Home / Intelligence / Blog / 2019 NRDL: Insights for Future Pricing Negotiations in China

Published June 2, 2020

Executive Summary

- China’s 2019 National Reimbursement Drug List (NRDL) update offers manufacturers key learnings and insights for future NRDL negotiations, particularly with respect to the negotiation tactics used in different disease areas; although in most disease areas the comparative negotiation rule was employed during the 2019 NRDL, the use of a new competitive negotiation rule employed in the hepatitis C disease area characterized the 2019 NRDL negotiations; under this rule, no base price was set and manufacturers were invited to provide their best price offers, resulting in the lowest price offer gaining NRDL listing with 2 years exclusivity

- Limited transparency and disclosure of information was also a theme of the 2019 NRDL, specifically in relation to the lack of disclosure of the full list of 128 products being negotiated, and some product prices being kept confidential following NRDL listing; in addition, steep price discounting was a key characteristic of the 2019 NRDL negotiations, with the average price discount for a patented product being ~60%

- Payer perceptions of the anti–vascular endothelial growth factor (anti-VEGF) products in ophthalmology offer insights and learnings for products with a similar mechanism of action to already listed NRDL products; due to the anti-VEGF products’ perceived comparable efficacy, utilization requirements established interchangeability of the products

Trinity’s Take: The competitive landscape of the NRDL dictates the negotiation methods used, therefore tracking competitor situations, for both branded and generic products is crucial; furthermore, considering the NRDL ‘routine update’ pathway for an undifferentiated product in a crowded disease space and where payers accept the current NRDL price level, could avoid the need for price negotiations.

The NRDL was Updated in Two Waves to Break Down the Type of Products:

Group 1: Routine Update Includes products which have similar or lower prices as the current standard of care (SoC) or where generics / biosimilars have become available and can be enlisted directly without pricing negotiations. This list also includes some products without immediate generic competition, however, the manufacturers took a voluntary strategy to lower the price to secure a place on NRDL e.g.,:

SIMULECT® (basiliximab, Novartis)

SIMPONI® (golimumab, Janssen Biotech)

ACTEMRA® (tocilizumab, Roche)

REVOLADE® (eltrombopag, Novartis)

KOMBIGLYZE® (saxagliptin and metformin hydrochloride, AstraZeneca)

JANUMET® (sitagliptin phosphate/metformin hydrochloride, MSD Pharma)

Group 2: Negotiation Update Includes high-cost products with exclusivity, where product reimbursement and price have been negotiated.

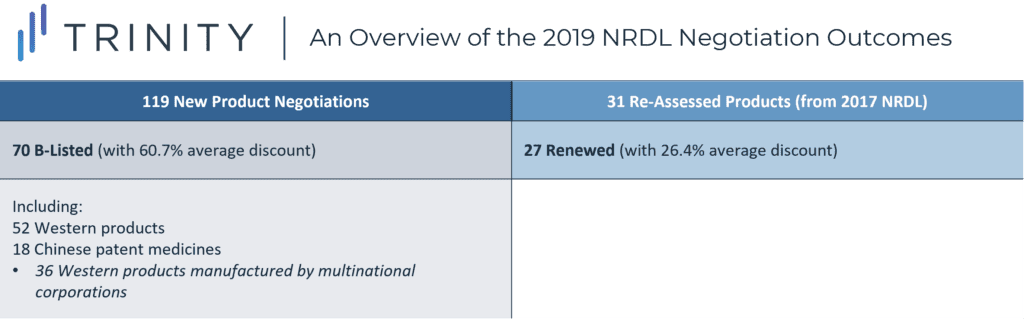

Overview of the 2019 NRDL Negotiation Outcomes

Significant amendments and evidence-based policy making were needed to ensure that the provision of healthcare was allocated consistently, effectively, and fairly. In this blog post, We will explore how the update has provided us with key learnings and insights for the future.

The Rules of Negotiation for China’s NRDL

The process of negotiation is defined by these rules and reflected by two main tactics of the National Healthcare Security Administration (NHSA).

- Comparative negotiation, as used in the majority of disease areas

The pre-negotiation assessment was completed by a committee of 39 pharmacoeconomic experts to evaluate cost-effectiveness, and 11 budget impact analysis experts to assess the healthcare insurance funding feasibility. This analysis resulted in the “base price” for the NHSA during the negotiation. The final agreed price could not exceed this “base price.” The manufacturers had two opportunities to offer a price, and if both price opportunities exceeded the base price by 15%, the product is out. - Competitive negotiation, as demonstrated in the Hepatitis C virus (HCV) product negotiations

This is a new approach taken in the 2019 NRDL negotiations. The method of the competitive negotiation is that no base price is set, and manufacturers provide their best offers and the lowest-priced offers enter the NRDL with two years of exclusivity.

Ophthalmology Product Negotiations in the NRDL

As the anti–vascular endothelial growth factor (anti-VEGF) therapies in ophthalmology, three high-efficacy products have been listed on the NRDL, including aflibercept, ranibizumab, and conbercept. While ranibizumab and conbercept were added to the NRDL since 2017 and have renewed for the 2019 NRDL with a further price discount, aflibercept is a new addition via the 2019 negotiations. The new price of conbercept – a drug manufactured by a Chinese pharma company, has been disclosed as CNY 4,160 (0.2ml / unit), while prices of aflibercept and ranibizumab remain confidential.

As payers consider that the three anti-VEGF products have comparable efficacy, the utilization requirements state that “Treatment is limited to nine units per eye, up to five units in the first year. The drug counts include aflibercept, ranibizumab, and conbercept” – establishing the interchangeability of the three products. This provides a case study for products with a similar mechanism of action and efficacy to existing reimbursed drugs, as aflibercept still managed to achieve coverage. Given that the NHSA limits the total units of treatment per year / per eye, to manage budget impact, this leaves the brand choice to physicians and patients.

How Can These Insights Help Shape Future NRDL Negotiations?

When assessing the previous NRDLs, there have been several significant differences with the negotiation process, particularly between the 2017 and 2019 NRDLs. Manufacturers can optimize on these learnings for the future.

In 2019, there was no disclosure of the full list of the 128 products being negotiated. In addition, based on a newly introduced negotiation method, some product prices were kept confidential rather than listed, providing an incentive for manufacturers to discount further without concerns over international reference pricing. However, upon prescription at the hospital, due to the set local reimbursement rate, drug prices often become visible, or can be back calculated based on patients’ out-of-pocket payment.

The competitive landscape of the NRDL dictates the negotiation methods. Tracking competitor situations in China is crucial, both for branded and generic products, as they are particularly key in China when manufacturers prepare their brand strategies. If a product is in a crowded disease space, and the existing NRDL prices are acceptable to manufacturers, a ‘routine update’ avenue should also be considered before entering negotiations. This is to avoid unnecessary risks unless additional benefits for the product can be demonstrated.

Innovative contracting had been suggested by some manufacturers, however this has not been incorporated into the NRDL and indicates that payers in China are not yet ready for the risk-sharing agreement. However, cost-effectiveness models and budget impact analysis will become increasingly important for Chinese payers. An accurate model with expert input will help guide the pricing to avoid “off-the-target” offers and assist pricing negotiations to justify any price premium.

Written by: Wenting Zhang, PhD and Annabelle Brough

Related Intelligence

Blog

NRDL 2024: Rare Diseases Deep Dive

China’s pharmaceutical landscape is not only vast in scale but also rapidly evolving with an emphasis on balancing access with affordability. This year’s NRDL update stands out. The introduction of the value rating system continues to raise the bar for clinical innovation, rewarding innovation that truly addresses unmet needs and demonstrates clear differentiation. The National […]

Read More

Blog

Joint Clinical Assessment in the EU: What Life Sciences Companies Need to Know

March 2025 marked a pivotal moment for pharmaceutical and biotech companies operating in the European Union (EU) as the first two molecules began to proceed through the Joint Clinical Assessment (JCA) process. At a recent seminar hosted by Trinity Life Sciences, stakeholders gathered to explore the implications of this new regulatory framework and how to […]

Read More

Blog

Pricing and Access in Germany: Innovation and Strong Evidence Rewarded

Germany’s Medical Research Act (Medizinforschungsgesetz or MFG), which came into force on October 30, 2024, is a major legislative reform aimed at strengthening Germany’s position as an attractive environment for medical innovation and pharmaceutical development. The act provides for confidential negotiated drug pricing, incentives for local clinical trials, simplified clinical trial approvals and harmonization of […]

Read More