Home / Intelligence / Blog / Pharmaceutical Innovation: Italy’s AIFA Algorithm for Assessing New Products

Published April 8, 2022

The Assessment Process of Innovativeness of a New Medicine in Italy

In April 2017, AIFA (Agenzia Italiana del Farmaco, Italian Medicines Agency) released an upgraded algorithm to assess and evaluate the level of innovativeness of new drugs seeking reimbursement from the EUR one billion innovative medicine fund made available by the Italian MoH (Ministero della Salute, Ministry of Health).

The algorithm introduced in 2017 provides a multi-dimensional approach: innovativeness will be judged by AIFA’s CTS (Commissione Tecnico-Scientifica, Technical and Scientific Committee) on the grounds of three evaluation criteria: unmet therapeutic needs, added therapeutic value, and quality of the evidence from the clinical trials.

Through this clinically focused evaluation process, new products are granted one of three designations:

- INNOVATIVE (Riconoscimento dell’Innovativita’)

- CONDITIONALLY INNOVATIVE (Riconoscimento dell’Innovativita’ Condizionata)

- NOT INNOVATIVE (Mancato Risconoscimento della Innovativita’)

Those therapies earning an ‘INNOVATIVE’ status benefit from gaining access to a special innovative drugs fund, immediate inclusion in regional formularies, as well as becoming exempt from pay-back requirements common in Italy. Meanwhile, those therapies given a ‘CONDITIONALLY INNOVATIVE’ designation only benefit from immediate regional formulary inclusion. Finally, therapies evaluated as ‘NOT INNOVATIVE’ will not benefit from any of the above-mentioned allowances.

Five years after this new regulation entered into force, literature shows a strong correlation between added therapeutic value as a criterion and innovative outcome granted, demonstrating the emphasis on clinical value and consistency and standardization of the revised AIFA framework. Manufacturers have had to shift their focus from the traditional budget impact / economic considerations to clinical evidence for seeking reimbursement in Italy for new therapeutic products.

The AIFA Innovation Algorithm: Dimensions, Ratings, and Criteria

In 2017, Italian authorities published a new system to assess the innovativeness of new treatments in an effort to minimize limitations of the previous decision-making process such as lack of consistency and transparency of the assessment methods. The new assessment framework took over five years to fully redesign and launch as its structure went through several iterations of refinement before being fully accepted by all parties, including the MoH.

The revised AIFA algorithm judges the level of innovativeness based on three dimensions…

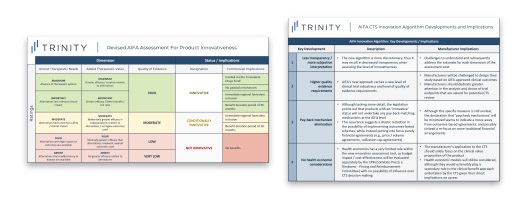

FIGURE 1 describes the three main dimensions utilized by the CTS for assessing the innovativeness of a new product:

- UNMET THERAPEUTIC NEED

- ADDED THERAPEUTIC VALUE

- QUALITY OF EVIDENCE

These criteria are assessed based on the GRADE (Grading of Recommendations Assessment, Development, and Evaluation) methodology.

While all three dimensions bring challenges to manufacturers, the ‘ADDED THERAPEUTIC VALUE’ dimension creates some unique complications. AIFA made clear in their guidance that outcomes must be recognized as clinically relevant and validated for the pathology in question. This consideration is even more relevant within the oncology space, where the gold standard is overall survival (OS). While continuing to value non-traditional measures (e.g., MRD+ in some tumor types), AIFA places great attention to how these metrics act as appropriate surrogate endpoints for OS and PFS. In other words, previously acceptable endpoints may be assessed more strictly in Italy under the revised framework.

…the evaluation results in the product being awarded with the status of INNOVATIVE, CONDITIONALLY INNOVATIVE, or NOT INNOVATIVE

As outlined in FIGURE 1, there are three potential designations for new products that are evaluated by the system:

- INNOVATIVE (Riconoscimento dell’Innovativita’)

- CONDITIONALLY INNOVATIVE (Riconoscimento dell’Innovativita’ Condizionata)

- NOT INNOVATIVE (Mancato Risconoscimento della Innovativita’)

The INNOVATIVE status comes with a series of rewards to boost patient access and availability of the product within the Italian market for a period of 36 months for first-in-class launches:

- ACCESS TO THE INNOVATIVE DRUGS’ FUND

- IMMEDIATE ACCESS TO REGIONAL FORMULARIES

- This translates to decreased hurdles posed by the regional HTA authorities, forcing prompt access to INNOVATIVE products at the sub-national level, with no / minor delays and diminished access inequalities throughout the market

- EXEMPTION FROM PAYBACK MECHANISMS

- In case any alternative contracting agreement is stipulated between parties, this eliminates the option of the manufacturer paying back to AIFA the costs of the therapy for non-responding patients

For products determined to be CONDITIONALLY INNOVATIVE due to moderate unmet need in disease area, moderate added clinical value, and / or moderate level of evidence provided, the benefit duration only lasts 18 months, but products will still receive immediate access to regional formularies similar to INNOVATIVE products.

Finally, products that receive the NOT INNOVATIVE outcome will not be rewarded any access or reimbursement benefits, but manufacturers are allowed to re-submit their application and request a new evaluation by the CTS if and when new evidence becomes available.

The AIFA Innovation Algorithm: Challenges, Uncertainties and Benefits

While the overall evaluation process gives a more structured framework when assessing a product’s innovativeness, it is important to note:

- While the benefits last 36 months for the first-in-class ‘INNOVATIVE’ drugs, any subsequently launched INNOVATIVE product only benefit for the duration of the remaining time from the initial first-in-class evaluation

- As an example, if PRODUCT X is awarded an ‘INNOVATIVE’ designation, its benefit will last 36 months as per legislation; however, if a PRODUCT Y (subsequent product with the same patient population and MoA) is also awarded as INNOVATIVE five months after PRODUCT X, it will benefit from this status for only 31 months

- Therefore, the second-in-class INNOVATIVE therapy cannot extend the period of benefits – it can only attach itself to the remaining period of benefit created by the first-in-class product

- Several challenges also need to be accounted for from a pricing and access perspective, as outlined in FIGURE 2

- The new framework focuses heavily on clinical evidence vs. health economic considerations, which leads to uncertainty in value of budget impact / cost-effectiveness arguments, which was a key focus of traditional AIFA evaluations

The current algorithm is a step forward in the evaluation of drug innovation…

Holistically, the revised process allows for a more discretionary approach to the evaluation of the product, decreasing the level of technicalities in favor of a more straight-forward process, while enhancing the level of evidence-based dialogue between the manufacturer and AIFA.

For instance, a previously sub-optimal evaluation result can now improve in standing through a clearer process and expectations for additional evidence. More importantly, the current AIFA algorithm differentiates the level of clinical benefit for each product, while avoiding any possible overlaps between clinical and purely economic considerations.

What actions can be undertaken by the manufacturer, to fully leverage the benefits of the current AIFA algorithm?

Considering the increasingly challenging market access environment in Italy given budgetary pressures, and to fully address the above-mentioned challenges that come with the algorithm, the manufacturer should consider these key actions during the submission process and CTS evaluation:

- PREPARE FOR ASSESSMENT SUBJECTIVITY THROUGH ONGOING PAYER COLLABORATION AND COMMUNICATION

- Manufacturers should develop their clinical value dossier for submission in Italy based on the CTS perspective on preferred clinical evidence dimensions

- To accomplish this, manufacturers should take advantage of AIFA’s Early Scientific Advice service in order to align around expectations for their product

- Manufacturers should promote more frequent and productive communication with AIFA to ensure alignment on key milestones and achieve common goals from the earliest stages of the process

- ANTICIPATE HIGHER QUALITY CLINICAL EVIDENCE REQUIREMENTS AND SEEK BUY-IN FOR NOVEL ENDPOINTS

- Manufacturers should focus on designing trials to yield what AIFA considers ‘high quality evidence’, seeking to reflect AIFA’s expectations through early communication with the authority

- Manufacturer should initiate payer education initiatives (i.e., conferences, symposia, sponsored events) in order to gain buy-in from the CTS with regard to lesser-known endpoints for evaluation (i.e., those beyond the traditional OS, PFS in oncology) that may still be considered valuable

- DEVELOP FINANCIAL BASED CONTRACTS TO SUPPORT ‘INNOVATIVE’ PRODUCT ACCESS

- While ‘payback mechanisms’ involving outcomes-based agreements are expected to decline with this policy, manufacturers should develop a stronger focus on purely financial based solutions (i.e., price / volume, patient and cycle cap) given the historical focus on such arrangements in an effort to secure access throughout the country’s many regions

Consistency in New Product Evaluations by AIFA

A recently published Frontiers in Medicine paper analyzed drugs reports submitted between April 2017 and January 2021 utilized a combination of statistical tests to evaluate the weight of each criterion in anticipating the innovativeness status of a new product submitted.

After analyzing 109 published papers, results demonstrated with an accuracy of 89.4% according to the model applied that only “added therapeutic value” was statistically associated with a product’s degree of innovation. This research finding indicates that added therapeutic value is likely the most important criterion for manufactures to pay attention to when considering submitting a new medical product.

Additionally, a mild association was found between the unmet therapeutic need and quality of evidence and no statistical difference was found between orphan vs. non-orphan products or oncological vs. non-oncological drugs. Overall, the article suggests that consistency and reproducibility have been maintained in AIFA’s innovativeness assessment decisions under the revised system.

Italy’s AIFA: A Trend Towards Clinical Value

Overall, AIFA’s revised algorithm provides a systematic and well-structured approach in the evaluation of new medicines that has demonstrated consistency and transparency in the decision-making process when assessing drug innovativeness. While this current framework shifts the emphasis of innovativeness from the traditional budget impact lens in Italy, the prioritization of clinical robustness allows manufacturers to focus on the treatment / curative nature of new products.

At Trinity, we will continue to engage with our Italian market experts to understand the impact of AIFA evaluations on market trends and reimbursement dynamics.

Complete the form below to access full data:

By submitting this form, creating an account, and/or using our website (or using our Services) you agree to our Privacy Policy. Information provided by you is stored in our database and may be used for sending you additional information about Trinity (including Trinity’s partners and affiliates) and our products and services. Such information may be transferred for this purpose to Trinity and affiliates in other countries. If you would like to opt out in the future, please email _compliance@trinitylifesciences.com.

Authors: Salomé Monreal Louly, Crystal Zhao

Related Intelligence

Blog

NRDL 2024: Rare Diseases Deep Dive

China’s pharmaceutical landscape is not only vast in scale but also rapidly evolving with an emphasis on balancing access with affordability. This year’s NRDL update stands out. The introduction of the value rating system continues to raise the bar for clinical innovation, rewarding innovation that truly addresses unmet needs and demonstrates clear differentiation. The National […]

Read More

Blog

Joint Clinical Assessment in the EU: What Life Sciences Companies Need to Know

March 2025 marked a pivotal moment for pharmaceutical and biotech companies operating in the European Union (EU) as the first two molecules began to proceed through the Joint Clinical Assessment (JCA) process. At a recent seminar hosted by Trinity Life Sciences, stakeholders gathered to explore the implications of this new regulatory framework and how to […]

Read More

Blog

Pricing and Access in Germany: Innovation and Strong Evidence Rewarded

Germany’s Medical Research Act (Medizinforschungsgesetz or MFG), which came into force on October 30, 2024, is a major legislative reform aimed at strengthening Germany’s position as an attractive environment for medical innovation and pharmaceutical development. The act provides for confidential negotiated drug pricing, incentives for local clinical trials, simplified clinical trial approvals and harmonization of […]

Read More