Home / Intelligence / Blog / Brazil’s Latest Updates to Drug Coverage in the Private Sector: Anticipated Impact and Implications

Published October 14, 2022

Executive Summary

- The “ANS rol” defines the minimum mandatory coverage of services (diagnostics, procedures, and treatments) in the private sector. While private providers could opt to provide coverage beyond this list, in practice, the “ANS rol” has traditionally been seen as the maximum coverage that would be provided with anything beyond the “ANS Rol” being typically rejected

- Law 14.454/2022 published in September 2022 establishes that the “ANS Rol” will dictate the minimum coverage that private payers need to provide, but it is not an exhaustive list of medical procedures and pharmaceuticals that payers will have to reimburse

- Newly launched therapies may be eligible for reimbursement in the private sector, even if not listed in “ANS Rol”, upon demonstration of clear benefits for the patient, or if recommended by the CONITEC (the Brazilian national health technology assessment (HTA) agency) or other renowned international HTA agencies

- The new law could have a significant impact on access dynamics in Brazil’s private sector, especially as it pertains to chronic diseases or oral oncology products that were not previously covered within the “ANS Rol”

Introduction

Agência Nacional de Saúde Suplementar (ANS) is the Brazilian regulatory agency linked to the Ministry of Health that oversees the private healthcare sector and insurance companies within the country. Key responsibilities of ANS include defining the legislation to regulate private plans and defining the minimum coverage that plans must offer to affiliates, which corresponds to approximately 22% of the Brazilian population.

“ANS Rol” is a formulary that delineates the minimum mandatory coverage of services (diagnostics, procedures, and treatments) that private payers must provide funding for. It consists of a list that is regularly updated, containing over 3,000 medical procedures, diagnostic tests, pharmaceuticals and other medical services. ANS does not specify, however, to what extent the formulary is comprehensive of all treatments that should be covered. For instance, although private payers could opt to provide coverage of treatments beyond the ANS Rol, in practice, the ANS Rol was typically seen as the maximum coverage that would be provided in the private sector.

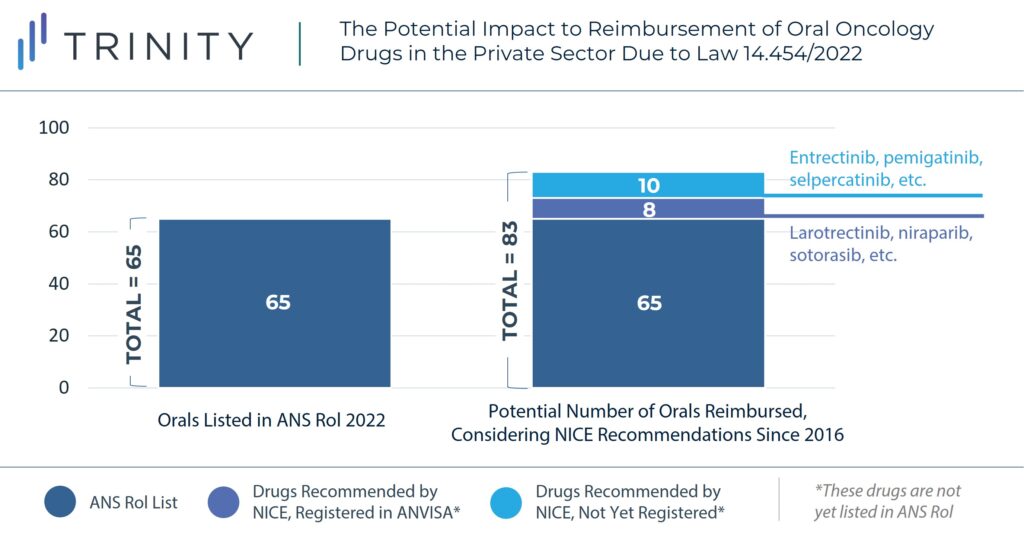

While IV oncology products and SC / IV immunobiologics for specific chronic conditions (rheumatoid arthritis, juvenile idiopathic arthritis, ankylosing spondylitis, psoriatic arthritis and Crohn’s disease) are automatically included in the ANS Rol and funded in the private sector, private payers would generally reject requests for funding beyond treatments mentioned in the ANS Rol, leading to patients resorting to judicial requests. Besides the cases of automatic inclusion, the “ANS Rol” includes funding with utilization guidelines (i.e., restrictions of use per indication, line of therapy or specified patient conditions) for 65 oral oncology molecules and a few select therapies for multiple sclerosis, psoriasis, ulcerative retocolitis, supurative hidradenitis, severe eosinophilic or allergic asthma, chronic spontaneous urticaria and active non-infectious uveitis.

Key Changes to the Brazilian Private Access Landscape

In June 2022, the Brazilian Superior Court of Justice defined the judicial understanding that the “ANS Rol” was indeed exhaustive, and thus only items listed in it would have mandatory coverage by health insurance providers. Brazilian congresspeople have since then developed a law project to discuss the comprehensiveness of the “ANS Rol” and reach an agreement on how it should be interpreted.

In September 2022, the Brazilian Federal Government finally published Law 14.454/2022, providing a final definition around the “ANS Rol” comprehensiveness. The new regulation establishes that the “ANS Rol” is not exhaustive and therefore should be used only as a reference for reimbursement. Consequently, therapies that are not listed in the “ANS Rol” should be accepted and covered by private plans if a valid request is provided. Requests may be considered valid and accepted if one of the following criteria are met:

- The product’s clinical benefit is clearly demonstrated

- The product is recommended for reimbursement by the Brazilian national HTA body, CONITEC or by at least one international stringent HTA agency

Instead of defining the maximum coverage, the ANS Rol is expected to delineate only the minimum coverage that must be provided in the private sector. As such, private providers may be mandated to provide funding for therapies beyond the ANS Rol if these have been recommended by CONITEC or one international HTA agency.

Implications of the New Law for the Pharmaceutical Industry and Future Therapies

The new Law 14.454/2022 brings a positive outlook for patients to access a broader range of therapies in the private sector. While the new law does not impact products that already benefit from automatic and mandatory funding in the private sector (e.g., IV oncologic products or IV / SC / IM immunobiologic drugs for specific chronic conditions), this is particularly relevant for highly innovative therapies that would otherwise undergo the typical formulary inclusion assessment, which could take several years after regulatory launch to achieve a positive reimbursement outcome in the private sector.

Manufacturers of oral chronic treatments not specified in the ANS Rol, oral oncology and neurological products are likely to benefit from this change, as it will provide a more favorable access landscape and price potential in Brazil’s private sector. The graph below provides an example of the potential impact of the new regulation to oral oncology drugs, considering NICE recommendations since 2016.

The new regulation also represents an opportunity for manufacturers seeking to launch in Brazil as there is potential for a more streamlined pathway to gain access in the private sector if recommended by international HTA bodies. High-cost therapies such oral tumor-agnostic therapies or cell and gene therapies may particularly benefit from the new regulation, as they have already been recommended by other international HTA agencies like NICE or HAS.

Despite the benefits and promise of the recently approved law, there is still uncertainty in the criteria for new products to be covered by private plans outside of the “ANS Rol”. Details around the scientific evidence that will be required to be covered have not been provided, and the international HTA agencies that would be considered have not been clearly specified.

Moreover, insurance companies are likely to position themselves against the new regulation under the argument that private health insurance may become less affordable for the general population if companies decide to increase prices to affiliates to account for the anticipated additional costs due to coverage provided outside of the “ANS Rol”.

Insurance companies may also respond by adopting more active management and imposing restrictive tools, as seen in certain therapeutic areas in the U.S. This could include more aggressive rebates or prior authorization with step therapy requirements to limit the patient populations covered and mitigate the anticipated budget impact.

Conclusion

The approval of the Law 14.454/2022 has the potential to impact the future access to therapies in the private sector in Brazil. Manufacturers seeking to launch oral products in oncology, rare diseases or chronic space are likely to see a more lucrative private healthcare sector in Brazil, benefiting from the potential funding of their products beyond what the ANS Rol dictates. While there are still uncertainties around the details and future implementation of the changes associated with the new law, they are promising news for patients and manufacturers considering the opportunities in the private sector. The impact of such changes on the overall pricing and access landscape in Brazil remain to be seen.

Related Intelligence

Blog

NRDL 2024: Rare Diseases Deep Dive

China’s pharmaceutical landscape is not only vast in scale but also rapidly evolving with an emphasis on balancing access with affordability. This year’s NRDL update stands out. The introduction of the value rating system continues to raise the bar for clinical innovation, rewarding innovation that truly addresses unmet needs and demonstrates clear differentiation. The National […]

Read More

Blog

Joint Clinical Assessment in the EU: What Life Sciences Companies Need to Know

March 2025 marked a pivotal moment for pharmaceutical and biotech companies operating in the European Union (EU) as the first two molecules began to proceed through the Joint Clinical Assessment (JCA) process. At a recent seminar hosted by Trinity Life Sciences, stakeholders gathered to explore the implications of this new regulatory framework and how to […]

Read More

Blog

Pricing and Access in Germany: Innovation and Strong Evidence Rewarded

Germany’s Medical Research Act (Medizinforschungsgesetz or MFG), which came into force on October 30, 2024, is a major legislative reform aimed at strengthening Germany’s position as an attractive environment for medical innovation and pharmaceutical development. The act provides for confidential negotiated drug pricing, incentives for local clinical trials, simplified clinical trial approvals and harmonization of […]

Read More