Home / Intelligence / Blog / What Market Access Opportunities Exist for Rare Disease Products in China? An Analysis of Rare Disease Product Inclusion in the 2020 NRDL

Published August 19, 2021

Executive Summary

- While 7 additional rare disease drugs were included on the 2020 NRDL in China, this development comes amid a backdrop of rare disease policy development signaling a move towards multi-channel funding mechanism to support more widespread patient access and maintain sustainability of the NRDL

- As such, manufacturers cannot solely rely on NRDL inclusion for their rare disease product market access strategy in China and should consider alternative funding opportunities outside of the NRDL (e.g., provincial critical illness budgets, special rare disease funding, commercial insurance, patient assistance programs, charity funding, self-pay) to help optimize pre-launch strategy and ensure timely market access

Trinity’s Take: Due to the rapidly evolving rare disease policy environment in China, manufacturers should prepare to take a flexible approach to their rare disease product market access strategy. This would include considering alternative funding opportunities outside of the NRDL and proactive engagement with relevant stakeholders ahead of launch, in order to optimize pre-launch strategy and ensure timely market access.

The Rare Disease Access Landscape in China

Access to rare disease products has historically been infrequent in China, in part due to government prioritization of including products with a high prevalence on the NRDL. Additionally, the high price of rare disease products and the lack of a clear definition and prevalence threshold* for defining and categorizing rare disease products has also contributed to the challenging access landscape. China’s first rare disease list (includes 121 rare diseases) was published in 2018 with the aim of enhancing societal awareness of rare diseases and to incentivize research and development. Compared with the numerous rare diseases recognized by regulatory authorities in the USA and EU, these 121 rare diseases have advantages in terms of being prioritized for reimbursement at both the national and local level in China.

The Beijing Rare Disease Treatment & Protection Association estimates that <1% of NRDL funds are currently devoted to rare disease products, which is significantly lower than the 7-9% seen in the USA and EU. This has led to influential expert groups in China calling for the use of a more standardized and formalized definition of rare diseases, as well as “1+4” multi-payer funding mechanism to support more widespread patient access. The “1” refers to NRDL-listed orphan disease therapies, and the “4” refers to additional funding sources, including special assistance programs, charity funding, commercial insurance, and self-pay by patients.

What Did Rare Disease Coverage Look Like in the 2020 NRDL?

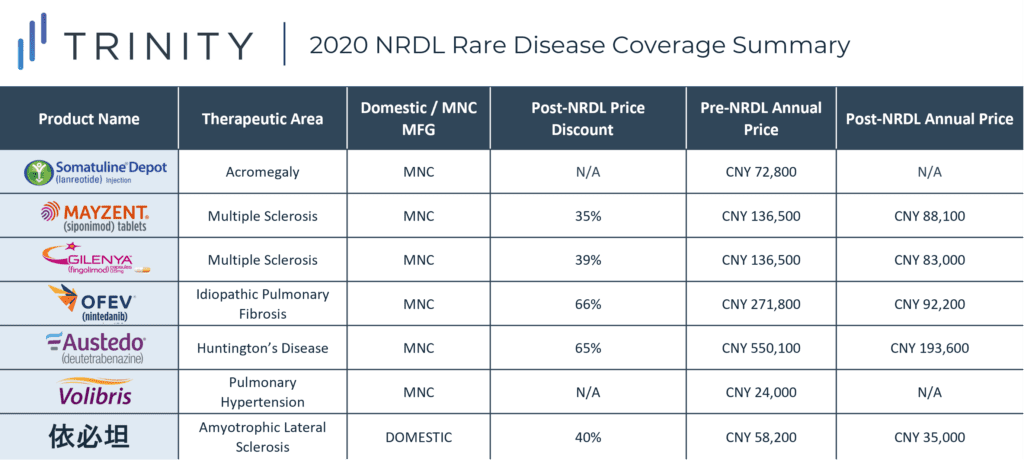

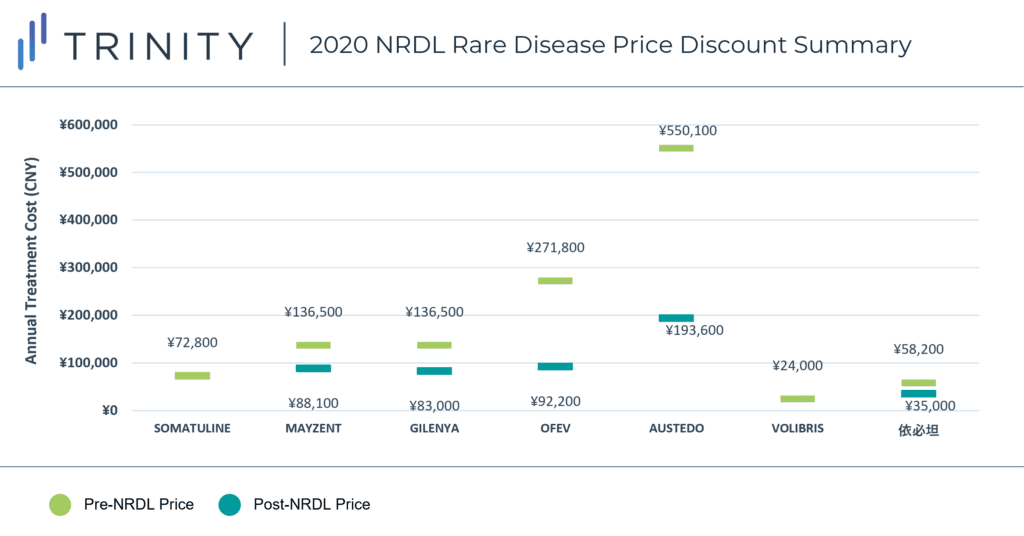

During the 2020 NRDL negotiations, 7 rare disease drugs were successfully negotiated and included on the NRDL, with indications covering arterial hypertension, idiopathic pulmonary fibrosis, acromegaly, multiple sclerosis, systemic sclerosis, amyotrophic lateral sclerosis, and Huntington’s disease. As of now, the NRDL includes a total of 55 drugs for the treatment of 24 rare diseases. TABLE 1 / FIGURE 1 outlines the 7 included rare disease drugs and post-NRDL inclusion price discount (where available).

The average price discount for rare disease products during the 2020 NRDL negotiations was ~50%, which aligns with the average discount observed across all therapeutic areas (~50%). Similar price discounts were observed for products in overlapping indications (i.e., MAYZENT and GILENYA in Multiple Sclerosis) which signifies NRDL negotiators preference for similar pricing across different products within the same therapeutic area. AUSTEDO was able to secure the highest post-NRDL price, which may be related to the lower prevalence (<0.5 per 100,000) of Huntington’s disease and associated budget impact implications. Additionally, Huntington’s disease is perceived to be associated with a high unmet need (due to the lack of available treatment alternatives in China). AUSTEDO was also able to demonstrate impressive clinical efficacy based on two Phase III clinical trials, which resulted in the NMPA granting the product priority review and approval within 4 months, culminating in China being AUSTEDO’s 2nd global regulatory approval market after the USA.

What Access Pathways Exist for Rare Disease Products Outside of the NRDL?

While NRDL inclusion is the optimal method for achieving broad market access in China, other access pathways do exist. In addition to private commercial insurance and charity schemes, there are also local funding channels including provincial critical illness budgets, special rare disease funding, or local medical support programs which can provide coverage for rare disease products. Examples of participating provinces including Beijing, Tianjin, Hebei, Zhejiang, Jiangsu, Shanxi, Hunan, Shandong. However, the coverage scope and inclusion of rare diseases can vary by province and city.

An alternative access pathway for rare disease products that are not yet approved in China includes medical tourism zones. While still in early development stages in China, local authorities in Hainan have initiated a pilot project to allow the use of innovative new drugs as soon as they become approved in the USA, Europe, Israel, and Japan. A batch of 100 innovative therapies (including 48 rare disease therapies) will be made available to patients seeking care at hospitals within the zone, with funding provided through private healthcare coverage or patient out-of-pocket (OOP) payments.

What Does the Future Access Landscape Look Like for Rare Disease Products in China?

While rare disease products continue to be listed on the NRDL with each passing year, government policy in China is signalling a clear move towards multi-channel funding mechanisms. As such, manufacturers cannot solely rely on NRDL inclusion for their market access strategy in China and should consider opportunities with local funding channels and various funding sources to help optimize pre-launch strategy and ensure timely market access. Furthermore, proactive engagement with relevant stakeholders ahead of launch (i.e., private provincial health insurance providers, charity foundations) could facilitate timelier access to rare disease products and support early physician experience with innovative new therapies.

*An unofficial prevalence threshold of <1 in 500,000 or a neonatal morbidity of <1 in 10,000 has been circulated in China, although has not yet been validated officially

By Annabelle Brough and Wenting Zhang, PhD

Related Intelligence

Blog

NRDL 2024: Rare Diseases Deep Dive

China’s pharmaceutical landscape is not only vast in scale but also rapidly evolving with an emphasis on balancing access with affordability. This year’s NRDL update stands out. The introduction of the value rating system continues to raise the bar for clinical innovation, rewarding innovation that truly addresses unmet needs and demonstrates clear differentiation. The National […]

Read More

Blog

Joint Clinical Assessment in the EU: What Life Sciences Companies Need to Know

March 2025 marked a pivotal moment for pharmaceutical and biotech companies operating in the European Union (EU) as the first two molecules began to proceed through the Joint Clinical Assessment (JCA) process. At a recent seminar hosted by Trinity Life Sciences, stakeholders gathered to explore the implications of this new regulatory framework and how to […]

Read More

Blog

Pricing and Access in Germany: Innovation and Strong Evidence Rewarded

Germany’s Medical Research Act (Medizinforschungsgesetz or MFG), which came into force on October 30, 2024, is a major legislative reform aimed at strengthening Germany’s position as an attractive environment for medical innovation and pharmaceutical development. The act provides for confidential negotiated drug pricing, incentives for local clinical trials, simplified clinical trial approvals and harmonization of […]

Read More