CAR-Ts: Barriers and Opportunities for the Migration into Earlier Lines of Therapy in the USA

Executive Summary

- Although CAR-Ts are on the cutting edge of oncology treatment, they are still only approved for administration following at least two other lines of treatment

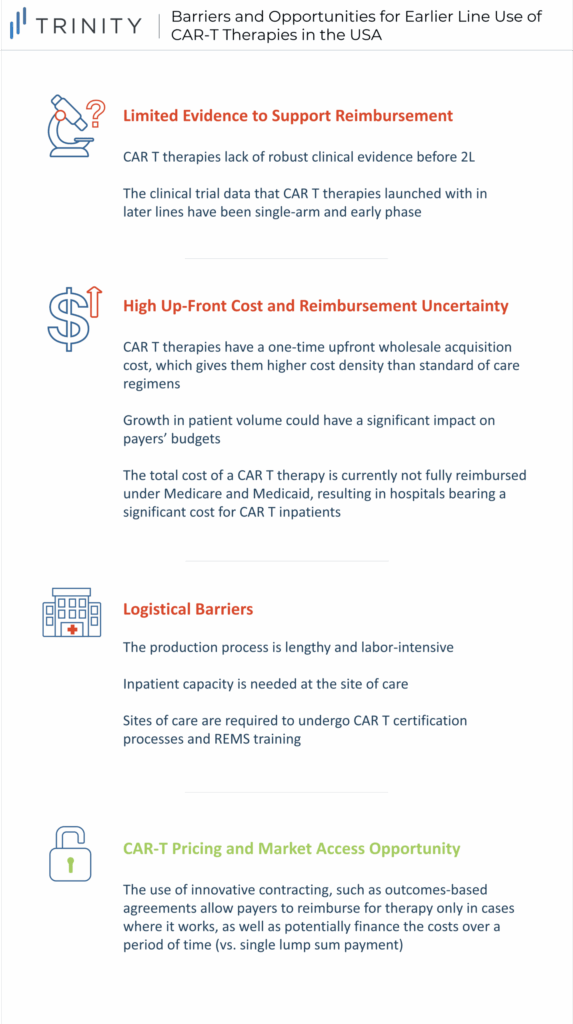

- Key barriers for CAR-T migration into earlier lines include the complex logistics and site of care restrictions, a lack of comparative 3L+ and 2L clinical trial data, and reimbursement uncertainty in fee-for-service (FFS) Medicare

- New opportunities to overcome these hurdles are being pursued in the form of innovative pricing and contracting strategies to enable broader access, as well as expansion of administration from exclusively academic hospital Centers of Excellence (CoEs) to community practices; generation of real-world evidence (RWE) will inform guidelines and increase confidence, and eventually allow for expansion of outpatient administration

Trinity’s Take: CAR-T treatment has changed the landscape for hematology diagnoses and will likely continue to do so well into the near future. Although CAR-Ts can provide impressive clinical benefits given their curative potential and long-term benefit, their chances of migration into an earlier line of therapy are reduced by logistical and site of care hurdles, lack of earlier line clinical trial data, and reimbursement uncertainty for FFS Medicare. Nevertheless, CAR-Ts have also proven to be innovative therapies with opportunities to develop new clinical and pricing strategies, such as innovations in the elimination of high-grade cytokine release syndrome (CRS) risk or outcomes-based contracting, to facilitate wider access and utilization – e.g., moving from 3L+ to 2L use.

The Rise of CAR-T Therapy in Oncology

Current cancer treatment options rely heavily on chemotherapies, radiotherapies, and stem-cell transplants. While these options can provide prolonged survival or a chance at remission, these interventions are not always effective in every cancer or patient, may not be chemo-sensitive, or may introduce complications based on the patient’s physical status. Such limitations by these traditional approaches have allowed innovations such as immuno-oncologics to attempt to address the unmet need. Within the vast field of immuno-oncologics, Cell & Gene therapies utilize the body’s natural defenses to engineer antibodies to fight against cancer-specific proteins. A commercially available example is Chimeric Antigen Receptor T cells (CAR-T) therapy, which adapts treatment to individual patients and their type of cancer and can lead to better efficacy and safety outcomes.

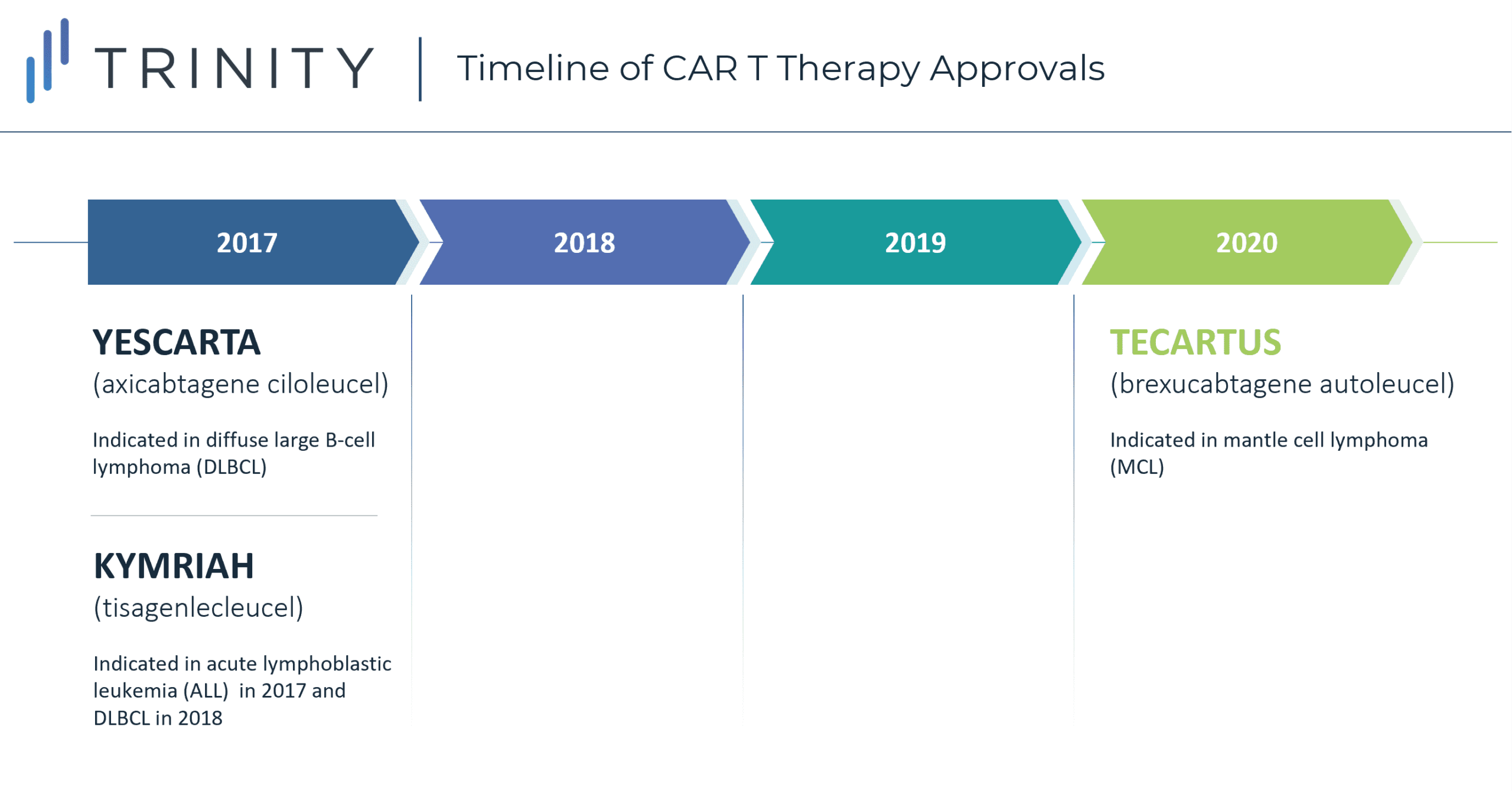

There are currently three approved CAR-T therapies available in the USA: YESCARTA (axicabtagene ciloleucel) indicated in diffuse large B-cell lymphoma (DLBCL) and approved in 2017, KYMRIAH (tisagenlecleucel) approved in 2017 for acute lymphoblastic leukemia (ALL) and in 2018 for its indication in DLBCL, and most recently TECARTUS approved in 2020 for mantle cell lymphoma (MCL). Although all three CAR-T therapies are highly targeted treatments, they are currently not available for first- or second-line use. There are three main barriers to entry in the current landscape: limited clinical evidence to support reimbursement, high upfront costs and reimbursement uncertainties, and logistical hurdles. Despite these key challenges, CAR-Ts can potentially overcome these hurdles using various logistical, clinical, and financial strategies that will allow for migration into earlier lines of treatment in the United States, with other countries to follow.

Limited Evidence to Support Reimbursement

A barrier to moving CAR-Ts to earlier lines of therapy is the limited comparative 3L+ and 2L clinical trial data. Not only do CAR-Ts lack data before 2L the data that they have launched with in later lines were single-arm early phase (Phase 1 / 2) results. While this is acceptable for 3L+ patients with high unmet need and no real standard of care (SoC), payers are less willing to reimburse based on less robust evidence in earlier lines where there are effective treatments. Additionally, from a clinical standpoint, payers are concerned with the duration of remission and the financial impact of CAR-Ts. More specifically, payers look for the durability of treatment and its financial value over time. This information is currently unavailable due to the novelty of these treatments, so looking forward, payers expect manufacturers to be committed to tracking patients long-term to monitor clinical and economic value. However, the success of YESCARTA has generated interest in testing CAR-Ts in earlier lines of treatment, especially for aggressive DLBCL. ZUMA-12 is the first clinical trial that will test the efficacy and safety of YESCARTA at the earliest time point so far in the course of the DLBCL treatment continuum (e.g., patients who have disease after only 2 cycles of induction chemoimmunotherapy). This is one of the first steps in filling in the current data gaps to provide payers sufficient clinical data to support reimbursement in earlier line use (e.g., 2L therapy). Another strategy to overcome the lack of comparative data is through Matched Adjusted Indirect Comparisons (MAIC). In the absence of head-to-head randomized controlled trials, MAICs use individual patient data from trials of one treatment to match baseline summary statistics from another treatment trial.

High Upfront Cost & Reimbursement Uncertainty

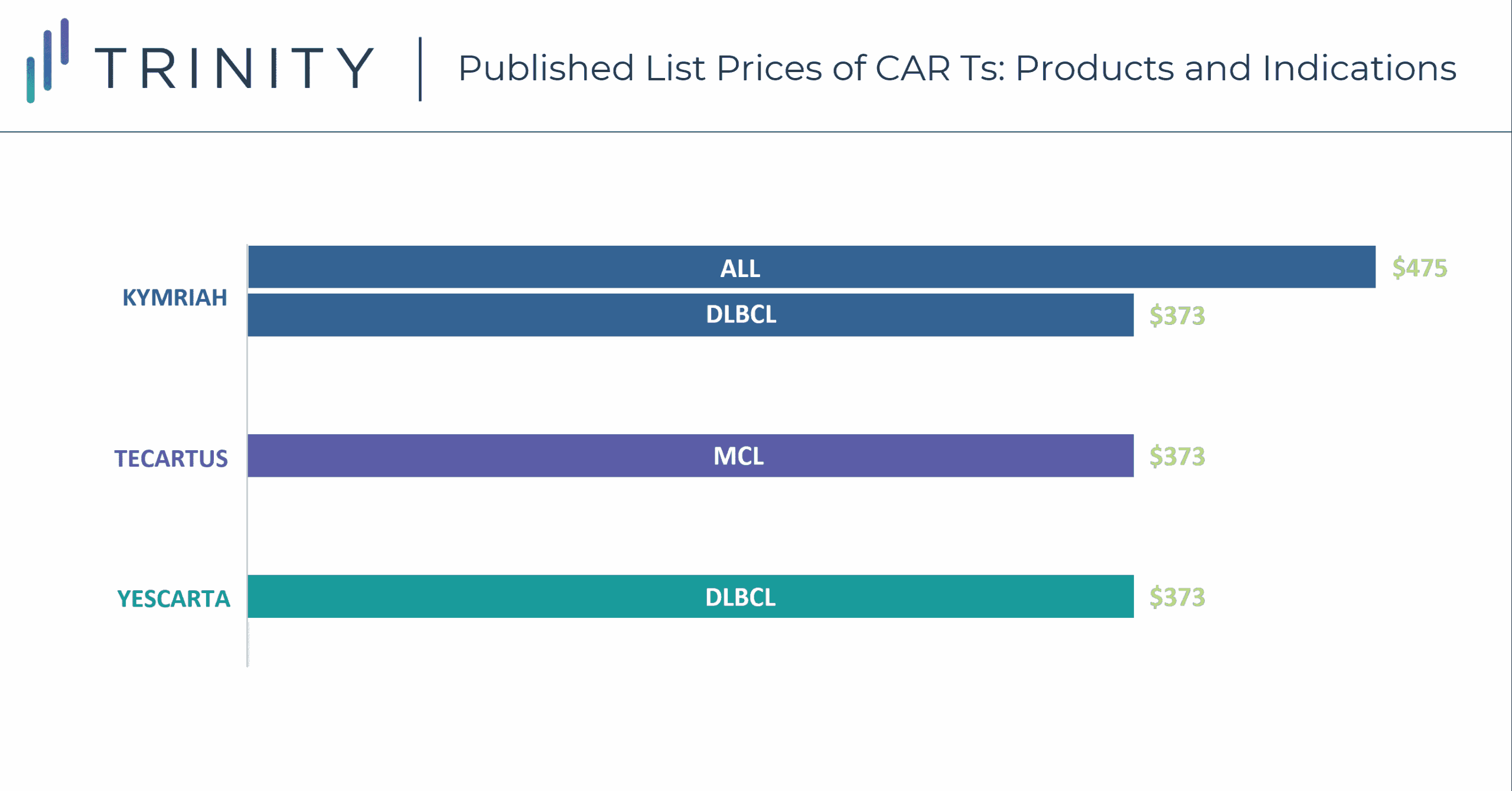

CAR-T therapies have a one-time, upfront wholesale acquisition cost (WAC), which is USD 373K for YESCARTA and TECARTUS, and USD 373K and USD 475K for KYMRIAH in DLBCL and ALL, respectively. While these treatment options are more expensive than SoC regimens such as R-CHOP for DLBCL with a WAC price of around USD 45k per treatment course, the one-time payout with a CAR-T may be seen as cost-effective, especially compared to the high-cost immune-oncologic products that carry an annual cost. Currently, the low CAR-T patient volume does not have a significant impact on payers’ budgets; however, this will change once CAR-Ts progress into earlier line use and more patients become eligible. Additionally, while current costs are manageable for patients who fall within the average range, outliers can exceed USD 1 million in their total cost of care, which is problematic for provider reimbursement and cost recovery. Furthermore, the total cost of a CAR-T therapy is not fully reimbursed currently under Medicare and Medicaid, thus resulting in hospitals bearing a significant cost for CAR-T patients. CMS is in the process of creating a new CAR-T specific Medicare Severity Diagnosis Related Groups (MS-DRG) that will have an unadjusted payment rate of USD 239,490. This new MS-DRG will hopefully alleviate some of the financial burden of CAR-T treatment from hospitals, allowing for higher utilization rates in this population.

Logistical Barriers

The production of a CAR-T treatment is labor intensive, with the average time from apheresis to the delivery of YESCARTA at the site being 17 days. Apheresis requires a lab, shipment through a pharmaceutical distributor (e.g., CARDINAL HEALTH), waiting for manufacturing, and then timing the delivery with the patient scheduling for their infusion. During the manufacturing period, there are often difficulties keeping patients eligible for infusion. Then, once CAR-Ts are delivered they must be administered intravenously, often followed by hospitalization to monitor cytokine release syndrome (CRS) or treat adverse events. This poses capacity issues for some sites who may be able to treat only a few patients per month. For 3L+ treatment, this limited capacity has less of an impact than with 2L use, given that there is less demand due to a smaller treatment population. Moreover, sites must undergo both manufacturer-specific CAR-T certification processes, as well as Risk Mitigation and Evaluation Strategies (REMS) training to be able to provide CAR-Ts, given the risk of CRS and complexities associated with CAR-T use. Given that a limited number of sites are CAR-T certified, getting patients referred to those sites is an additional challenge, particularly in earlier lines of therapy where community practices are able to treat those patients in-house. Therefore, expanding CAR-T uptake and utilization in 2L may depend on adding capacity to administer therapies beyond CoEs to more community-based sites as well as increase administration in the outpatient setting in order to mitigate these site of care limitations.

CAR-T Pricing and Market Access Opportunity

While currently there are a few barriers to CAR-T use in earlier lines of therapy, there are some promising opportunities, the first being innovative contracting. Despite many types of innovative contracts, the most notable example to assist the migration of CAR-Ts into earlier lines is an outcomes-based agreement that allows payers to reimburse for therapy only in cases where it works. This agreement relies on the CAR-T value proposition of durable benefit for reimbursement. NOVARTIS initially pursued an outcomes-based agreement to mitigate concerns of long-term value and improve public pricing perceptions. However, the contract proposed by NOVARTIS, whereby payers reimburse KYMRIAH if patients respond within one month following treatment, was cancelled by CMS given the short time frame of evaluation. Despite initial failure in the US, Italy has already employed this strategy with YESCARTA, dividing the cost of treatment (list price of USD 365K) into three payments made at 3, 6, and 12 months if the patient is responding to treatment. Another example is in Spain, where an outcomes-based agreement is used which includes a primary payment at the time of infusion and a follow up payment at 18 months, given the patient is still alive. Other strategies to expand into earlier lines of treatment include innovations that improve efficacy and safety outcomes and greater use in the outpatient (e.g., community / infusion center) setting, and physician advocacy given the curative potential of CAR-Ts.

Conclusion

Given how new these therapies are, the hurdles are not surprising. However, there has already been a decrease in overall costs with increased physician experience and comfort, with an expectation of further decreases in production costs as the technology matures. Overall, despite logistical hurdles, evidence generation requirements, and high upfront costs leading to reimbursement risks, CAR-Ts have the potential to transform oncology treatment paradigms further with incremental expansion from 3L+ to 2L treatment.

Written by: David Chung, PhD, Sophie Katz, Danika Berman, Tessa Malone, and Jessica Samuels