Is the Pricing Discount for Chinese NRDL Inclusion Worth it? NRDL Commercial Impact Assessment

Executive Summary

- The Chinese National Reimbursement Drug List (NRDL) is managed and negotiated by the National Healthcare Security Administration (NHSA) and drugs listed on the NRDL are reimbursed by the public insurance

- Since 2017, on average, a significant price discount of 44-61% was required for products to achieve a positive listing on the NRDL

- Based on average 2018 sales data, products included on the 2017 NRDL were able to achieve an increase in sales revenue (188%) despite the steep average price cut (40%)

- The magnitude of sales increase differed for multinational (MNC) vs. domestic manufactured products, with the latter generally receiving a higher increase in sales revenue despite a smaller average price cut

Trinity’s Take: Based on the short-term follow up sales data, the increase in average sales revenue and volume growth offset the average price discount for the majority of NRDL listed products in 2017, which justifies the steep price cut to unlock commercial opportunity and highlights the significant bargaining power that the NHSA has in the biopharma space.

NRDL Evolution Over Time

Since 2017, China has updated its National Reimbursement Drug List (NRDL) annually. On average, a price discount of 44-61% was required across the last four annual updates to achieve a positive listing. The major features considered during NRDL negotiations include product clinical efficacy, cost effectiveness and budget impact, international reference pricing (IRP), and product price in the private market.

The 2020 NRDL update saw manufacturer applications allowed for the first time, greater clarity on the eligibility criteria for product inclusion and adjustment, as well as alignment with other healthcare initiatives (i.e., essential drug list, imported drug list, national volume-based procurement list). Combined with the recent policy change to phase out provincial reimbursement drug lists (PRDLs) over the next three years, the importance of NRDL inclusion for achieving broad market access in China has been emphasized.

One of the major questions pharmaceutical manufacturers face when considering whether to launch a product in China is if the steep price discount will be offset by increased uptake. By taking a closer look at these dynamics for products listed on the 2017 NRDL and subsequent 2018 sales data, manufacturers can assess this question holistically, to support a better understanding of the commercial opportunity within China.

2017 NRDL Commercial Impact Analysis – Is the Pricing Discount for Chinese NRDL Inclusion Worth it?

The 2017 NRDL update saw 32 manufacturers (44 products) engage in negotiations. A total of 36 products entered the final list, with an average price cut of 44%. Of the 36 products, a majority (61%) were produced by multi-national companies (MNCs), while 39% were produced by domestic manufacturers. The 36 products spanned a variety of indications, including diabetes, cardiovascular diseases, mental health disorders, and oncology.

Source: Ministry of Human Resources and Social Security (Pharmaceutical Database)

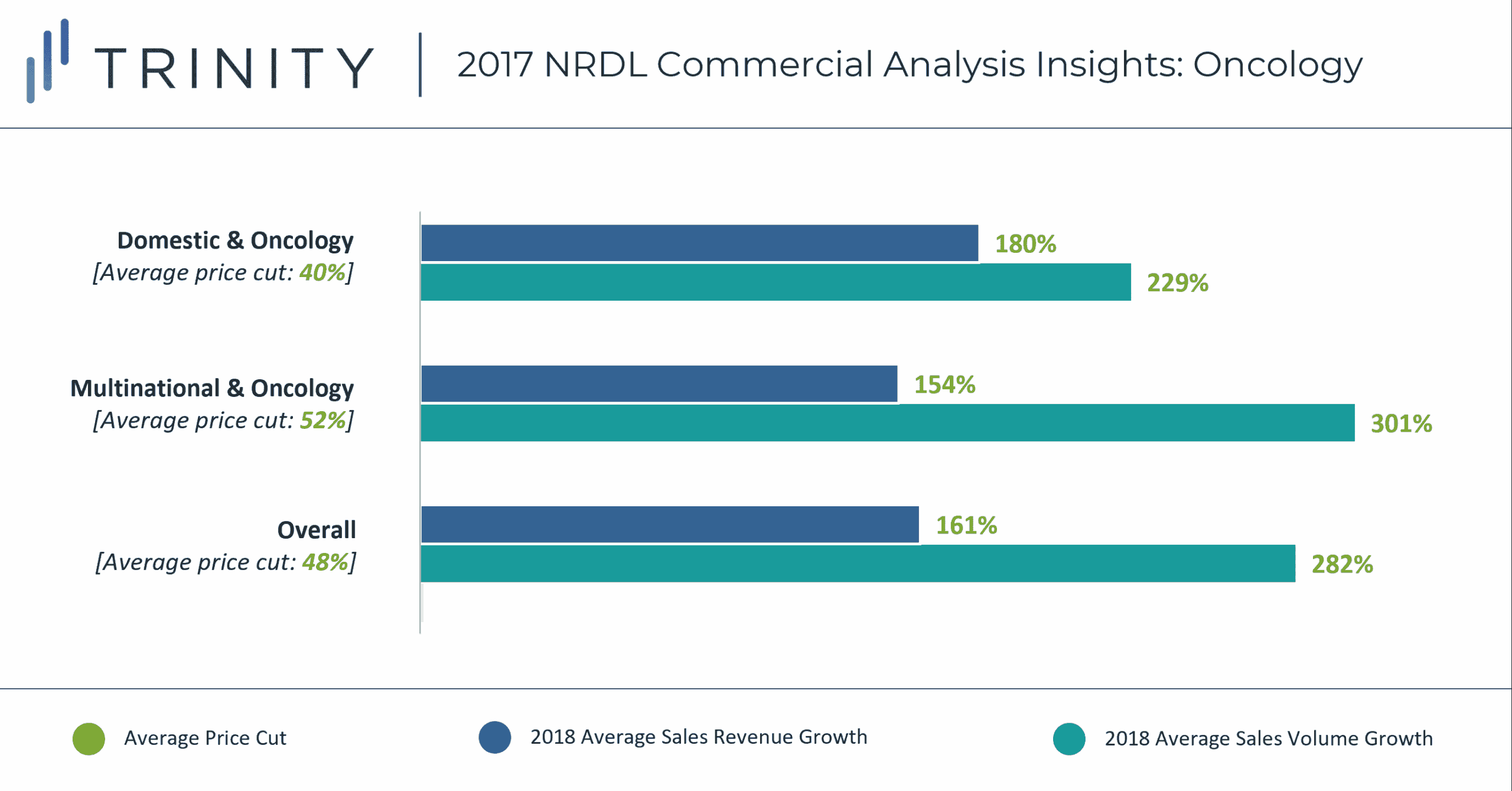

MNC manufactured oncology products experienced a steeper average price cut of 52% vs. 40%, although this does not seem to translate into a higher increase in sales revenue vs. domestically manufactured products. Despite the steeper price cut, MNC manufactured products show a directional trend of being more expensive, and with a typical 30-40% patient copay for high-cost branded products, this could inhibit further growth in sales potential and shift market share towards domestic products. Domestic manufacturers may also have a stronger local presence / sales force vs. MNC manufacturers which could further support sales growth vs. MNC manufactured products.

Source: Ministry of Human Resources and Social Security (Pharmaceutical Database)

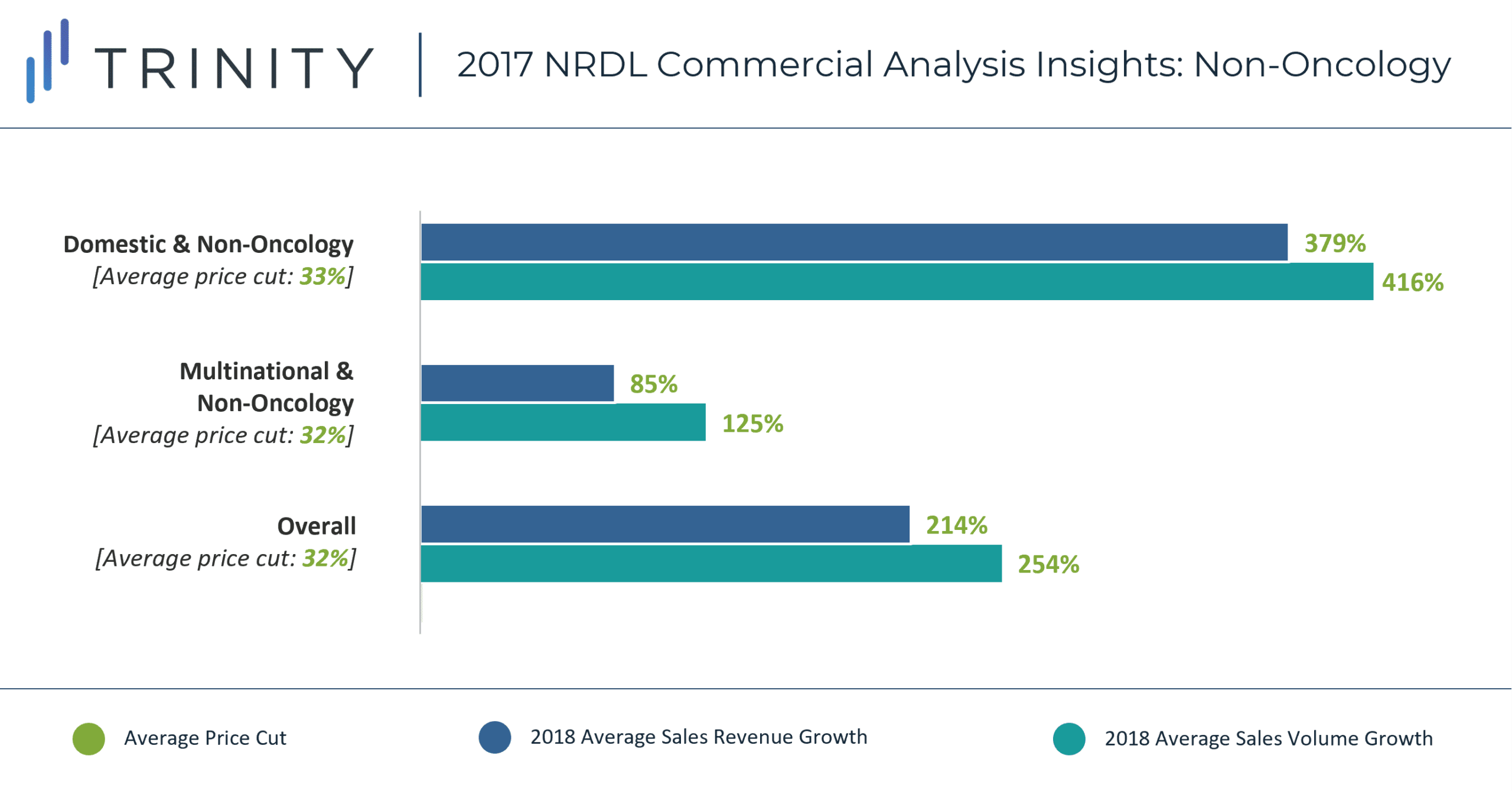

Domestic non-oncology products experienced the largest increase in sales revenue (379%), despite taking a similar average price cut to MNC manufactured non-oncology products (~32%). Similar to the oncology analysis, a lower initial product price for domestic vs. MNC manufactured products, as well as stronger local presence / sales force could be responsible for the discrepancy in sales revenue. Additionally, more prevalent indications (e.g., macular degeneration, heart failure, high blood pressure) were covered by domestic manufacturers vs. MNC manufacturers (e.g., hemophilia, schizophrenia, depression, multiple sclerosis) and that could also be responsible for driving this additional increase in sales potential. In addition, ease of access to timely diagnostic care for non-oncology vs. oncology indications may also be responsible for the higher observed increase in sales revenue and uptake.

Overall, oncology products experienced a higher average price cut vs. non-oncology products (48% vs. 32%), but lower increase in sales revenue compared to non-oncology products (161% vs. 214%). This trend only stays true for the MNC manufactured products – domestic non-oncology products experienced higher increase in sales revenue vs. oncology products.

The overall market value of the 36 included products was RMB 20.4 billion in 2017 and reached RMB 38.6 billion in 2019 (~90% increase), which further supports the notion that NRDL inclusion results in a significant boost to commercial potential in CHN.

Key Takeaways

Based on the short-term follow up sales data, the increase in average sales revenue and volume growth offset the average price discount for the majority of NRDL listed products in 2017, which justifies the steep price cut to unlock commercial opportunity.

However, manufacturers should ensure to conduct competitive intelligence analysis prior to launch to understand the domestic landscape, since domestic products may be at a competitive advantage with pre-existing lower private prices and resulting lower co-pay, which could influence patient / physician treatment choice.

Domestic manufacturers may also be more willing to offer steeper discounts in China due to China being the priority launch market, resulting in less concern for international reference pricing implications, which compares with MNCs who tend to launch products globally and therefore must consider reference pricing implications as part of their global launch strategy. Historically, drug prices in China have not been formally referenced by other markets due to the infrequent nature of NRDL updates; however, the now annual NRDL updates could see Chinese drug prices become more attractive to include in formal external reference pricing baskets, or even informally by payers in other Asia Pacific markets (e.g., Korea, Taiwan). As such, reference pricing considerations may also become a more important consideration for MNCs in the future when deciding whether to launch in China.

Domestic manufacturers may also have a stronger local presence / sales force which could provide a competitive advantage upon NRDL inclusion. As such, MNCs should take early, proactive steps to ensure that they have a strong local presence / sales force to facilitate market uptake in China once a product has successfully been included on the NRDL.

Written by: Wenting Zhang, PhD, Annabelle Brough, Windy Chen