Rise with the Waves: Italy – AIFA Restructuring and Budget Reforms – Stepping into a New (Uncertain) Future?

Executive Summary

The Italian Medicines Agency (AIFA) underwent transformative changes on January 30, 2024, following a much-anticipated reorganization. AIFA’s restructuring has already faced challenges, with the recent resignation of the newly created Scientific and Economic Commission’s (CSE) chairman followed by the appointment of a new acting chairman, highlighting the need for a stable and collaborative leadership within AIFA.

Although AIFA’s overhaul has been implemented following a year-long delay due to bureaucratic complexities and is currently facing uncertainties, it will be important to monitor if the streamlined CSE will result in shortened HTA timelines, or if the restructuring and reduction in workforce will backfire and lead to delayed access.

In parallel, national health budget reforms under the 2024 budget law are expected to have an overall positive impact for the pharmaceutical industry considering the increased availability of resources for healthcare expenditure and adjustments to drug reimbursement budget caps. These measures have the potential to reduce overspending of the direct drug purchase budget and the resulting paybacks, hereby alleviating manufacturers’ budgetary concerns. Further reforms earlier published in 2023 specifically provided additional reimbursement budget resources only to manufacturers who have settled overspending paybacks from previous years thus, improving the availability of cashflow to fund and increase access to innovative therapies.

This blog focuses on two high impact reforms in Italy, (i) the evolution of AIFA’s restructuring, and (ii) 2024 Italian healthcare budget, and the opportunities and challenges that companies will have to consider to optimize the pricing and market access potential for their assets.

Key Policy Updates

The New AIFA Restructure: Reorganization and CSE Creation

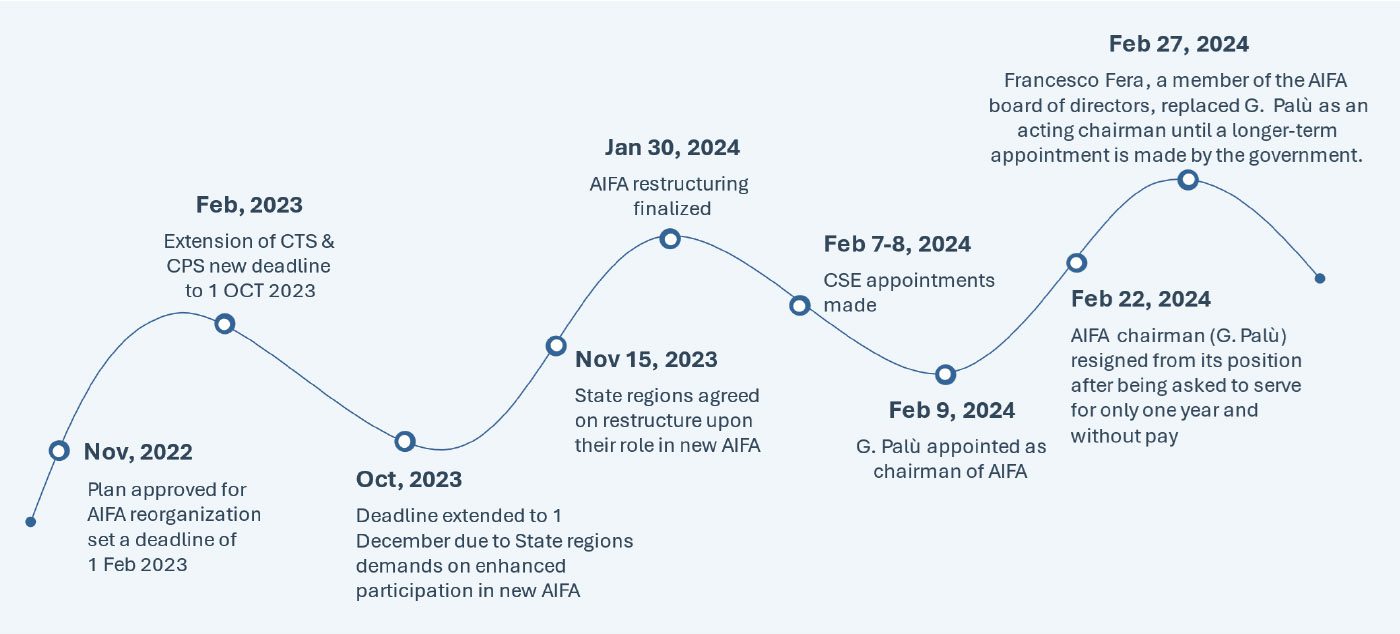

The plan for the AIFA restructuring was announced by the Minister of Health on Nov 8, 2022, and more than one year later, this long-awaited reform was published in the Italian Official Journal on January 15, 2024 and finally became effective on January 30, 2024. The key change in the restructure involves the merger of The Technical Scientific Commission (CTS) and Pricing and Reimbursement Committee (CPR) into a new “Scientific and Economic Commission (CSE)”, which will now be responsible for both the evaluation of the clinical benefit of new health technologies and the establishment of their pricing and reimbursement conditions. However, the CSE will have to perform these assessments with half the members that constitute the incumbent committee (10 members* in place of the previous 20).

The AIFA restructure involves the following additional changes:

- Establishment of the new roles of Technical and Scientific Director and of Administrative Director, with specific duties and responsibilities

- Elimination of role of Director General, with the president of AIFA assuming the official legal representation

- President of AIFA will be appointed by the Minister of Health with the agreement of the Permanent Conference for Relations between the State, Regions, and Autonomous Provinces

Below is a detailed timeline from planning until implementation of the new, restructured AIFA , which would potentially reshape the healthcare landscape in Italy:

HIGH PRICING AND MARKET ACCESS IMPACT: AIFA’s restructuring signals a clearer path for manufacturers in potentially streamlining and expediting the access process. Moreover, the shift towards aligning national and regional priorities, particularly through enhanced state-regions participation in the CSE, represents a significant milestone. This shift has the potential to reduce inequalities and delays in regional access to healthcare. All the involved stakeholders (specifically pharmaceutical manufacturers, scientific societies, patient associations) are eager to understand the practical implications of this restructuring in terms of impact on the assessment timelines and efficiency of the procedures. Based on the ongoing restructuring delays, the industry should anticipate challenges, specifically considering the reduction in the workforce leading to potential obstacles in the drug assessment process.

FUTURE OUTLOOK: 2024 will be a pivotal year for manufacturers as they closely observe the direction taken by the new AIFA leadership and the roll out of new CSE assessment frameworks. This period will be crucial for manufacturers to remain agile in adapting their market access strategies for addressing any uncertainties around drug assessment requirements and timelines specifically with the potentially greater influence of regions in AIFA’s decision-making.

2024 Italian Healthcare Budget and Reforms

On Dec 29, 2023, Italy’s Parliament approved the 2024 budget law aimed at enhancing the overall profitability of Italian healthcare market. Following are the main measures of the 2024 budget law:

- Increase of an additional €3 billion for 2024, €4 billion for 2025, and €4.2 billion in 2026 (confirming the level of health expenditure at 6.4% of GDP for the years 2024 and 2025) to the National Health Fund (Fondo Sanitario Nazionale, FSN)

- Increase in the ceiling for pharmaceutical expenditure for direct purchases**, which includes hospital drugs, to ~8.6% of the FSN (up from 7.65% in 2023)

- Spending on drugs not used in the hospital setting (i.e., through pharmacy network) will be capped at 6.8% (down from 7% in 2023) of total healthcare expenditure

- Community dispensing of some drugs that were formerly limited to hospital pharmacies. AIFA (along with the State-Regions Conference) is expected to review the Hospital-Outpatient Formulary and the list of off-patent drugs that could be dispensed and reimbursed through retail pharmacies by Mar 30, 2024 (and annually thereafter)

- Amendments to the ‘Decreto Bollette’ allows transfer of funds between the community and hospital drugs budgets in case one is in deficit while the other has surplus funds

Over the past years, the budget allocated to direct drug purchasing has gradually increased from 6.7% (2020) to 7.7% (2021), 8% (2022) and 8.3% (2023). Despite the increase, budgets have historically been insufficient to mitigate the spending deficit. For example, in the first 9 months of 2023, overspend had already reached €2.87 billion, half of which pharmaceutical companies will be required to pay back.

While it is expected that these adjustments will not affect the overall spending ceiling on reimbursed drugs (already set to 15.3% of the FSN for 2024, an increase from 14.85% in 2023), the Council of Ministers noted that these would reduce (although not eliminate) overspending of the direct purchase budget and the resulting paybacks. Moreover, back on July 21, 2023, in an attempt to promote fiscal responsibility and reward compliant pharmaceutical companies with expanded access to funding resources, the Italian government published a decree declaring that additional reimbursement budget resources would be provided only to those manufacturers who have been compliant in settling any overspending paybacks from 2019-2021.

HIGH PRICING AND MARKET ACCESS IMPACT: Italy’s 2024 budget law reflects a heightened focus on optimal access to resources by adjusting caps on pharmaceutical expenditure for drugs used in hospital and non-hospital setting. Furthermore, pharmaceutical manufacturers can expect reduced payback amounts related to any overspending, although its impact remains uncertain until additional clarifications from relevant authorities. The proposed budget increases to the FSN will also boost healthcare resources specifically available for direct drug spending (including hospital drugs) potentially providing a consistent and sustainable access of drugs to patients in Italy.

FUTURE OUTLOOK: Alongside the AIFA restructure, 2024 budget reforms have the potential to generate positive effects on the access to drugs and pharmaceutical services in Italy. It will be important to monitor the continuous application of these budget adjustments and reallocations to understand their impact in willingness to pay for high-cost treatments, as well as help mitigate gaps in hospital drug funding.

Conclusions

The long-awaited restructuring of AIFA happened after repeated delays and with the greater involvement of regions in decision making, underlining the complexities and challenges encountered along the way. The restructured AIFA still stands at critical crossroads with the potential to transform into a more dynamic and agile drug pricing and access evaluator, harmonizing the clinical and economic dimensions of the CSE. On the contrary, if limited by staffing constraints, it can potentially adversely impact the assessment process resulting in delayed access.

A few questions remain unanswered as to when the new chairman will be appointed, when the CSE is going to be fully operational, what will be its modus operandi, and will there be any impact on the submission requirements and assessment timelines?

On the other hand, the 2024 budget law included a few access boosting measures, such as increased funding for direct pharmaceutical spending, allowing transfers between hospital and community budgets, potentially reduced overspending of the direct purchase budget and the resulting paybacks owing to ceiling on reimbursed drugs and community dispensing of some drugs formerly limited to hospital pharmacies.

It is imperative for manufacturers to closely monitor the potential impact of AIFA restructuring given significant landscape shifts and actively strategize to optimize future assets’ pricing and market access potential. Further, manufacturers should also analyze the outcomes from the budgetary reforms specifically to achieve homogeneous and sustainable access of medicines to patients across Italy.

Acronyms: AIFA: Italian Medicines Agency; CSE: Scientific and Economic Commission for Pharmaceuticals; CTS: The Technical Scientific Commission; CPR: Pricing and Reimbursement Committee; HTA: Health Technology Assessment; FSN: Fondo Sanitario Nazionale

Notes:

*10 members include: the Technical-Scientific Director of the Agency; the President of the Italian National Institute of Health or their delegate; four members (one of these to serve as chairman) appointed by the Minister of Health (members must demonstrate proven and documented national and international technical-scientific competence and at least five years’ experience in drug evaluation and in the methodology of health economics and pharmaceutical pricing); one member appointed by the Minister of Economy and Finance; three members appointed by the Permanent Conference for Relations between the State, Regions and Autonomous Provinces of Trento and Bolzano. Non-executive members will have a three-year term of office, which may be extended once. As per the recent appointments made on Feb 7, 2024, the Health Minister appointed four members, including a professor, an internal medicine expert, a general practitioner, and a pharmacist. Meanwhile, the Finance Minister’s selection includes an HTA expert for the CSE. Additionally, three CSE members, comprising two experts from pharmaceutical and medical devices and an oncology expert, were chosen by the State-Regions Conference

**Direct purchase refers to prescription drugs dispensed in hospital, in local health authority facilities or by retail pharmacies acting on behalf of local health authorities

AUTHORS: Nikhil Taxak, Harshmani Sapra, Andreia Ribeiro, Karla SanchezGonzalez, Salomé Monreal Louly, Maximilian Hunt