Home / Intelligence / Blog / Access and Reimbursement: Access to Digital Therapeutics in a Post-COVID-19 World

Published July 14, 2020

Executive Summary

- Digital therapeutics (DTx) represent a novel approach to delivering improved clinical outcomes, but the unstructured nature of today’s DTx access process has presented a major hurdle to broader uptake

- Payers are still at very different stages in their acceptance of DTx, and in contrast with traditional pharmaceuticals, buy-in from senior leadership will be an essential part of the top-down decision-making process for DTx prioritization

- Pharmacy benefit managers (PBMs) have taken a leadership role in facilitating a pathway for digital therapeutics adoption, and they are likely to remain the optimal entry point for DTx coverage and reimbursement in the near term

- Employer groups are likely to be early advocates for the benefits of DTx after running individual pilot programs, whereas managed care organizations (MCOs) may be less receptive to covering DTx until a national body of real-world evidence becomes available

- Ultimately, payers still have limited willingness to pay for DTx that lack clear impact on plan expenditures, and they will expect to see risk-sharing contracts on the table that can address these uncertainties

Trinity’s take: Even in lieu of standardized coverage of DTx, manufacturers and their industry partners can capitalize upon pockets of high-value opportunity by prioritizing PBMs and employer groups, investing in executive-level relationships, and preparing targeted payer communications on clinical evidence, total cost of care impact, and risk-sharing agreements.

The Digital Therapeutics Landscape

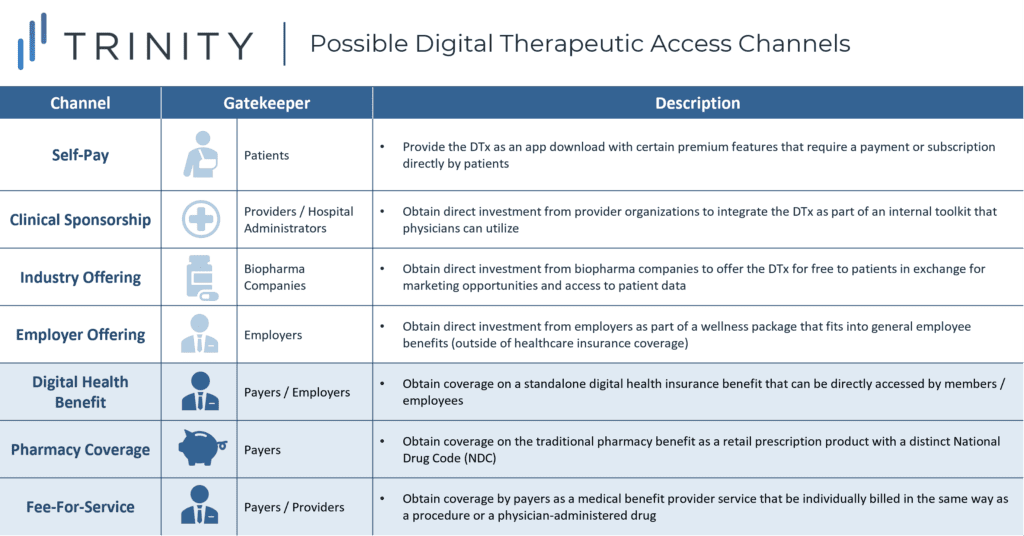

COVID-19 has brought about an unprecedented shift in the acceptance of digital technologies for healthcare applications. While it has been challenging in the past for digital therapeutics to build enough momentum to achieve coverage, payers’ appetite for digital solutions is certainly higher today than ever before. In a world where the number of DTx is rapidly increasing, it will be important for pharma and biotech companies to understand the range of possible access channels, especially as they consider DTx that can serve as digital companions to their drug portfolios (see Figure 1).

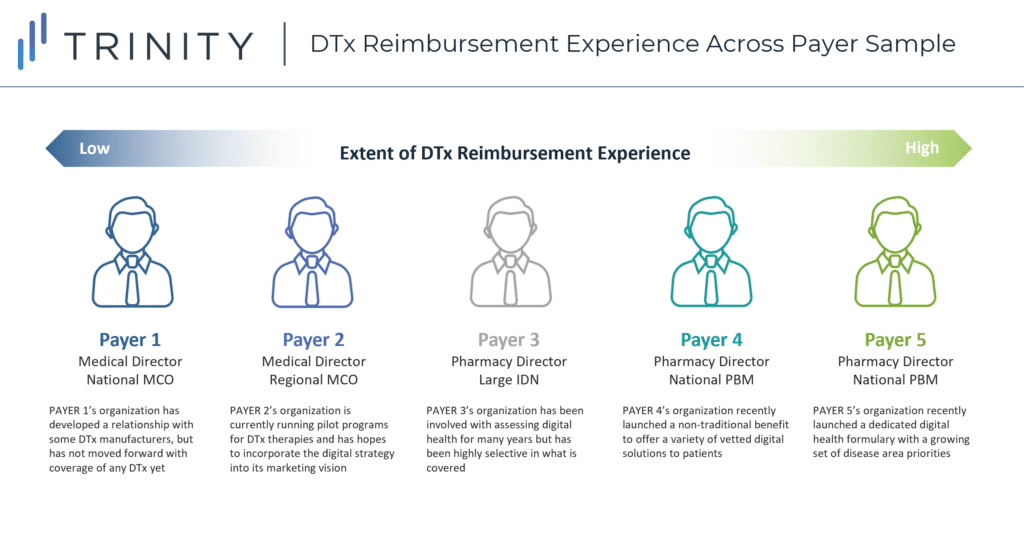

To acquire a deeper understanding of the three payer-influenced access channels highlighted above, CBPartners conducted primary research with N=5 commercial payers in May 2020. The research included organizations falling along a broad spectrum of DTx reimbursement experience in order to ensure a balanced set of perspectives on the key questions posed (see Figure 2).

Key Research Questions and Findings

1. What is the current payer mindset / approach to evaluating digital therapeutics?

- Although most commercial payers are aware of formal definitions from organizations like the Digital Therapeutics Alliance (DTA), they do not yet clearly distinguish between DTx and other digital health products (i.e., payers consistently referenced wearables in the same stream of thought as DTx)

- The lack of a filtering process has given payers the impression of an overwhelming digital pipeline, which has led to the avoidance of formal horizon-scanning processes for DTx

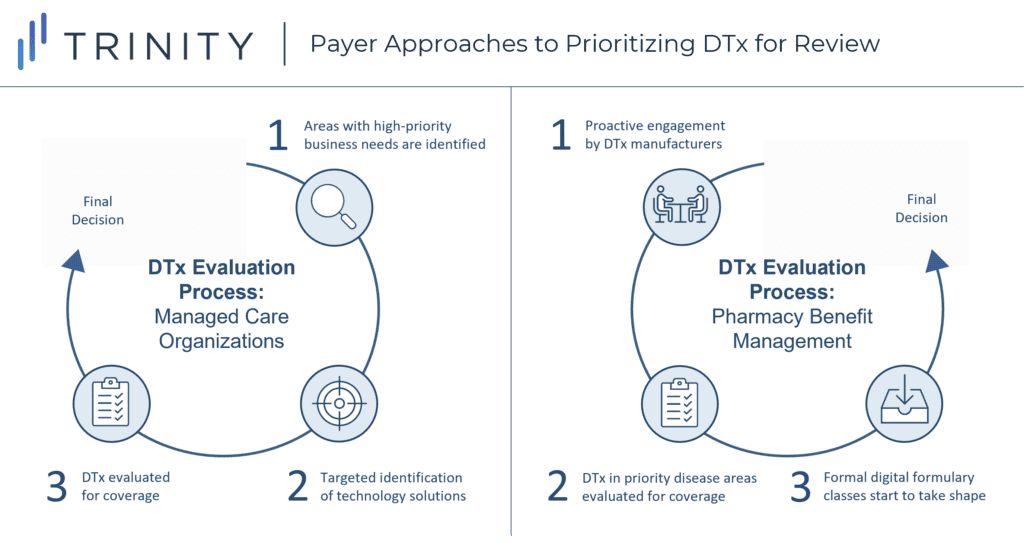

- There is no consistent approach across payers for how DTx are introduced into their organizations for evaluation. However, some trends exist by payer type (see Figure 3):

- MCOs: Tend to first identify specific priority business needs before scoping out possible digital solutions in an ad-hoc fashion

- PBMs: Tend to welcome proactive engagement from DTx manufacturers but will prioritize forward action in disease areas with higher potential for cost savings

- For DTx that are deprioritized by MCOs and PBMs, payers believe there is still ample opportunity to obtain access through employers, who have become increasingly receptive to DTx as a way to improve wellness and employee retention, especially when they target common chronic conditions like diabetes, mental health, etc.

- Key takeaway: Building a successful payer relationship will require DTx manufacturers and their industry partners to focus their messaging around relevant needs and priorities for that specific payer type; additionally, DTx manufacturers should continue to guide payers towards standardized criteria to distinguish clinically validated digital therapeutics from the broader class of digital health interventions

“There are thousands of apps and digital tools out there. A lot of the decision-making is disease-state driven – diabetes, respiratory disease, and opioid addiction are the biggest ones right now. If a DTx came through that’s in a non-priority therapeutic area, it won’t automatically go through a review… but the manufacturer should feel free to reach out, and if there’s something there, maybe we would consider it.”

Payer 5, Pharmacy Director, National PBM

2. Who within the payer organization should be engaged about reviewing new DTx?

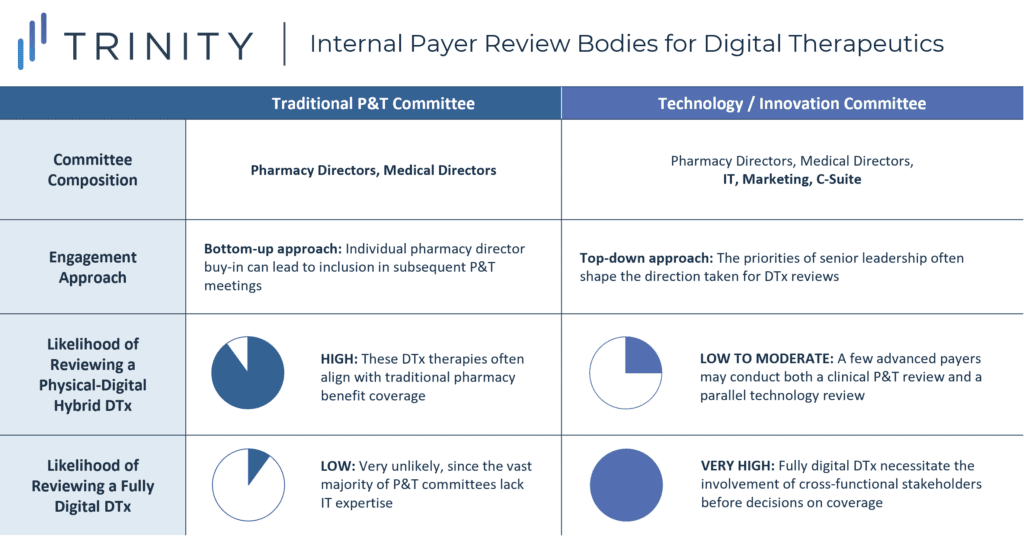

- DTx that are fully digital would fall outside the purview of the Pharmacy & Therapeutics (P&T) committee and will instead go through a separate internal review body for novel technologies; the composition and responsibilities of these technology review bodies will vary widely across payers (see Figure 4):

- For some payers, this committee has already been in existence as a MedTech review body, and it has recently absorbed digital health into its scope of evaluation responsibilities

- For other payers, this body has been separately constructed as an innovation committee responsible for forward-looking strategic investments; such a committee may consist of a cross-functional team with some P&T overlap, some level of senior leadership involvement, and some representation from both the IT and marketing departments

- For DTx designed to be digital drug companions that have close alignment with traditional pharmacy benefit coverage (e.g., ABILIFY MyCite, PROAIR Digihaler), the most likely review body will still be a traditional P&T committee; however, more sophisticated payers may conduct a parallel review within their technology committee before making final coverage decisions

- Some trends have emerged in terms of the effectiveness of different entry points to pitch a novel DTx:

- Bottom-up Approach: This approach has been standard practice for traditional pharmaceuticals reviewed by P&T committees, and setting up time to speak with individual pharmacy directors can lead to subsequent P&T meeting inclusion

- However, identifying the right individuals to engage for DTx can be difficult, as technology committee stakeholders may fall outside of those contacts known to the biopharma industry

- Moreover, due to the cross-functional nature of most technology committees, getting buy-in from one stakeholder type may be insufficient to drive the prioritization of a DTx for review

- Top-down Approach: This approach has been taken by past DTx manufacturers who closely engaged with payers’ senior leadership teams to shape the direction of organizational digital strategies

- The executive marketing / commercial leadership may be a better entry point for DTx than the clinical / IT leadership, as these stakeholders will have a broader vision for the overall digital strategy to drive member retention / growth

- While a top-down approach may be more effective than a bottom-up approach for DTx, attempts to engage with senior leadership can still fall flat if DTx manufacturers fail to present a payer-relevant pitch; given the significant number of non-viable digital health products in the market, payers have become relatively jaded and are unlikely to move forward on DTx that lack targeted communications on financial impact

- Clinician-driven Approach: This approach is applicable to integrated delivery networks (IDNs), where an initial clinician champion can advocate for the DTx to a department head, who can then elevate the DTx to the IDN’s technology review body

- IDNs are the exceptional payer type where a clinician-driven bottom-up approach is essential, as the lack of physician support will automatically disqualify a DTx for review

- While the champion could technically be any physician within the IDN, this individual should ideally be capable of defending the DTx on both clinical and economic grounds

- Bottom-up Approach: This approach has been standard practice for traditional pharmaceuticals reviewed by P&T committees, and setting up time to speak with individual pharmacy directors can lead to subsequent P&T meeting inclusion

- Key takeaway: Because traditional bottom-up engagement may not be effective for digital therapeutics, DTx manufacturers and their industry partners should consider early investment in building inroads with payer leadership teams (including marketing leadership) through concise, targeted messaging about the robustness of the evidence package and the anticipated impact on payer cost savings; partnerships with biopharma companies who already have strong payer relationships will be invaluable for DTx to gain expedited traction for review

“We don’t have a formal review process yet for DTx – it’s so nascent that we’re just not there yet. Right now, DTx are going through one of the three possible channels – the clinical innovation committee, the non-clinical innovation committee, or the cost savings initiative committee. However, the vision of our marketing team is that they own our digital strategy, from Apple Watch apps to DTx. There are so many different opinions going around that you really need top-level buy-in to get any momentum.”

Payer 2, Medical Director, Regional MCO

3. Once payers identify DTx of interest to review, how will they determine what evidence is necessary before covering it?

- There is not yet a standardized set of criteria that DTx review bodies will utilize, although the presence of high-quality clinical trial data (i.e., randomized, comparative, multi-center) will certainly be viewed as a positive decision-driver

- Payers are likely to have mixed opinions on the merit of clinical trial data vs. real-world evidence for access decisions:

- Only a minority of payers believe that robust, randomized controlled trial (RCT) data is enough on its own to warrant a coverage decision, as it would be for a traditional drug or device; that said, disease-specific challenges or concerns about DTx implementation could change their evaluations on a case-by-case basis (e.g., if skepticism exists around sustained patient use of an app in an uncontrolled setting)

- Most payers believe that while clinical trial data should still serve as the table stakes for considering a DTx for review, real-world evidence will be necessary before coverage is granted

- Payers expressed caution about signing onto pilots for unproven DTx, as they noted that taking benefits away from their members has been difficult in the past, even when the outcomes did not warrant coverage

- However, payers noted that employer groups have shown greater willingness to engage in smaller-scale pilots to inform their evaluation of a DTx, making them a viable testing ground for DTx with limited clinical evidence

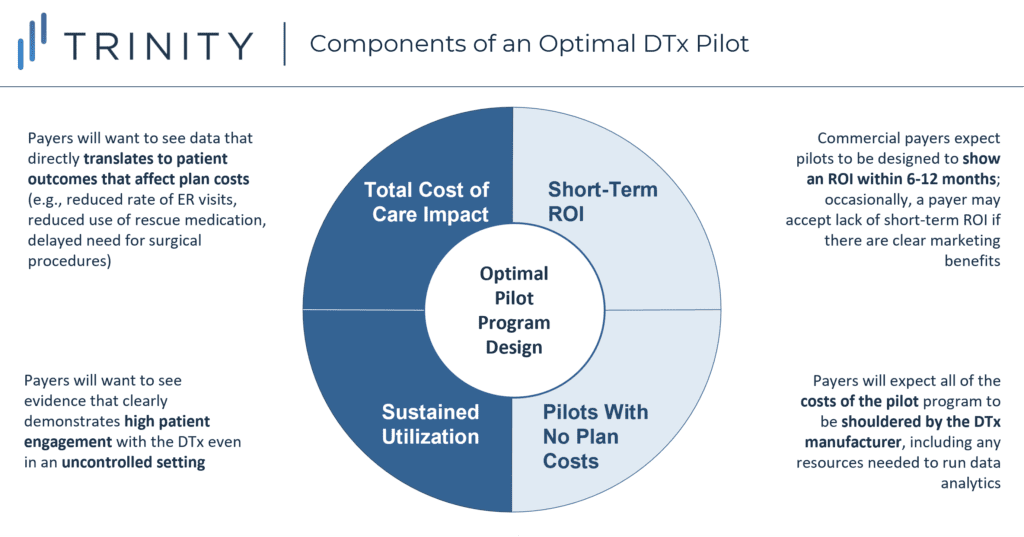

- In general, payers agreed that successful DTx pilot programs share four common traits (see Figure 5):

- Total Cost of Care Impact: Rather than endpoints like patient satisfaction and adherence, which may be fine for a proof-of-concept, payers want to see direct impact on patient outcomes that would translate into reduced costs for health plans (avoiding hospital stays, reducing the use of acute or chronic medications, delaying or eliminating expensive procedures, etc.)

- Sustained Utilization: Even if the clinical trial already collected data on payer-relevant endpoints, historical DTx adherence has been notoriously low, so clinical trial results alone are unlikely to reassure payers that patients will remain compliant; payers want to see a high level of patient engagement even in an uncontrolled, real-world environment where confounding factors could hypothetically lead to suboptimal utilization of the DTx

- Short-Term Return on Investment: Commercial payers continue to have concerns that member turnover could void the benefits of DTx with longer-term patient impact; as such, they want pilots to be completed and show a return on investment (ROI) within 12 months

- This presents an advantage for DTx in therapeutic areas which have a faster onset of patient benefit

- That said, there may be the occasional payer (particularly those with marketing involvement in their technology review committees) who will prioritize DTx for the purpose of marketing benefits rather than for short-term ROI

- Pilots with No Plan Costs: A consistent point of payer feedback was that pilots should not come with costs to the plan; payers also expect the DTx manufacturer to take the lead on collecting and analyzing the real-world evidence, without placing any additional burden on the payers’ internal staff

- Key takeaway: DTx manufacturers and their industry partners will need to carefully balance their financial investments in clinical trials vs. real-world data generation, especially since many payers currently expect to see pilot data even after an RCT is completed. That said, over the next 5 years, an increasing number of DTx in the market could trigger the FDA or CMS to establish more rigorous requirements for real-world evidence; this could then lead to a shift away from plan-specific pilots towards broader acceptance of pivotal real-world evidence studies occurring prior to launch

“The pilot phase is just to work through implementation steps with a limited number of physicians to see if there are any challenges or bugs to fix before a full rollout. We’ve learned not to pilot things to prove they work… it’s the same mindset for why we don’t like taking drug samples, as we don’t want dependency and familiarity to be the reasons why we choose to cover something.”

Payer 3, Pharmacy Director, National IDN

4. How will payers decide whether to cover DTx on the pharmacy benefit, the medical benefit, or as a separate digital health benefit?

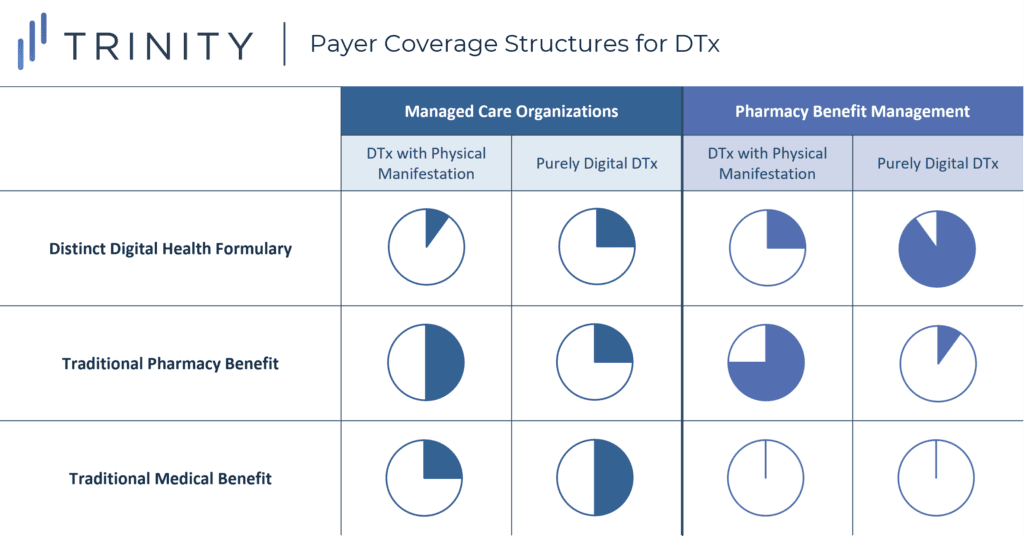

- One key uncertainty in DTx coverage stems from the fact that the traditional medical benefit-pharmacy benefit infrastructure is poorly suited for the complex manifestations of DTx products. As such, there is still variation in how payers are thinking about the execution of DTx coverage (see Figure 6)

- MCOs: Commercial MCOs generally expect DTx that are purely digital to be covered on the medical benefit or as part of a standalone disease-related benefit (e.g., mental health or wellness benefit) with minimal or no cost-sharing for patients

- However, DTx with physical components (e.g., ABILIFY MyCite) would likely still fall under the pharmacy benefit as long as they are reviewed by a traditional P&T committee

- Generally speaking, MCOs are not yet sold on the idea of creating a digital health formulary, as they are concerned that this would hold them accountable for reviewing all DTx, which would be overwhelming in the absence of standardized prioritization / evaluation criteria

- PBMs: PBMs have been comfortable taking a leadership role in crafting standalone digital health formularies that involve a range of disease areas

- However, they have been hesitant to apply management criteria within their digital health formularies in the same way that they have managed their pharmacy benefits; PBMs believe that placing roadblocks at this stage would be counterproductive to long-term adoption of digital solutions

- While eligibility determinations for app downloads has currently been left up to the discretion of provider care coordinators or case managers, and utilization management has not yet entered those conversations, payers believe that in the long-term, they will inevitably carry over tools like prior authorizations (PAs), differential copay tiering, and step therapy into their digital health formularies to better capitalize upon cost savings opportunities

- Key takeaway: DTx manufacturers and their industry partners should prepare contingency plans in the case that any one of these coverage types is granted, making sure to understand the implications on patient out-of-pocket (OOP) and provider reimbursement; they can also begin to think proactively about ways in which payers might manage across benefits (e.g., stepping the DTx through a traditional pharmacy drug) and which disease areas would have the highest risk of this

“We’re skeptical about a digital formulary because it means that, like our traditional formulary, we would have to review all the DTx products that obtain FDA approval. We are not even close to the idea that every DTx deserves a review, and my impression is that a lot of the movement from PBMs on this has been marketing rather than well-thought-out business decisions.’’

Payer 2, Medical Director, Regional MCO

5. What types of pricing structures / models will payers expect for DTx?

- Payers generally perceive DTx as having high sunk costs for research and development but minimal marginal costs from scaling up production, similarly to how they view small-molecule drugs; as such, they expect to see prices significantly below the specialty threshold (i.e., < $670 per patient per month) for any DTx that will not directly replace drug expenditures (i.e., digital companions)

- When assessing the “fair price” of a digital companion, payers will reference the cost offsets linked to usage of that DTx; since such data is normally not available from clinical trials, this heightens the importance of conducting plan-specific pilots, which can generate economic data that both the plan and the DTx manufacturer can agree upon

- For DTx that can substitute a traditional pharmaceutical, payers will likely evaluate the comparative efficacy and cost in the same way that a next-generation drug would be evaluated; in this case, a DTx may be able to sustain an incremental premium larger than $670 as long as there is sufficient clinical evidence and support from key opinion leaders (KOLs)

- Additionally, pricing expectations will likely differ depending on the disease area based on unmet need and budget impact, whereby an oncology DTx may obtain a higher per-patient price than an asthma DTx

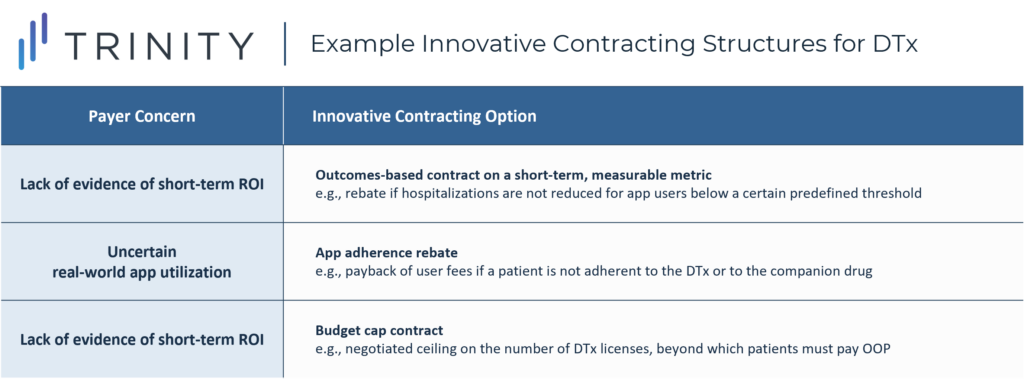

- In past examples of DTx that have obtained coverage, payers typically paid the DTx manufacturer on a per-download / per-patient model with additional risk-sharing conditions; there was a strong level of agreement across payers that innovative contracting will be essential for DTx to overcome uncertainties and obtain access

- While payers have been hesitant in the past about innovative contracting for drugs, DTx occupy a space where payers perceive greater risk from accepting a traditional discount, as the thresholds for “fair pricing”, even if validated through a pilot, can fluctuate based on real-world uncertainties

- To ensure value-based pricing for DTx, payers expect the DTx manufacturer to take on some degree of risk, with the specific contract type dependent upon which concerns are most relevant (see Figure 7)

- Key takeaway: DTx manufacturers and their industry partners will need to think through what types of pricing models / risk-sharing contracts would be strategically optimal to maximize payer opportunity, including leveraging discounts on DTx pricing to preserve the pricing of associated drugs; it will also be important to preemptively determine which economic metrics in real-world pilots can best support clear cost offsets, which will subsequently raise the attainable prices for DTx

‘‘When we ask DTx developers how many patients are currently using their app, they say 200 or 400 but then go on to make aspirational statements based on our millions of members. Given this, a best practice for these companies would be showing a willingness to enter into a risk-sharing agreement with the plan. We acknowledge that scaling up will be a challenge, and we don’t know what outcomes we’ll be able to see in the real world.”

Payer 1, Medical Director, National MCO

The Outlook for Digital Therapeutics in a Post-COVID-19 World

- COVID-19 has heightened the focus on DTx to address patient needs: COVID-19 has triggered a recognition of the value of digital health solutions by both the FDA (i.e., recent emergency use approvals) and commercial payers, making it increasingly important for manufacturers to understand how to best leverage this opportunity

- Payers’ evaluation of DTx remains highly fragmented: There is still no consistent DTx evaluation process, and individual payers continue to make ad-hoc decisions based on their individual business priorities and the strength of their relationships with DTx manufacturers and industry partners

- Certain payer types have higher receptivity to DTx coverage:

- PBMs are eager to continue spearheading coverage of DTx in high-profile chronic diseases, partly to support their marketing efforts and partly to capitalize upon cost savings from the scale of their covered lives

- Employer groups are also expected to facilitate DTx adoption due to the greater weight they place on employee productivity and retention, even in lieu of substantial healthcare cost offsets

- Certain public payers, particularly the VA (Veterans Affairs) and Medicaid, may become increasingly receptive to DTx that can achieve savings in the longer term, as they have lower rates of patient turnover

- Real-world clinical and economic evidence is critical for DTx access: Payers expect to see an evidence package that includes robust clinical trial results, evidence of sustained impact in a real-world setting, and data on cost offsets with which to establish “fair pricing” for the DTx

- Biopharma partnerships can substantially expedite access for DTx: Partnering with established biopharma players will be highly valuable for DTx manufacturers, as their existing payer relationships, including with employers and public payers, can be leveraged to pursue a top-down engagement approach; biopharma companies can also contribute their expertise to help DTx manufacturers prepare risk-sharing agreements, which payers will increasingly expect to see

- Utilization management of DTx has yet to manifest but is on the horizon: While payer approaches to DTx coverage will continue to vary over the next few years, once a standardized coverage infrastructure can be defined and competitive entrants manifest, utilization management of DTx will not be far behind; it will be important for DTx manufacturers and their industry partners to monitor the evolution of digital health formularies, as DTx are not currently protected from rigorous payer restrictions

- Momentum for DTx coverage may be driven by CMS policies: Once the USA political environment stabilizes, CMS will be poised to make major decisions on the future of digital health reimbursement, which could then encourage or deter commercial payer activity on DTx access

- Especially if COVID-19 remains present in 2021, CMS could choose to proactively move forward with demonstrations that broaden Medicare’s coverage of DTx; that said, CMS may limit such programs only to COVID-related DTx, and it may set a limit to the duration of coverage

- In parallel, while DTx access today has been concentrated within commercial lives, payers may begin to explore the expansion of coverage to Medicare Advantage patients, especially as more DTx begin to show proof of cost savings potential

- Finally, legislation was introduced in the House of Representatives in December 2019 (H.R.5333 – Ensuring Patient Access to Critical Breakthrough Products Act of 2019) that would accelerate coverage of DTx by making coding available for all new DTx and by requiring CMS to consider permanent coverage determinations; if this policy is eventually passed, Congress will essentially force CMS’ hand on moving forward with DTx coverage for digital companions

Written by Tom Rutkowski, Eric Yang, Eric Bernath, Temitope Coker, and Manon Ricard

Related Intelligence

Webinars

Learn From the Past – Launch Better Tomorrow

Available On Demand

Whether you are an emerging, mid-tier or large-tier company preparing for launch, this webinar is a must-watch. Join us for an informative webinar as our experts dive into Trinity Life Sciences’ latest white paper, the Trinity Annual Drug Index—an evaluation of commercial performance over three years of 58 novel drugs approved in 2020. Hear from […]

Watch Now

Blog

ISPOR 2023 Trinity Panel: Enabling Patient Access to Digital Therapeutics – The Optimal Approach?

Monica Martin de Bustamante, Sr. Partner of Trinity’s Evidence, Value, Access, and Pricing (EVAP) team, moderated an exciting conversation at ISPOR 2023 Global in Boston earlier this month. Monica spoke with Lisa Marsch, Ph.D., Benjamin Parcher, PharmD, MS, and Fulton Velez, MD, MS, MBA, all experts in the field of Digital Therapeutics (DTx), about the […]

Read More

Webinars

Payer Predictions: Evolution of the U.S. Digital Therapeutics Reimbursement Landscape

Available On Demand

The digital therapeutics (DTx) market is growing rapidly, but a lack of clarity around their reimbursement framework in the U.S. means that there is limited coverage. DTx developers— and pharmaceutical organizations seeking an integrated digital offering— are left to wonder how the payer landscape will evolve as they strategize for the future. Join Trinity Life […]

Watch Now