Rise with the Waves: UK – Now and Beyond – Four Policy Trends That May Shape Pharma’s Future

Executive Summary

The global payer landscape is rapidly evolving and is expected to continuously impact manufacturers’ decisions about new launches, portfolio management, trial design and importantly, pricing and market access strategy. In the UK, several policy reforms have been introduced which are expected to improve patient access while balancing financial healthcare sustainability and overall market attractiveness. A few key developments announced or already implemented include:

- The shift of the much-debated Voluntary Scheme for Branded Medicines Pricing and Access (VPAS) to the Voluntary Scheme for Branded Medicines Pricing, Access and Growth (VPAG) aims to re-establish the international commercial attractiveness for branded medicines in the UK by striking a balance between patient access and affordability, and support the development of innovative medicines

- National Institute for Health and Care Excellence (NICE)’s introduction of the proportionate appraisals scheme aims to leverage learnings from past assessments for faster access and greater collaboration with NICE, resulting in a less resource-intensive route to market

- The Competition and Markets Authority’s (CMA) endorsement about transparency and communication between manufacturers for combination therapies aims to facilitate a more collaborative environment to increase the likelihood of favorable appraisals for combination treatments

- The ‘International Recognition Framework’ allows the UK Medicines and Healthcare products Regulatory Agency (MHRA) to reference decision and expertise of specific international regulatory agencies such as EMA, PBAC, etc. while evaluating regulatory applications in the UK thus enabling expedited regulatory approval and faster drug access

As such, this blog will focus on the individual opportunities and challenges of the highlighted policy changes, particularly from a lens of what these entail for the pharmaceutical pricing and market access environment in the UK.

Key Policy Updates

1. Transforming VPAS to VPAG: A Sigh of Relief for Pharma Manufacturers?

The VPAS, signed back in 2019, led to industry bearing much of the risk with branded medicines as revenue clawback rates soared to 26.5% in 2023 from 15% in 2019. This level of clawback discouraged companies from investing in developing and launching new medicines in the UK, depriving patients of access to certain established and upcoming innovative therapies. After high-profile exits of AbbVie and Eli Lilly, threatened product withdrawals and further warnings of severe long-term consequences to the UK economy, the VPAG announcement in 2023 was expected to realign the UK back on the path for growth.

The new VPAG aims to secure rapid patient access to new cost-effective medicines with appropriate rewards for innovation so that the UK remains a global competitive location for launching innovative therapies. Notable changes versus the prior VPAS scheme include the gradual increase in annual sales growth from 2% to 4% by 2027, a shift from VPAS’s 2% limit, while the clawback rate for all medicines for the first quarter of 2024 will be 19.5% for voluntary participants of the VPAG (refer to the table below for further details).

| VPAS (Jan 2019 – Dec 2023) |

VPAG (April 2024 – Dec 2028) |

|

|---|---|---|

| Sales Growth Cap | Annual sales growth cap of 2% | Increase in annual sales growth from 2% to 4% by 2027 |

| Clawback/Repayment | Universal clawback rates for branded medicines rising to 26.5% in 2023 from 15% in 2021 | Differentiated repayment rates based on old vs. new medicine (10% baseline payment rate vs. 15.1% claw back) |

| Industry Investment | N/A | £400m industry contribution over 5 years through Life Sciences Investment Programme |

| Budget Impact Threshold | £20m | £40m |

Starting April 1, 2024, the differentiated payment mechanism for older and newer products was implemented, with newer medicines* facing a 15.1% clawback rate and older medicines** being subject to a baseline 10% payment rate, with top-up payments of up to 25% for certain products. The Department of Health and Social Care (DHSC) estimated that the savings to the National Health Service (NHS) over the next five years are expected to reach ~£14bn.

An additional layer of the VPAG includes a £400m industry contribution over five years through the Life Sciences Investment Programme.*** Finally, despite NICE’s Incremental Cost Effectiveness Ratio (ICER) threshold remaining at £20-30,000 per quality adjusted life year (QALY), NHS England will explore outcomes-based agreements and potential doubling of the budget impact threshold to £40m.

The UK Department of Health and Social Care has also proposed changes to the UK Statutory Scheme for Branded Medicines. Similarly to the VPAG, the Statutory Scheme for Branded Medicines underwent key changes implemented on January 1, 2024, including a permissible sales growth rate of 2% (up from 1.1%) set for 2024-2026 with rebates of 21.9%, 24% and 26.8% in 2024, 2025 and 2026, respectively. Furthermore, an exemption from payment for medicines containing a new active substance for 36 months from the date of marketing authorization is included, in addition to further exemptions for exceptional central procurements and centrally procured vaccines were introduced, reflecting equivalent exemptions in the voluntary scheme.

HIGH PRICING AND MARKET ACCESS IMPACT: The UK’s VPAG demonstrates how the Association of the British Pharmaceutical Industry, and the UK Department of Health and Social Care can collaborate effectively by agreeing to each other’s demands. Implementation of the VPAG will potentially result in faster patient access to life-saving treatments, better fiscal management of the NHS and improve the commercial attractiveness for branded medicines in the UK.

FUTURE OUTLOOK: The VPAG promotes a growth-oriented environment, the right direction forward for the UK to maintain its reputation as an internationally competitive market for new medicines’ launches. To this end, the implications of the VPAG may vary among different manufacturers considering older branded medicines could be subject to higher rebates than newer products. As a result, stakeholders should closely monitor any further evolution of the voluntary scheme to mitigate risk and maximize benefit from its commercial opportunities, as well as assess any upcoming changes to the Statutory Scheme and the pursuit of equivalence between the two schemes.

2. Proportionate Approach to NICE Assessments

Faster and more efficient evaluation timelines have always been on the NICE’s agenda, as seen from the changes to HTA processes reported in 2022.

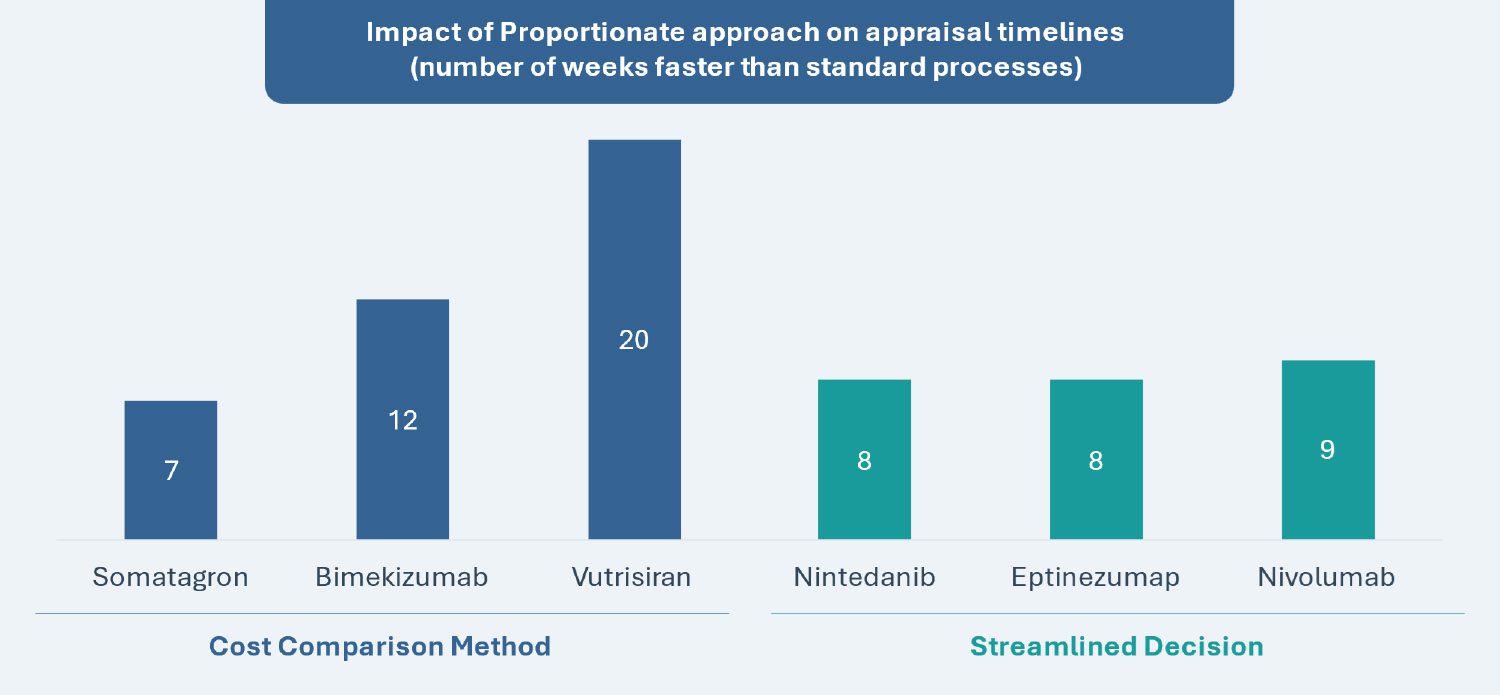

Two key pathways have been created for the proportionate assessment approach: “Cost Comparisons” and “Streamlined Decisions.” The overarching goal is to simplify assessments for low-risk appraisals (i.e., disease areas with significant prior experience and knowledge), reduce review processing times and increase capacity by leveraging existing disease area expertise (e.g., nearly half of NICE’s technology appraisals are in only 10 disease areas).

The “Cost Comparisons” pathway does not require a formal meeting and is only applicable for products that can be compared with another intervention that NICE has previously recommended in technology appraisal guidance for the same indication. Furthermore, the chosen comparator must be established in practice and have substantial use in the NHS in England for the same indication. The “Streamlined Decisions” pathway permits leveraging advice from a subset of the committee for decisions with low likelihood of error and technological complexity, also outside of a formal meeting setting.

| Cost Comparison Method | Streamlined Decision Making | |

|---|---|---|

| Scope | Compares new products with existing interventions previously recommended by NICE for the same indication | A subset of the committee evaluates lower-risk technologies |

| Comparator Selection | Chosen comparator must be established in practice and widely used in NHS England for the same indication | Evaluation considers complexity of technology, associated uncertainties and potential impact on resources and stakeholders |

| Time Saved (refer to graph below) |

Shortened timeline by 45% to 23 weeks | Shortened timeline by 25% to 30 weeks |

| Piloted Examples (refer to graph below) |

Bimekizumab, Somatagron and Vutrisiran | Eptinezumab, Nintedanib and Nivolumab |

Source: Based on data from the National Institute for Health and Care Excellence (NICE)

HIGH PRICING AND MARKET ACCESS IMPACT: The new proportionate assessment approaches result in faster access and greater collaboration with NICE resulting in a less resource-intensive route to the market for low-risk appraisals. For both pathways, it will be important for manufacturers to identify and evaluate potentially eligible assets, pressure-test the validity of assessments through early engagement opportunities and refine internal identification criteria and assessment methodologies for future medicines.

FUTURE OUTLOOK: Manufacturers should monitor current and future assets recommended by NICE via these pathways to understand the trends and rationale behind the decision-making, thereby predicting their suitability for current and future pipeline assets. Further updates to the NICE assessment manual are expected, such as a new pathway for decisions across multiple drugs within a disease area.

3. CMA’s Endorsement of Transparency and Communication Between Manufacturers of Combination Therapies

The CMA has issued a pivotal statement supporting collaborative efforts between pharmaceutical companies developing combination therapies for NHS patients. The CMA has clarified that it will not investigate such engagements between manufacturers under the Competition Act 1998, provided certain conditions are met. The conditions include agreed pricing limits for NHS payments, negotiations in good faith, limiting exchanges of information only limited to what is necessary, and conducting agreements linked to contribution payments without aiming to fix component medicine prices or engaging in collective actions beyond reimbursement approval for combination therapies.

MEDIUM PRICING AND MARKET ACCESS IMPACT: The CMA’s endorsement allows communication, albeit limited, between both manufacturers of combination therapies during pricing and market access negotiations. This supportive stance may influence market dynamics and set a global precedence. The CMA’s stand also provides an opportunity for pharma companies to conduct early engagement, exchange information and align strategies to alleviate cost-effectiveness concerns and reach a commercial agreement for relevant combination therapies (particularly in oncology).

FUTURE OUTLOOK: Pharmaceutical manufacturers should capitalize on the new framework set by the CMA and engage in discussions with relevant backbone therapy manufacturers to improve the likelihood of favorable appraisals for combination treatments in the UK while staying compliant with the conditions mandated by CMA to ensure sustained support throughout the process.

4. International Recognition Framework (IRF) – Expediting the MHRA Approval Process

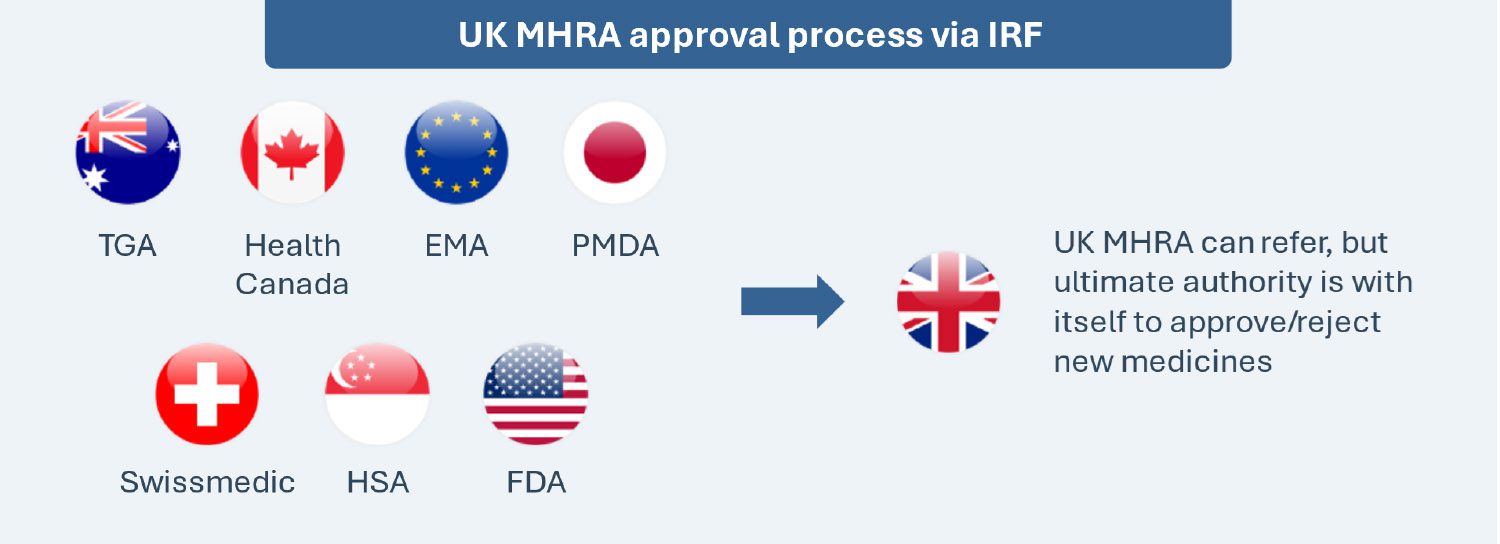

Implemented on January 1, 2024, the International Recognition Framework seeks to expedite access by leveraging decisions of seven select regulatory counterparts (Australia, Canada, the EU, Japan, Switzerland, Singapore and the U.S.) for the MHRA’s decisions. The framework is applicable to new active substances, new indications, extensions of marketing authorizations and variations of existing marketing authorizations. This is a voluntary and complementary pathway, and it does not replace the existing routes for obtaining a marketing authorization in the UK (e.g., national procedure, the decentralized procedure, etc.).

Two types of recognition procedures (A and B) with respective eligibility criteria and differentiated fees are available for therapies seeking regulatory approval through this scheme, though the MHRA retains the authority to reject applications if the evidence provided is considered insufficiently robust. Recognition A has a 60-day timetable with no option to stop while Recognition B has a 110-day timetable with one opportunity to stop at day 70, enabling the applicant to have up to 60 days to respond to any issues raised. The MHRA also launched an “Eligibility Checker” tool to determine whether a Marketing Authorization Application (MAA) is eligible and to identify which route to follow. The Eligibility Checker should be submitted at least six weeks prior to making a full submission under the IRF.

This framework does not guarantee automatic approval of medicines in the UK even if approved in any other of the seven counterparts, as the MHRA may have different views or expectations vs. the reference regulators and reserves the right to deny approvals.

The new IRF took just 30 days for the MHRA to grant its first marketing authorization in the UK for Amgen’s new formulation of XGEVA® (denosumab), used in adults to prevent serious bone-related complications caused by bone metastasis and to treat osteoclastoma of bone in adults and adolescents. This expedited approval timeline under the new framework was based on the CHMP’s positive opinion published on January 25, 2024.

LOW PRICING AND MARKET ACCESS IMPACT: Beyond granting pharmaceutical manufacturers greater regulatory efficiency, expedited access and standardized guidance, the International Recognition Framework fosters greater collaboration and communication between the MHRA and reference regulators. It also enables some assessment-related cost-savings from reduced regulatory burden for pharmaceutical manufacturers (e.g., avoiding duplication of evidence generation work by leveraging past assessments) and mitigates evaluation-associated hurdles. However, the MHRA reserves the right to deny approvals, potentially limiting the benefit of regulatory efficiency for some products.

FUTURE OUTLOOK: Having only been implemented since January 1, 2024, this framework is a new and evolving procedure that may not have established precedents or guidance for certain products or situations, although the recent approval for XGEVA paves the way for a promising future. However, it is imperative for manufacturers to closely monitor and manage the framework’s process, and to anticipate and mitigate any potential risks or delays. manufacturers may engage with the MHRA and the reference regulators early by seeking their advice on the suitability of the framework for their assets and gauge expectations for dossier development and the assessment itself.

Conclusion

The UK government has addressed the feedback from pharmaceutical manufacturers on shortcomings and challenges associated with the VPAS by introducing the new VPAG to promote access to innovative medicines and provide predictability and stability for the manufacturers’ revenue over the next five years. Further, the CMA endorsement of transparency and communication between manufacturers of combination therapies sets a precedent, as it will influence market dynamics by relieving a significant negotiation barrier, and increases the chances of commercial agreements for drug combinations that might otherwise have to be withdrawn from the market. On the regulatory side, the new IRF from the MHRA aims to expedite regulatory approval process and facilitate access to new drugs by leveraging approval decisions from seven other reference international markets.

Overall, the UK policy changes outlined in this blog are multi-faceted, ranging from cost-containment, access-boosting strategies to adaptations of HTA and regulatory frameworks, and showcase efforts towards making the UK a competitive market for launching innovative therapies. While some immediate impact from these policies has already been realized in 2024, manufacturers should closely monitor the evolution of these reforms and adapt their pricing and access strategies to mitigate any risk and eventually ensure a balance between innovation, growth potential and financial sustainability within the evolving UK market.

Further Impactful Policy Changes

UPCOMING: NICE plans to continue refining and expanding its proportionate approach, including the development of a pathway model for appraisals. Furthermore, the second phase of the proportionate approach involves piloting pathway appraisals, aiming for quicker and less resource-intensive evaluations

ONGOING: Analysis of the feedback from the public consultation sessions to the proposed changes for the Statutory Scheme for Branded Medicines.

Abbreviations: NHS: National Health Service, NICE: National Institute for Health and Care Excellence; IRF: International Recognition Framework; CMA: Competition and Markets Authority; VPAS: Voluntary Scheme for Branded Medicines Pricing and Access; VPAG: Voluntary Scheme for Branded Medicines Pricing, Access and Growth; QALY: Quality Adjusted Life Years; ICER: Incremental Cost Effectiveness Ratio; MHRA: Medicines and Healthcare products Regulatory Agency; EU: European Union; CHMP: Committee for Medicinal Products for Human Use; IRF: International Recognition Framework

Notes:

* Defined on “virtual therapeutic moiety” level whose supplementary protection certificate on the active ingredient(s) has yet to expire, and where no supplementary protection certificates were granted to any active ingredient of the medicine and where the first licensed presentation(s) was/were approved for marketing less than 12 years ago

** Any product in the scheme that does not meet the definition of a newer product

*** The Life Sciences Investment Programme is a £200m initiative managed by British Patient Capital designed to address the growth equity finance gap faced by high-potential UK life sciences companies. This is expected to attract at least a further £400m of private investment.

AUTHORS: Jeremy Pang, Nikhil Taxak, Andreia Ribeiro, Salomé Monreal Louly, Karla Sanchez Gonzalez, Harshmani Sapra, Max Hunt