Home / Intelligence / Blog / Insulin Approval Pathways USA vs. EU

Published November 2, 2021

Executive Summary

- In March 2020, the FDA amended its classification of add-on insulin products, changing the approval pathway from that of a chemical drug follow-on to a biosimilar and more closely aligning with the EMA’s longstanding biosimilar insulin approval pathway

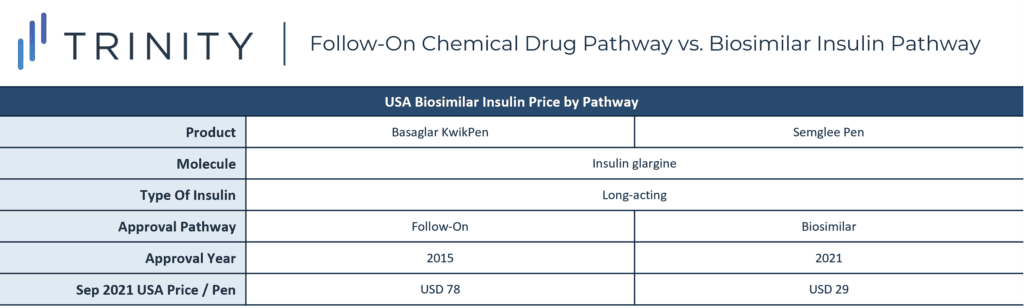

- The FDA approved the Semglee Pen (insulin glargine) as the first product through the new biosimilar insulin approval pathway in July 2021; the Semglee was priced as almost three times less costly in the USA than the previously approved biosimilar Basaglar KwikPen which was approved by the previous chemical add-on pathway

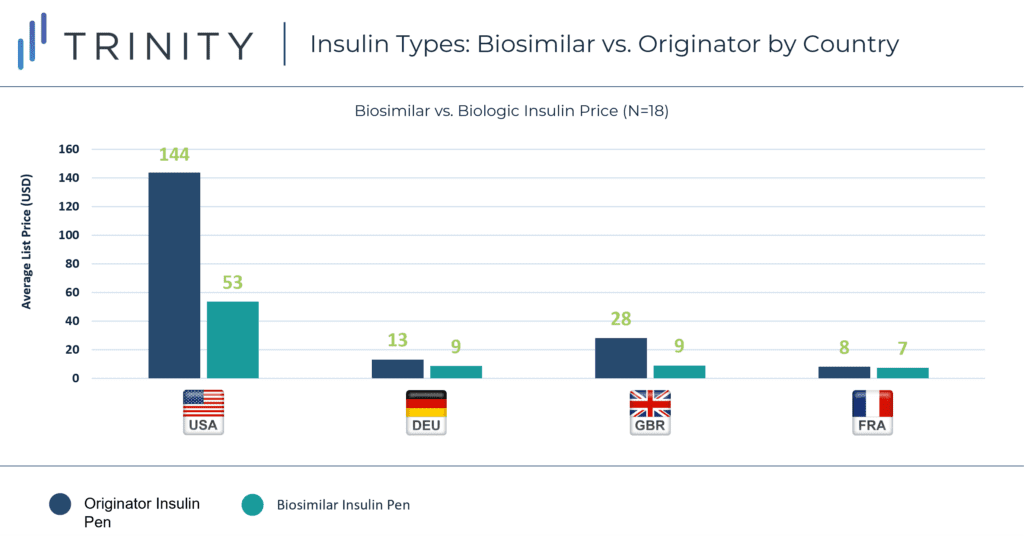

- When analyzing the prices of 18 equivalent insulin pen products across the USA, DEU, GBR, and FRA, the prices in the USA were consistently higher than the EU equivalents to the extent that the average price of biosimilar insulin in the USA was substantially higher than the average price of originator insulin in all three EU markets

Trinity’s Take: All types of insulin products included in this analysis had significantly higher list prices in the USA vs. DEU, GBR, and FRA despite the availability of often equivalent products, brands, and technologies. While the only biosimilar insulin to be approved by the FDA through the new pathway had the lowest price nationally, the even lower price of Walmart’s private label insulin analog demonstrates biosimilars may not be the only competitor putting downward pressure on insulin prices in the USA.

America’s Insulin Problem

As of 2018, approximately 10% of Americans were living with diabetes and 33% of them required insulin to manage the disease. Despite this high prevalence, a Yale Diabetes Center study in 2019 found that 25% of surveyed diabetes patients in America reported cost-related insulin underuse, which ranged from using less insulin than prescribed or not filling the prescription due to cost. Similarly, a 2020 International Diabetes Federation survey found that 0% of UK diabetic respondents demonstrated insulin underuse while 25% of US respondents did. The growing price of insulin is evidenced in average list prices which tripled in the 2010s and patient out-of-pocket costs which doubled in the same time in the United States.

The problem of insulin unaffordability seems to disproportionately affect Americans compared to citizens of other countries. In a 2018 analysis by the RAND Corporation, the average list price of insulin in the USA was thirteen times as expensive as insulin in the UK, at USD 98.70 a unit vs. USD 7.52 a unit. In the same year Americans were approximately a third of insulin consumers and accounted for 84% of insulin sales. Several factors influence the discrepancy in insulin price in the USA vs. abroad.

The Development of Insulin

Unlike some high cost drugs, insulin is not a new therapy. Insulin was discovered and purified in 1921, and first used to treat diabetes patients in 1922. Due to its life saving potential, the inventor team Frederick Banting, James Collip, and Charles Best sold the insulin patent to the University of Toronto for USD 1. However, the insulin of today differs from the original. Analog insulins, which first entered the market in 1996, are laboratory-grown and can be genetically modified to act faster or more uniformly for improved blood sugar management. While human insulin is still available, analog insulin is the most common type used today.

Despite decades on the market, insulin faces limited competition in the United States, partly due to the lack of generic competitors. A 2019 FDA report found that the first-to-market generic small molecule drugs typically had an average manufacturer price that was 39% lower than the branded small molecule drug, which dropped to 54% lower upon the entry of a second generic. However, insulin in the United States does not follow typical generic dynamics which drive competition and thus lower prices.

Biosimilar Competition for Insulin

Insulin does not have generic competitors because it is not a small molecule drug, but instead a hormone. Insulin is classified as a biologic, which is defined by the EMA as a medicine whose active substance is made by a living organism. While small molecules’ active substance can be replicated exactly by generics, biologics are biologically unique. Instead of generics, biosimilars drive competition against biologics. Biosimilars are highly similar, but not identical, to biologics, which already have an approved structure, biological activity, efficacy, safety, and immunogenicity profile. Biosimilars must prove equivalent efficacy and safety to the originator in order to gain market approval.

The additional complexity of biosimilars compared to generics results in a longer and more costly development process. As of 2013, bringing a generic small molecule drug to market cost USD 1-4 million and bringing a biosimilar to market cost USD 100-250 million, leading to slower entrance of biosimilars compared to generic small molecule drugs. The pathway for biosimilar authorization also differs across markets, making access an addition variable.

EMA Biosimilar Approval Pathway

Biosimilars, including insulin, must undergo comprehensive comparability studies with the reference medicine to gain EMA approval. Once they have proven comparability to the original large molecule in both non-clinical and then clinical settings, biosimilars use the originator’s package of pharmaceutical quality, safety, and efficacy studies as part of their evidence foundation. Regardless of approval pathway, all EU medicines must pass the same quality standards, proving chemical purity, biological activity, strength, and formulation among other features.

Post-BREXIT as of JAN 2021, GBR’s Medicines and Healthcare Products Regulatory Agency (MHPRA) reduced the clinical trial data requirements for biosimilar submissions compared to the EMA. The MHPRA eliminated the requirement for comparative efficacy trials for many therapies when sufficient comparative analytical and functional data exists, making the biosimilar approval pathway even more achievable in the UK compared to the EU.

USA FDA Insulin Approval Pathway

Prior to 2020, despite being considered a “biological product,” insulin was regulated as a chemical drug in the USA, which required each follow-on insulin to seek approval under an abbreviated new drug pathway. The classification of chemical drug provided insulin with neither a generic nor biosimilar pathway approval and under the previous pathway, only two biosimilar insulins (LLY’s insulin glargine BASAGLAR in 2015 and SNY’s insulin lispro ADMELOG in 2017) were approved in the USA. The new guidance opening the biosimilar regulatory pathway to add-on insulins is meant to streamline and expedite the process, theoretically promoting the quicker and more frequent entrance of biosimilar insulin products. In 2021 VTRS’ SEMGLEE (insulin glargine-yfgn) became the first insulin biosimilar to be approved under the biosimilar pathway.

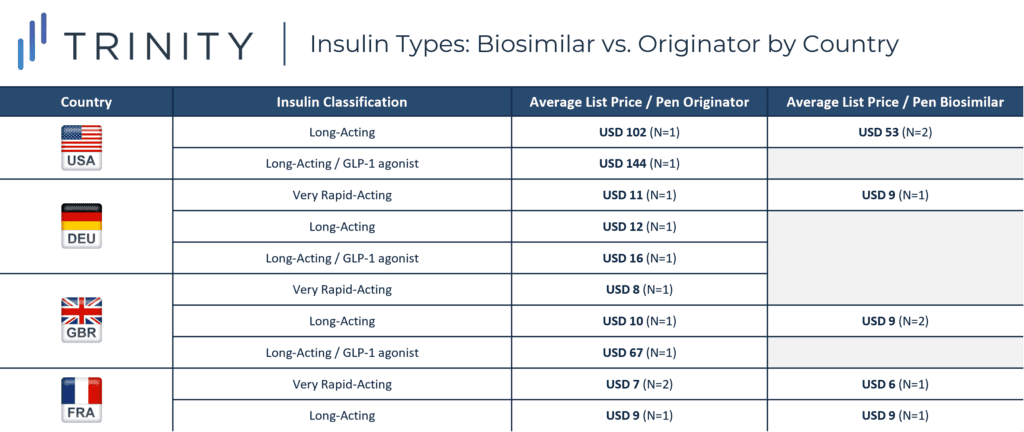

This analysis explores the prices of 18 insulins, four in the USA, four in DEU, five in GBR, and five in FRA to compare the cost of biologic vs. biosimilar insulin within and between the countries. To make the comparisons as accurate as possible, only pen-injectable insulin with 100 units of insulin / mL and three mL per pen were priced (300 insulin units / pen), and for applicable products 33 iu / microgram.

An additional nuance was the categories of insulin: very rapid acting, long acting, and combination long acting / GLP-1 agonists. Depending on the individual needs for diabetic patients, they may be limited to selecting only from a specific category. The most expensive category of insulin was the combination long-acting insulin glargine / GLP-1 agonist, which currently is only available as branded biologic SOLIQUA. However, with DEU’s SOLIQUA priced at only USD 16 compared to the USA list price of USD 144, DEU’s most expensive insulin, within the analysis criteria, was nine times less expensive than the same insulin in the USA. Pricing for SOLIQUA was not available in FRA, which contributed to its comparatively low prices and narrower difference between biosimilars and biologics.

The disparity in price between originator insulin and biosimilar insulin varied in each market. GBR had the largest difference between average list price of biosimilar and originator insulin, narrowly surpassing the difference in the USA. DEU and FRA had closer pricing between biologic and biosimilar insulins with DEU biologic insulin priced as less than two times the price of biosimilars and FRA biologics priced almost equivalent to biosimilars.

In perhaps the most evident trend, the USA stood out with prices much higher than the three EU markets. The average price of biosimilar insulin in the USA was substantially higher than the average price of biologic insulin in all three EU markets.

Follow-On vs. Biosimilar Insulin Prices in USA

The analysis also looked to see if the new biosimilar approval pathway in the USA could impact insulin prices. When comparing the price of Basaglar KwikPen, approved within the old framework as a follow-on insulin, with Semglee Pen, approved within the new pathway as a biosimilar insulin, the trend is promising. New biosimilar insulin Semglee Pen was almost three time less costly than follow-on insulin-approved Basaglar KwikPen’s, despite the similarities of both products containing molecule insulin glargine and being long-acting, biosimilar insulins.

Future Outlook for Insulin

With only one biosimilar insulin approved by the FDA through the new biosimilar insulin approval pathway, it is too soon to tell if the new approval pathway will result in lower cost biosimilar insulin, but its first-approval was the lowest cost insulin on the market in the USA of the four USA insulin products fulfilling our analysis criteria. Comparisons of various equivalent insulin products and categories of insulin demonstrate the price of insulin is significantly costlier in the USA compared to DEU, GBR, and FRA across the board. Additionally the difference in biosimilar insulin pathway pre-2020, does not explain the price difference between insulin products in the USA and EU. As of OCT 2021, the EMA has only approved four biosimilar insulin products compared to the FDA’s three. It is likely that the approval of additional biosimilar insulin products in the USA could come with lower prices, but also that these lower prices will still not match the price of insulin products in the EU.

Separate from the new FDA approval pathway, Walmart and Novo Nordisk recently partnered to launch a private brand analog insulin, which became available in Walmart and Sam’s Club pharmacies in July 2021. As of JUN 2021, the private label NovoLog fast-acting analog insulin (insulin aspart) had a list price of USD 17 per pen, notably over 1.5 times less expensive than the lowest priced biosimilar insulin in the USA included in the prior analysis. While it should be noted that this is an apples to oranges comparison since the NovoLog is a fast-acting insulin, with a 10mL pen compared to the 3mL, long-acting pens shown for the USA, this development suggests biosimilar entry may not be the only mechanism lowering insulin prices in the USA.

Written by Grace Mock, Nicole Kastelic, and Cameron Lam

Related Intelligence

Webinars

Part D in Peril: The Inconvenient Math of IRA Part D Redesign

August 14, 2025 | 12:00 – 12:45 PM ET

Medicare Part D is undergoing its most significant transformation in decades largely driven by the IRA. What does this mean for pharmaceutical manufacturers? Join us for an engaging discussion with Max Hunt, Partner at Trinity, and special guest Dan Simenc, clinical and actuarial expert at Milliman, as they provide perspectives on recent developments and future expectations for Medicare Part D and Medicare Advantage.

Sign Up Now

Blog

Joint Clinical Assessment in the EU: What Life Sciences Companies Need to Know

March 2025 marked a pivotal moment for pharmaceutical and biotech companies operating in the European Union (EU) as the first two molecules began to proceed through the Joint Clinical Assessment (JCA) process. At a recent seminar hosted by Trinity Life Sciences, stakeholders gathered to explore the implications of this new regulatory framework and how to […]

Read More

Blog

Pricing and Access in Germany: Innovation and Strong Evidence Rewarded

Germany’s Medical Research Act (Medizinforschungsgesetz or MFG), which came into force on October 30, 2024, is a major legislative reform aimed at strengthening Germany’s position as an attractive environment for medical innovation and pharmaceutical development. The act provides for confidential negotiated drug pricing, incentives for local clinical trials, simplified clinical trial approvals and harmonization of […]

Read More