Poland’s Medical Fund Bill to Improve Access to Oncology Drugs

Executive Summary

- The Medical Fund Bill would increase drug spending up to 4% of the total healthcare spending in Poland

- The reimbursement applications can be reviewed as quickly as 180 days, reducing the typical time-to-market of two – three years

- The criteria for “innovativeness” that need to be met for inclusion on the list are still not fully fleshed out to date

- Only four of the 12 candidates on the list have been approved by the Health Minister to secure reimbursement

Trinity’s Take: The recently introduced Medical Fund Bill has potential to improve access to novel therapies applying for reimbursement in Poland, however, it is yet to be seen how the criteria for inclusion in the Fund’s list are clarified locally and whether a broader scope of therapies will be eligible for the scheme to deem the market more attractive for submissions.

An Introduction to The Medical Fund Bill in Poland

The Medical Fund Bill was introduced in Poland by the President in 2020 with the aim to improve access to drugs for rare diseases, specifically in oncology. The Bill proposed 9bn zloty (EUR 900 million) to the Fund targeted at improving access to expensive therapies.

With the total healthcare expenditure of ~120bn zloty in 2021, 4.7 bn of which was spent on drug programs, the Fund would increase drug spending up to 4% of the total healthcare spending in Poland, up from 0.01% in 2015. Similar to the emergency access to drug technologies (RTDL) procedure, the Fund will offer conditional access to drugs, while encouraging pharma companies to apply for reimbursement.

The Pathway to Drug Reimbursement in Poland

The reimbursement process in Poland, which includes both the HTA and negotiations, typically takes two to three years, but inclusion in the new list is meant to expedite the reimbursement times, as under this scheme, reimbursement applications can be reviewed as quickly as 180 days. As of today, there can be up to 12 drugs on the list that are recommended for reimbursement, with the Health Minister in charge of selecting a subset of these 12 therapies to provide coverage for up to two years. The number of therapies listed is not rigid and can vary depending on the health technology assessment (HTA) basket.

There are five criteria for “innovativeness” that need to be met for inclusion on the list, but these have not been clearly defined to date. The HTA would still apply to the candidates for inclusion in the Fund, incorporating clinical evaluation, evaluation of the magnitude of benefit, economic evaluation, and assessment of the budget impact.

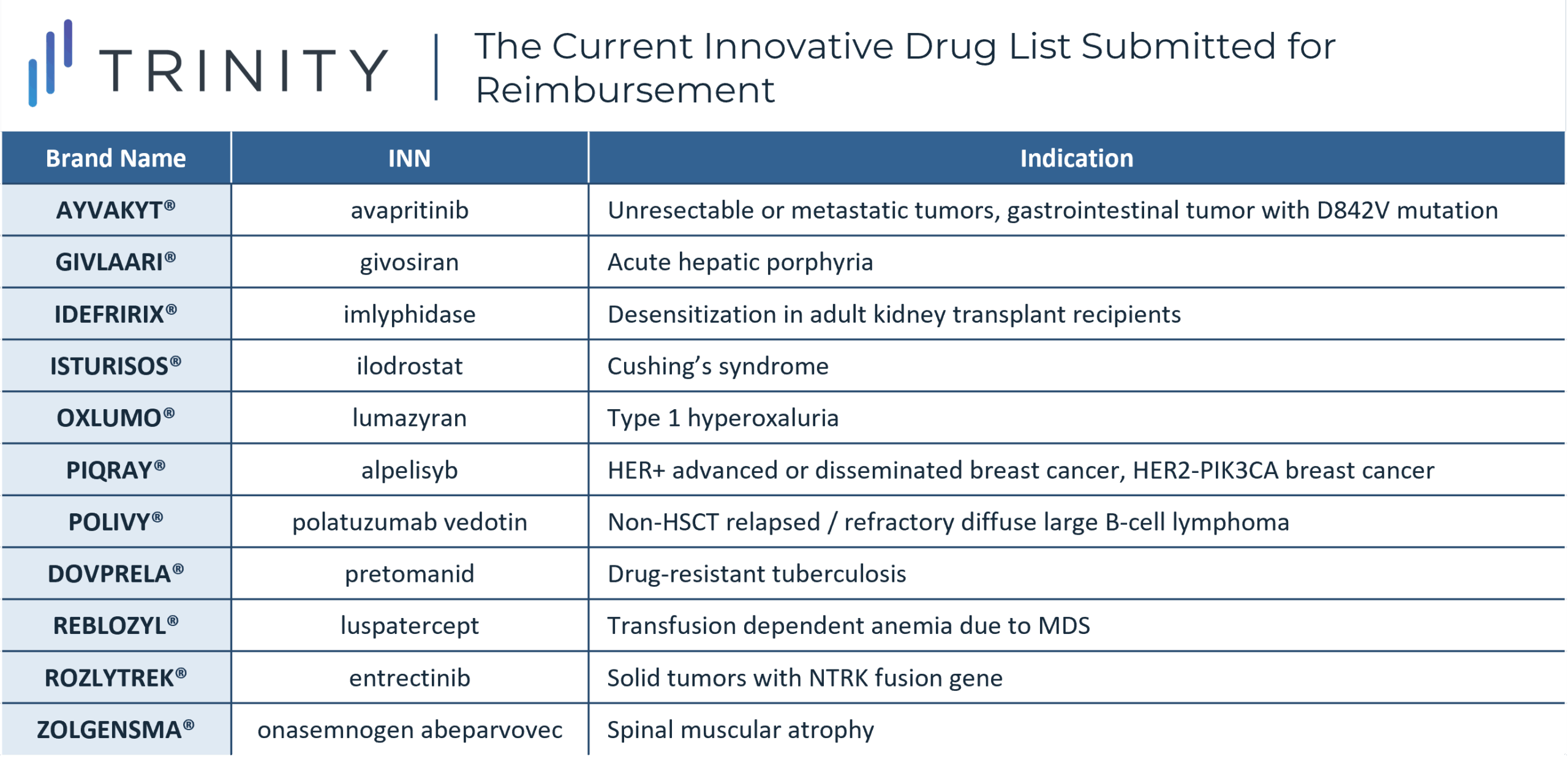

The Current Innovative Drug List Submitted for Reimbursement

Considerations for Poland’s Medical Fund Bill

The new fund has received mixed perceptions as some stakeholders argue that for such a large undertaking, the rollout was too quick and could lead to potential gaps in the plan. For example, the Polish Parliament notes that the reimbursement list seems to use a reallocation of funds, rather than a procurement of additional funds, which means a risk of taking the funding away from other areas of the Polish state budget.

As currently only four of 11 therapies have been indicated as priorities and achieved reimbursement, the overarching perception has been less positive, given more drugs were expected to be on the list and receive funding. A higher level of monitoring for drugs that achieve reimbursement has been announced as well with specific attention focused on driving clinical results, however what this monitoring will entail has not been fully fleshed out in the official sources.

Despite industry criticisms, patients view this decision positively as increased access to high-cost therapies has potential to drastically improve quality of life and decrease time to access for the listed therapies, even if patients are not hospitalized. Historically, many drugs in Poland are listed in the hospital drug program instead of the pharmacy drug program, thereby limiting access to medications, given patients must be enrolled in the hospital drug program and hospitalized to receive therapy.

The Mission to Improve Access to Drugs for Rare Diseases Continues

While the Agencja Oceny Technologii Medycznych i Taryfikacji (AOTMiT) has recently made the move to list certain medications on the pharmacy list, increasing access and alleviating burden on hospitals, research suggests that Polish patients still lack access of up to ~60% of high-cost oncology therapies due to high cost. Full access is reported for only 28 among the 128 therapies registered in Europe over the last 15 years, while 39 therapies have restricted access, and 61 medications have no access despite proven efficacy benefit, so it is yet to be seen how establishment of the new list will affect these figures in the future.

Written by Elena Subbotina and Maya Iyer