Japan’s Latest Drug Pricing Policy Updates: Off-Year Revision and Other Anticipated Changes in 2023

Executive Summary:

- The 2023 off-year Drug Price Revisions are the second implementation of the off-year re-pricing approach by the Japanese Ministry of Health, Labor and Welfare (MHLW) and are predicted to result in additional price cuts to 48% of listed products across multiple therapeutic areas.

- Although the MHLW continues to maintain a stance of leveraging price revisions to achieve budget savings, other policies (i.e., expansion of Orphan Drug Designation and Price Maintenance Premium revisions) signal an intent to foster and incentivize innovation within the Japanese pharmaceutical industry.

Introduction & History of the Regular Price Revisions in Japan

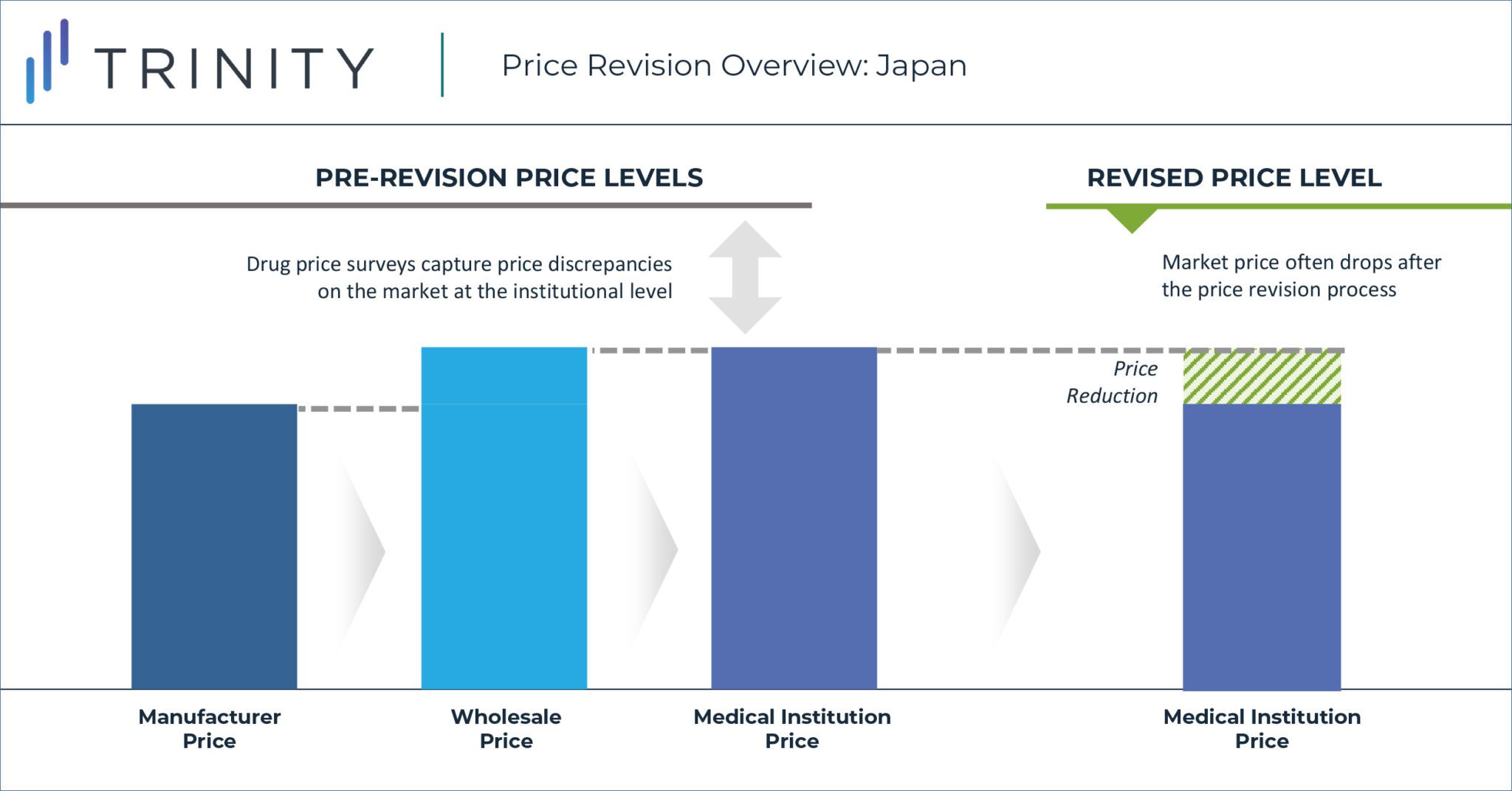

For over two decades, Japan has maintained a biennial re-pricing approach in which drug prices are surveyed through wholesaler offices and healthcare institutions to capture the product discrepancy rates between National Health Insurance (NHI) prices and actual sales prices (i.e., the market price). Survey insights and general drug pricing rules, outlined by the MHLW, are then leveraged to guide the magnitude of price cuts in the process depicted below. With the new implementation of the off-year price revision however, the average discrepancy rates captured in the survey are utilized to directly guide the scope of price revisions.

In 2016, the MHLW introduced a new pricing policy reform that effectively adjusted the biennial price survey to an annual cadence to create additional budget savings. This new annual cadence that occurs in odd-years (i.e., 2021, 2023, etc.) is referred to the “off-year” price revisions. The off-year price revision scope is intended to be more limited when compared to the traditional “on-year” price revisions, which also include price adjustments related to the entry of branded and generic products that change market dynamics. In the first iteration of the off-year price revision, the discrepancy rate threshold to determine which products would be affected was calculated by multiplying the average NHI / market price discrepancy rate from the drug survey by the adjustment factor. It resulted in 69% of NHI listed products being included in the price revision process. Industry stakeholders, such as the Japan Pharmaceutical Association (JPA), continue to publicly voice their frustrations with the now annual price revisions, with key arguments centred around drug price cuts inhibiting industry growth and innovation.

In the first iteration of the off-year price revision in 2021, products with a discrepancy rate >5% across multiple therapeutic areas were subjected to price reductions, namely patented products (N=1,350), including N=240 products granted Price Maintenance Premiums (PMPs), long-listed products (N=1,490), generics (N=8,200), and products listed on or before 1967 (N=1,140). As a result of the price revisions spanning across multiple product types, most manufacturers had numerous products in their portfolio subject to price revisions, although on average, the price reduction across products was < 8%. The five products with the greatest magnitude of price reduction in 2021 are listed in the table below:

| COMPANY NAME | PRODUCT NAME | THERAPEUTIC AREA | OFF-YEAR PRICE REDUCTION RATE |

|---|---|---|---|

| Pfizer | VYNDAQEL® (tafamidis meglumine) |

Transthyretin-Mediated Amyloidosis Cardiomyopathy | 75.0% |

| UCB | E KEPPRA® (levetiracetam) |

Epilepsy – Myoclonic Seizures | 25.7% |

| Santen Pharmaceutical | ALESION® (epinastine hydrochloride) |

Bronchial Asthma | 19.9% |

| Nobelpharma | NOBELZIN® (zinc acetate) |

Wilson’s Disease, Hypozincemia | 16.0% |

| Takeda | TAKECAB® (vonoprazan fumarate) |

Acid-Related Disease | 15.8% |

2023 Off-Year Price Revision & Comparison to Previous Price Revisions

The MHLW announced on December 16th, 2022 that the discrepancy rate for the 2023 off-year price revision will apply to products with a discrepancy rate > 4.375%. Although the threshold is lower than in 2021 (>4.375% in 2023 vs. >5% in 2021), both off-year price revision thresholds target 69% of all listed products. The initial plan also included maintaining the same adjustment multiple to define the discrepancy threshold by multiplying the average NHI / market price discrepancy rate from the drug survey by the adjustment factor of 0.625 (i.e., 7% * 0.625 = 4.375%). Due to concerns raised around higher drug prices due to increasing raw material costs that have destabilized supply for manufacturers, the MHLW reduced the scope of products to 48%. As a result, the initially announced 4.375% threshold does not match the product scope for the upcoming price revision this year.

Analysis of Drug Price Revision Evolution

The table below outlines the dynamics of the price revision process since 2020 (including both on-year and off-year price revisions). A historical review of the discrepancy rates from 2020 to 2023 shows that the average rate has decreased by 1%. This may suggest that downward pricing pressure on drug prices through traditional price revisions in conjunction with off-year price revisions may have incentivized manufacturers to naturally adjust prices to be in line with the market price. Counter to this, the average price reduction is increasing year on year, which combined with the proportion of products impacted by the price revision being lower over time, suggests a more targeted approach for re-pricing going forward.

| YEAR | AVERAGE NHI-MARKET PRICE DISCREPANCY RATE | OFF-YEAR PRICE REVISION DISCREPANCY RATE THRESHOLD | AVERAGE PRICE REDUCTION |

|---|---|---|---|

| 2020 | 8.0% | N/A | 4.38% |

| 2021 | 8.0% | > 5% (69% of All Listed Product Facing Price Cuts) |

5.20% |

| 2022 | 7.6% | N/A | 6.69% |

| 2023 | 7.0% | > 4.375%* (48% of All Listed Products Facing Price Cuts) |

To be announced |

FIGURE 3 | Drug Price Revisions in Japan: 2020-2023

Ongoing Drug Pricing Debates

It is no surprise that the off-year drug price revision policy has faced continued criticism from pharmaceutical manufacturers and associations. Leading up to the announcement of the 2023 discrepancy rate, healthcare provider representatives highlighted that discrepancy rates may shrink in the years to come due to downward pressure from more frequent price revisions. As a result, stakeholders emphasize that price revisions should be targeted only for “products with large discrepancies” rather than maintaining a standardized formula, an approach that is widely supported by healthcare payer representatives such as the Liberal Democratic Party, who advocate for increased access to health insurance for patients.

Additional 2023 Drug Policy Updates

While off-year drug price revisions will be rolled out in April 2023 and will likely lead to downward pricing pressure for manufacturers, the MHLW has also approved policies that are expected to incentivize innovation in high unmet need therapeutic areas.

Orphan Drug Designation Program Investment

The MHLW intends to expand its Orphan Drug Designation (ODD) program by allocating additional budget to enhance staffing and services to support and stimulate increased development of novel therapies targeting therapeutic areas with high unmet need in Japan. Products that receive ODD in Japan are eligible for the PMP and Marketability Premium, and manufacturers are also able to claim subsidies and tax credits for some of their Research and Development (R&D) costs. With this change, the MHLW hopes to incentivize manufacturers to develop new medicines in Japan and in turn, increase the number of drugs receiving an ODD, as Japan currently has the lowest number of designations when compared to the U.S. and Europe.

Price Maintenance Premium Expansion

Price Maintenance Premiums (PMPs) serve to incentivize and reward manufacturers for developing ground-breaking drugs (i.e., first-in-class Mechanism of Action (MoA), products in orphan disease areas, etc.) and compensate for NHI downward price revisions to support drug development innovation in Japan. As described in our previous blog post entitled “Japan’s Latest Drug Pricing Policy Updates: Key Changes and Expected Impact” (2022), PMPs are traditionally awarded on the basis of ‘manufacturer tier’ and only the top 25% of manufacturers receive full price maintenance while the middle and lowest tiers only receive a reduced premium rate. Although the system in selecting products impacted is under discussion, the MHLW’s 2023 PMP expansion plan is set to grant additional premiums to these two lower tiers. Instead of receiving their initial lower PMPs after the price cut of the off-year price revision, the higher PMPs intended to make up 95% of their list price cut. This PMP expansion aims to allow products to maintain higher prices for longer, offset the effects of price cuts from the 2023 off-year price revisions and continue to incentivize development of innovative products in Japan. Although this expansion is intended to have a positive impact, some pharmaceutical industry stakeholders are still hesitant to support the expansion of PMPs, as they feel the scope is limited in comparison to the annual price revisions.

Conclusion

The outlined changes to drug pricing reform in Japan have the potential for both positive and negative implications. Manufacturers should be aware that there will be continued downward pressure on drug prices with the upcoming implementation of the second off-year drug price revision. However, through changes to the ODD and PMP regulations, the government is sending a strong signal that Japan remains open to incentivize and reward innovation in high unmet need therapeutic areas. We have provided a snapshot of what is to come in April 2023, and plan to expand on the real-world implications following the implementation of these policies at the beginning of the fiscal year.

Authors: Malia Yamamura, Tami Sacre, Hannah Squires, Annabelle Brough, Shinkyu Park

Other blog posts in this series: