Service and Coast Guard).

Remaining factors prescribing information, comparative effectiveness and unmet need will also be evaluated to evaluate how selected therapies compare to their therapeutic alternatives.

Prescribing Information

Prescribing information will be leveraged to identify the correct dosage and pricing for a 30-day supply of therapies for therapies selected for negotiation as well as their therapeutic alternatives.

Comparative Effectiveness

CMS has confirmed that although comparative effectiveness of therapies will be considered to understand the value of therapies vs. their therapeutic alternatives, QALYs will not be used in the negotiation process and thus any comparative effectiveness methodology employing QALYs will not be considered. This aligns with prior rules forbidding CMS from considering QALYs. CMS has not yet determined which comparative effectiveness methodology they will employ and will review cost-effectiveness measures and studies for the 2026 negotiation to determine whether the measure used may be considered in accordance with the law. CMS notes that measures will not be used to adjust the initial MFP offer if the measure does not provide relevant information. Changes to productivity, independence and QoL will be considered if they correspond with a direct impact on the individuals taking the drug or therapeutic alternatives.

Unmet Need

CMS will also evaluate the extent that a therapy and its therapeutic alternatives address unmet medical needs. CMS will be using the FDA’s definition for unmet need, defined as a condition whose treatment or diagnosis is not addressed adequately by available therapy and includes an immediate need for a defined population (i.e., to treat a serious condition with no or limited treatment) or a longer-term need for society (e.g., to address the development of resistance to antibacterial drugs).

Additionally, CMS will consider information about underserved or underrepresented populations experiencing disparities in health outcomes or access to a selected drug. CMS will also consider unmet needs related to the caregiver perspective as it relates to the patient experience or health outcomes of the patient.

Many commenters advocated for an expansion of negotiation factors, including adding adherence, convenience, social value, independence, lost wages and value of hope as factors. CMS considers these factors as part of the patient experience and thus believes that they are already included. However, CMS revised the language through the guidance to specify that they will consider health outcomes and other outcomes when evaluating the benefit of a selected therapy as well as therapeutic alternatives. Outcomes like changes to productivity, independence and QoL will be considered to the extent that they impact patients.

Maximum Fair Price Setting Rules

Providing additional granularity, CMS will use the daily supply field within PDE data to calculate a 30-day equivalent supply when setting the MFP ceiling and considering the cost of therapeutic alternatives. In an interesting update, CMS will use the WAC ratio to apply the MFP across dosage forms and strengths of a drug. While the agency notes that they have chosen not to consider AMP to avoid disclosing proprietary data to the public, this decision places an atypical emphasis on WAC level pricing for the U.S. where net pricing dynamics are usually much more heavily weighted.

The MFP ceiling will be applied to the lower of either the allowable non-FAMP price or the allowable plan-specific enrollment weighted price. Depending on when a therapy is launched, the allowable non-FAMP is either the 2021 or first year on market non-FAMP, increased annually by CPI. The sum of plan-specific enrollment weighted amounts is an average of Part D negotiated prices that includes point of sale, and direct and indirect remuneration price concession amounts. The plan-specific enrolled weighted will include all Part D plans that have PDE data for dosage forms and strengths of the selected drug in this calculation.

MFP Implementation, Formulary Access and Reimbursement

The creation of the MFP negotiation program in the IRA has many downstream effects through the actual implementation of ensuring that eligible Medicare beneficiaries have access to the discounted prices.

MFP Implementation

In order to ensure feasible implementation of the MFP program, CMS will be engaging Medicare Transaction Facilitators (MTF). CMS will work with the MTFs to facilitate the exchange of data to help ensure eligible Medicare beneficiaries have access to the MFP through a retrospective refund model. CMS is also exploring allowing the use of a standardized refund amount for manufacturers to retrospectively refund pharmacies through the use of a 14-day prompt refund pay standard from manufacturers to pharmacies and other dispensing entities. Additional information about how a refund model will be implemented is expected prior to the implementation of the first set of MFPs in 2026.

One interesting point clarified in the guidance is that for 2026, CMS does not expect manufacturers to provide MFP access to eligible Part B beneficiaries, including in Medicare Advantage plans, when the negotiated Part D therapies are received through hospitals, physician’s offices, or other providers of services rather than the pharmacy.

Formulary Access / Management

Part D plans are required to include all dosage forms and strengths of Part D MFP negotiated drugs on their formularies. However, there are currently limited rules for specific position or access of these therapies within the formulary. If payers begin to limit access the negotiated therapies via utilization management or tiering on formulary, CMS plans to use its clinical formulary review process to ensure that plans do not game management disadvantageously for beneficiaries.

Legal Battles on the Horizon

As the pharma industry begins to prepare for MFP implementation, several manufacturers have filed lawsuits challenging the law. Notably, Merck, BMS, Johnson & Johnson and Astellas have filed lawsuits arguing that the IRA infringes on First and Fifth Amendment rights of free speech and protection from the government seizing private property. Similarly, pharma manufacturer interest group Pharmaceutical Research and Manufacturers of America (PhRMA) filed a lawsuit arguing that the IRA violates the Eighth Amendment against excessive government fines. Future resolution of these legal challenges has the potential to drastically alter the scope and impact of the IRA if concluded to favor manufacturers.

It is likely that the IRA negotiation process may begin while the industry is still awaiting potential legal adjustments to the program, as the list of therapies for the first ten negotiations will be published in September 2023. Ultimately despite the direction provided by the guidance, the IRA negotiation process will likely continue to evolve as key legal and political events transpire.

Authors: Max Hunt and Grace Mock

Related Intelligence

Blog

Joint Clinical Assessment in the EU: What Life Sciences Companies Need to Know

March 2025 marked a pivotal moment for pharmaceutical and biotech companies operating in the European Union (EU) as the first two molecules began to proceed through the Joint Clinical Assessment (JCA) process. At a recent seminar hosted by Trinity Life Sciences, stakeholders gathered to explore the implications of this new regulatory framework and how to […]

Read More

Blog

Pricing and Access in Germany: Innovation and Strong Evidence Rewarded

Germany’s Medical Research Act (Medizinforschungsgesetz or MFG), which came into force on October 30, 2024, is a major legislative reform aimed at strengthening Germany’s position as an attractive environment for medical innovation and pharmaceutical development. The act provides for confidential negotiated drug pricing, incentives for local clinical trials, simplified clinical trial approvals and harmonization of […]

Read More

Blog

Seizing the Storm: Why Pharma Must Plan, Not Panic in Trump’s Second Term

The first 100 days of President Trump’s return to the White House have been anything but ordinary. With a true “Flood the Zone” strategy, there has been a flurry of executive orders, leadership reshuffles, and a re-assertion of executive power, which has signaled the administration is interested in seeing what policy options can “stick.” While […]

Read More