Novel Combinations: Double the Trouble

Executive Summary

- Branded novel combinations are increasingly entering the oncology market but bring a unique set of challenges to gain access and pricing success

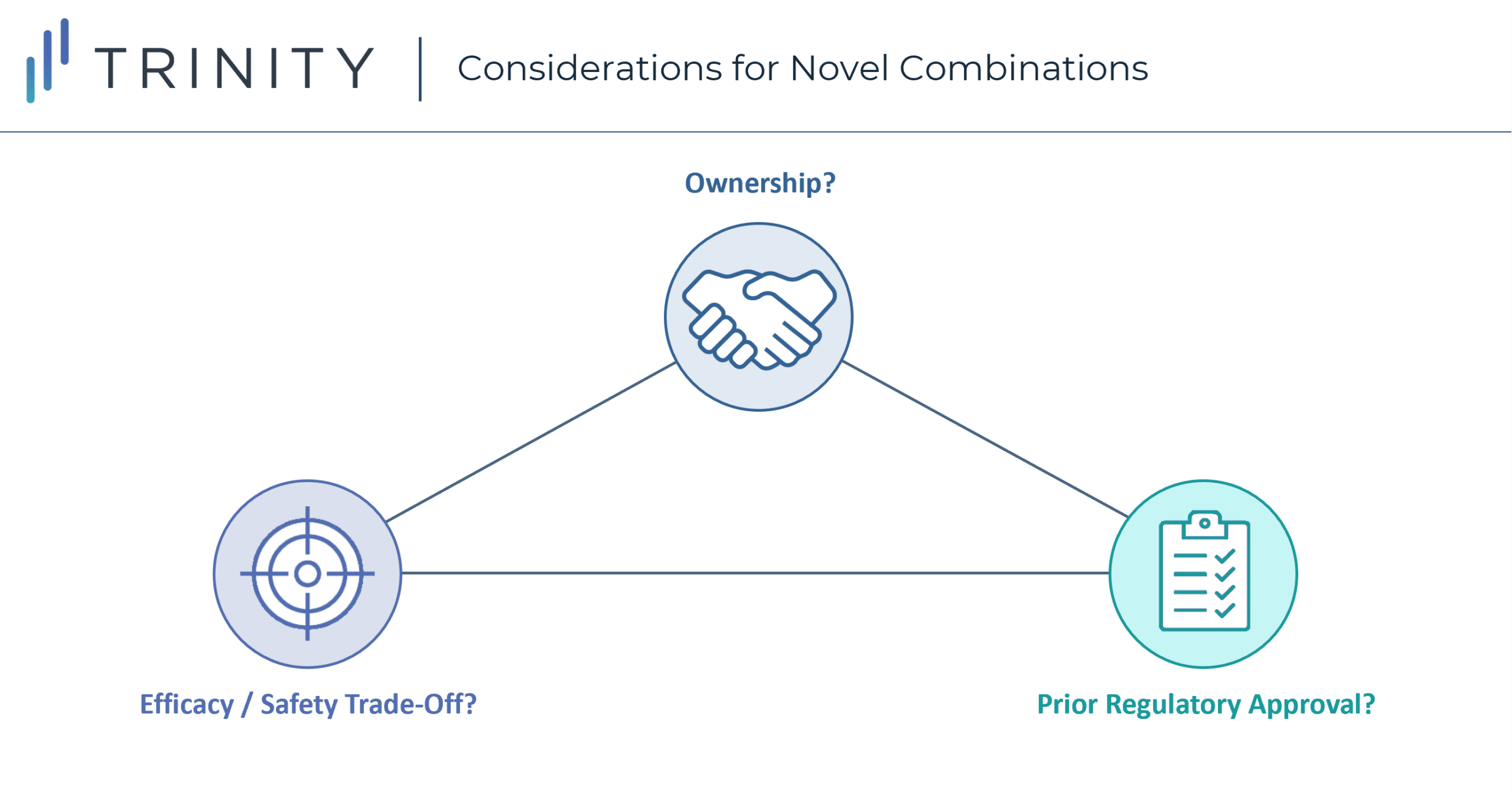

- Dynamics beyond demonstrating synergistic efficacy should be taken into consideration to optimize combination price / access outcomes

Trinity’s Take: In this article, Trinity uses select combination case studies to highlight the key elements to consider when thinking through price / access strategy for a novel combination

Evaluation of the Novel Combinations Landscape

The pursuit of a successful novel combination launch is one that is heavily sought after, however the price and access problems faced by such combinations are well documented. How can manufacturers take payer considerations into account during early development, and ensure access success at launch? Trinity has reviewed the P&MA outcomes from successful combinations in oncology to provide some insights.

Our first example is OPDIVO® + YERVOY®, both of which are owned by BMS. OPDIVO® + YERVOY® pursued a combination launch in 1L Renal Cell Carcinoma in 2018. Across markets, the combination achieved a favorable price and access, however there were stumbling blocks along the way. For example, whilst the combination had a great efficacy profile (Median overall survival [mOS] not reached with OPDIVO® + YERVOY® vs. 26.6 months with SUTENT®), it conversely had toxicity concerns (Treatment emergent adverse events [TEAE] leading to discontinuation in 22% of the OPDIVO® + YERVOY® group vs 12% seen with SUTENT®).

It is accepted that a combination brings synergistic benefits when it comes to efficacy, but this is directly related to an increase in safety issues; whilst efficacy is a key driver during payer decision making, safety also plays a significant part. Despite this safety concern, OPDIVO® + YERVOY® were able to achieve Considerable Added Benefit in Germany and ASMR III in France suggesting perhaps there is a point at which payers agree the synergistic efficacy brought by a combination outweighs the increased safety risks. But where exactly is that point, and does it differ across indications?

Another interesting combination is REVLIMID® + NINLARO® which was approved in multiple myeloma in 2015. REVLIMID® is owned by BMS, whilst NINLARO® is owned by TAKEDA. The combination did not demonstrate significant efficacy improvements (at launch, undetermined significance of overall survival [OS] in first and second interim analyses due to mOS not being reached) which drove poor payer value perception and unfavorable health technology assessment (HTA) outcomes. However, the brunt of these unfavorable outcomes was borne by NINLARO® rather than REVLIMID®. TAK’s NINLARO® took on the label update for negotiations which based on ASMR V in France and Unquantifiable Benefit in Germany led to tough pricing negotiations with REVLIMID® taking up the majority of the REVLIMID® + NINLARO® combination price. Should this have been factored into TAKEDA’s decision making when pursuing a combination in multiple myeloma? Could they have better protected themselves? What are the implications of pursuing a combination launch with an external partner? A final example is BRAFTOVI® + MEKTOVI®. Both oral therapies are owned by Pfizer (USA) / Pierre Fabre (EU) and neither component / asset has a previous regulatory approval in any indication before their initial combination launch in metastatic melanoma in 2018. BRAFTOVI® + MEKTOVI® pivotal trial was a phase III, three-arm, open-label RCT (COLUMBUS) where patients received BRAFTOVI® + MEKTOVI® vs. ZELBORAF® monotherapy vs. BRAFTOVI® monotherapy. In theory, MEKTOVI® had no evidence of clinical benefit as a monotherapy in metastatic melanoma or in any indication for that matter. This lack of previous regulatory approval did not have any effect on payer decision making (although BRAFTOVI® + MEKTOVI®’s status as the third BRAF/MEK inhibitor to launch may have contributed). The combination was reimbursed in France and Germany, but the interesting dynamic was the distribution of list price across the components and across the markets differed. In France, MEKTOVI® constitutes about 50% of the combination cost but in Germany, this is more like 31%. Could it be lack of prior approval helped flexibility around individual component pricing? Or could this be related to both components being owned by the same manufacturer?

Considerations When Launching a Novel Combination Therapy

Launching a novel combination therapy offers manufacturers a unique set of challenges and opportunities to achieve positive pricing and access outcomes. These combinations show us there are several considerations beyond differentiating efficacy that go into negotiations. However, it is also unlikely these considerations are created equal. What is the sequence through which their impact needs to be considered? When and how should their impact be incorporated into early-stage development? What needs to be done to fully optimize access / pricing for a novel combination?

Written by: Bami Oshinowo, Anna Alonso, and Grace Mock