NRDL 2024: Rare Diseases Deep Dive

China’s pharmaceutical landscape is not only vast in scale but also rapidly evolving with an emphasis on balancing access with affordability. This year’s NRDL update stands out. The introduction of the value rating system continues to raise the bar for clinical innovation, rewarding innovation that truly addresses unmet needs and demonstrates clear differentiation.

The National Reimbursement Drug List (NRDL) in China is a government-approved roster of medications that are covered by the national health insurance system. Inclusion on this list greatly enhances the accessibility and affordability of a drug for patients throughout the country.

Here we discuss key updates from the 2024 NRDL outcome analysis, including an introduction to the new NRDL value rating system and its implications.

The Significance of the New NRDL Value Rating System

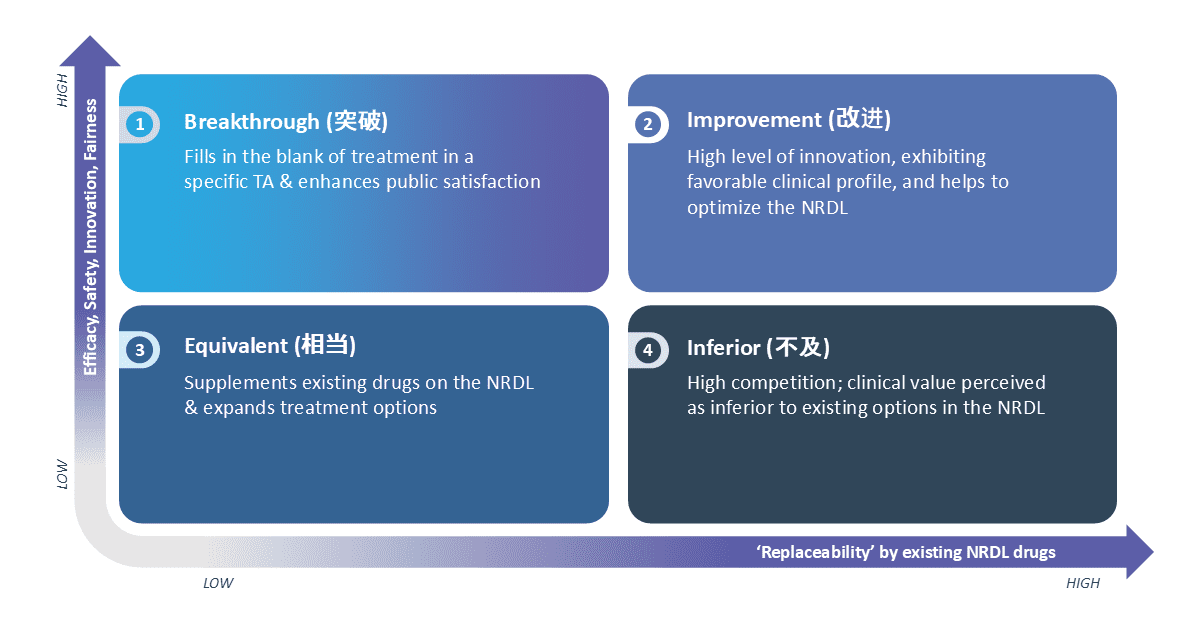

Since 2023, the NRDL introduced a new value rating framework to assess the value of drugs seeking inclusion on the list. This framework categorizes products based on clinical characteristics, efficacy, safety, innovation and fairness, considering factors such as unmet needs addressed and replaceability of existing NRDL drugs.

The Value Rating Framework aims to enhance the chances of a drug passing the NRDL expert review process. A higher tier rating increases the likelihood of progressing through the review process and advancing to the negotiation phase, highlighting the NRDL’s interest in innovative therapies.

The pricing impact resulting from the value rating framework will vary depending on the perceived value of the product, pricing relative to relevant NRDL benchmarks, and the expected overall budget impact.

The value rating categories include:

Breakthrough: Addresses a treatment gap in a specific therapeutic area and enhances public satisfaction.

Improvement: Demonstrates a high level of innovation with a favorable clinical profile, contributing to optimizing the NRDL.

Equivalent: Complements existing NRDL drugs and expands treatment options.

Inferior: Perceived as having lower clinical value compared to current options on the NRDL

The implementation of the NRDL value rating system has supported the NRDL experts to determine a product’s value objectively.

Figure 1: The Value Rating Framework Categories Established in 2023

The 2024 NRDL Highlights: Rare Disease

The 2024 NRDL underwent a familiar process compared to previous years, with a substantial attrition rate from initial application to final negotiation.

A total of 574 manufacturers submitted applications for their products to be considered for inclusion, which underwent review by the NRDL expert panel. Out of the 440 products that underwent expert evaluation, only 162 advanced to the price negotiation phase, with a final of 117 drugs successfully enlisted onto the 2024 NRDL, representing a 72% success rate for products that entered negotiation.

Out of the 117 drugs that were included in the NRDL 2024 listing, eight treatments in the rare disease category were successfully enlisted. This underscores the National Health Security Administration’s (NHSA) ongoing commitment to addressing unmet needs and giving priority to reimburse treatments indicated for rare diseases.

In comparison to other therapeutic areas, rare disease therapies tend to obtain a higher annual price due to the limited budget impact, but the informal historical price ceiling of CNY ¥500,000 / USD $70,000 for negotiation and CNY ¥300,000 / USD $42,000 reimbursement still holds true.

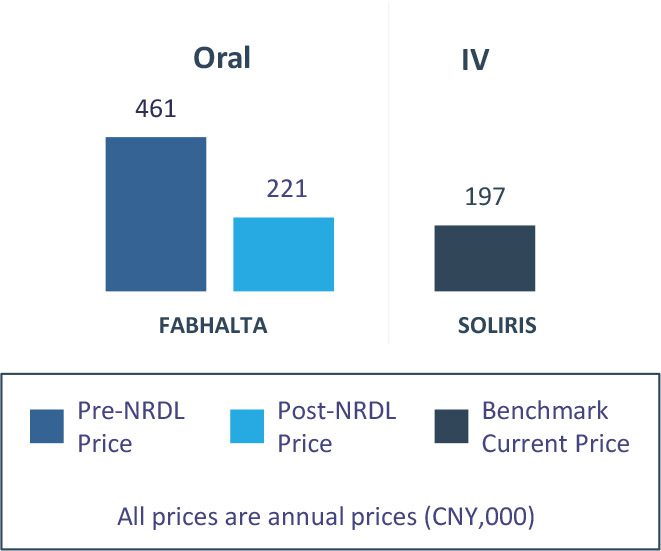

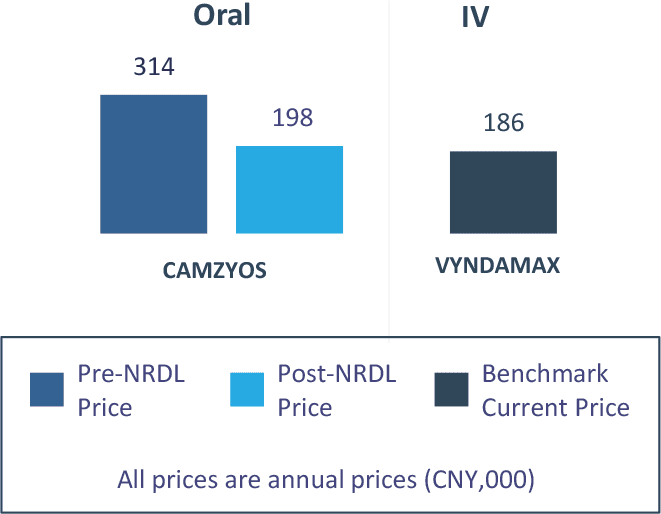

FABHALTA® (iptacopan) and CAMZYOS® (mavacamten) are two examples of rare disease treatments listed in NRDL 2024 (see Figure 2 and 3).

FABHALTA®

- FABHALTA has demonstrated notable clinical efficacy improvements over the standard of care (SoC) in PNH—SOLIRIS® and ULTOMIRIS®—supported by both global clinical trials and real-world evidence. However, the absence of direct head-to-head comparisons with SoC in the first line (1L) setting introduces uncertainty regarding its relative benefit. Consequently, broader use in both 1L and second line (2L) settings, along with real-world SOLIRIS titration practices, may limit its ability to command premium pricing

- Nonetheless, FABHALTA’s inclusion in the NRDL underscores that therapeutically equivalent alternatives remain valued, and reflects the NHSA’s commitment to expanding treatment options for physicians

Figure 2: Expected Value Rating, Clinical Benefit and Pricing of FABHALTA®

Likely NRDL Value Rating & Rationale

Improvement (2L) / High Uncertainty(1L)

FABHALTA has shown significant improvement in clinical efficacy over the SoC in PNH, SOLIRIS/ULTOMIRIS, as evidenced in global trials and a real-world study

Clinical Benefit

| PNH* | Global Ph3 RCT (no CHN sites) |

Global Ph3 Single-arm (with CHN sites) Accepted for Full Approval |

Real-World Study (no CHN sites) |

|

|---|---|---|---|---|

| FABHALTA (2L post C5i) |

SOLIRIS/ULTOMIRIS | FABHALTA (1L) |

SOLIRIS/ULTOMIRIS | |

| Increase in Hb** | 82% | 2% | 92% | 28% |

| Transfusion Avoidance | 95% | 26% | 98% | 59% |

| Serious AEs | 5% | 9% | 2% | N/A |

Pricing (vs. Benchmarks)

Despite significant advances in 2L post-SOLIRIS/ULTOMIRIS, FABHALTA’s lack of direct 1L SoC comparison creates uncertainty about its benefit; its broader 1L/2L use and real-world SOLIRIS titration likely further leads to no premium pricing between the drugs

* In the control group of the global Phase 3 RCT APPLY-PNH, 65% of patients received SOLIRIS while 35% received ULTOMIRIS; the real world study enrolled 98% patients treated with SOLIRIS and 2% treated with ULTOMIRIS

** An increase in haemoglobin of at least 2g/dL when compared to baseline

CAMZYOS®

- CAMZYOS represents a breakthrough as the first and only innovative therapy approved for obstructive hypertrophic cardiomyopathy (oHCM), achieving a compelling 26% vs. 4% complete response rate and 44% vs. 4% improvement in ≥1 NYHA class

- In the absence of a branded comparator to guide pricing, Chinese payers are likely to benchmark CAMZYOS against therapies in adjacent disease areas with similar prevalence and innovation profiles

Figure 3: Expected Value Rating, Clinical Benefit and Pricing of CAMZYOS®

Likely NRDL Value Rating & Rationale

Breakthrough

The first and only innovative medication approved for oHCM, addressing critical unmet needs in this space

Clinical Benefit

| oHCM | China Ph3 RCT Accepted for Full Approval |

|

|---|---|---|

| CAMZYOS | Placebo | |

| CR | 26% | 4% |

| ≥1 NYHA class improvement | 44% | 4% |

Pricing (vs. Benchmarks)

Manufacturers argue that VYNDAMAX® is an appropriate pricing benchmark, which is likely accepted by the NHSA, since both products target rare cardiovascular diseases and are deemed ‘highly innovative’

Considerations for the Future

The NRDL encourages the submission of alternative treatment options that offer comparable clinical profiles, reinforcing its commitment to broadening access and choice for patients and physicians. Based on the inclusion of rare disease therapies in the 2024 NRDL, it is evident that therapeutically equivalent products continue to have a place within the listing, with pricing expectations set at parity or modest discounts for such comparable products.

Innovative therapies for rare diseases often carry higher annual costs compared to treatments for broader indications, primarily due to their limited overall budget impact. However, as affordability continues to be an important consideration when discussing price negotiations with NHSA, existing NRDL benchmarks and informal pricing thresholds will also be considered by payers to ensure the sustainability of public funding.

For therapies granted breakthrough status, in the absence of a branded comparator to serve as a pricing benchmark, payers are likely to reference products from adjacent disease areas with similar prevalence and levels of innovation when determining pricing.

Authors: Cindy Pang, Venus Leung and Wenting Zhang

Special thanks to: Allen Liu, Rya Zhang, Karen Yang and Peter Law