Bypassing NICE: Manufacturers are Looking Towards NHS England to Support Early Access

Executive Summary

- The National Institute for Health and Care Excellence (NICE) is the major reimbursement body and pathway to achieving market access in England, although products that have not been evaluated by NICE or have received a negative NICE outcome can still achieve local access through CCGs (Clinical Commissioning Groups)

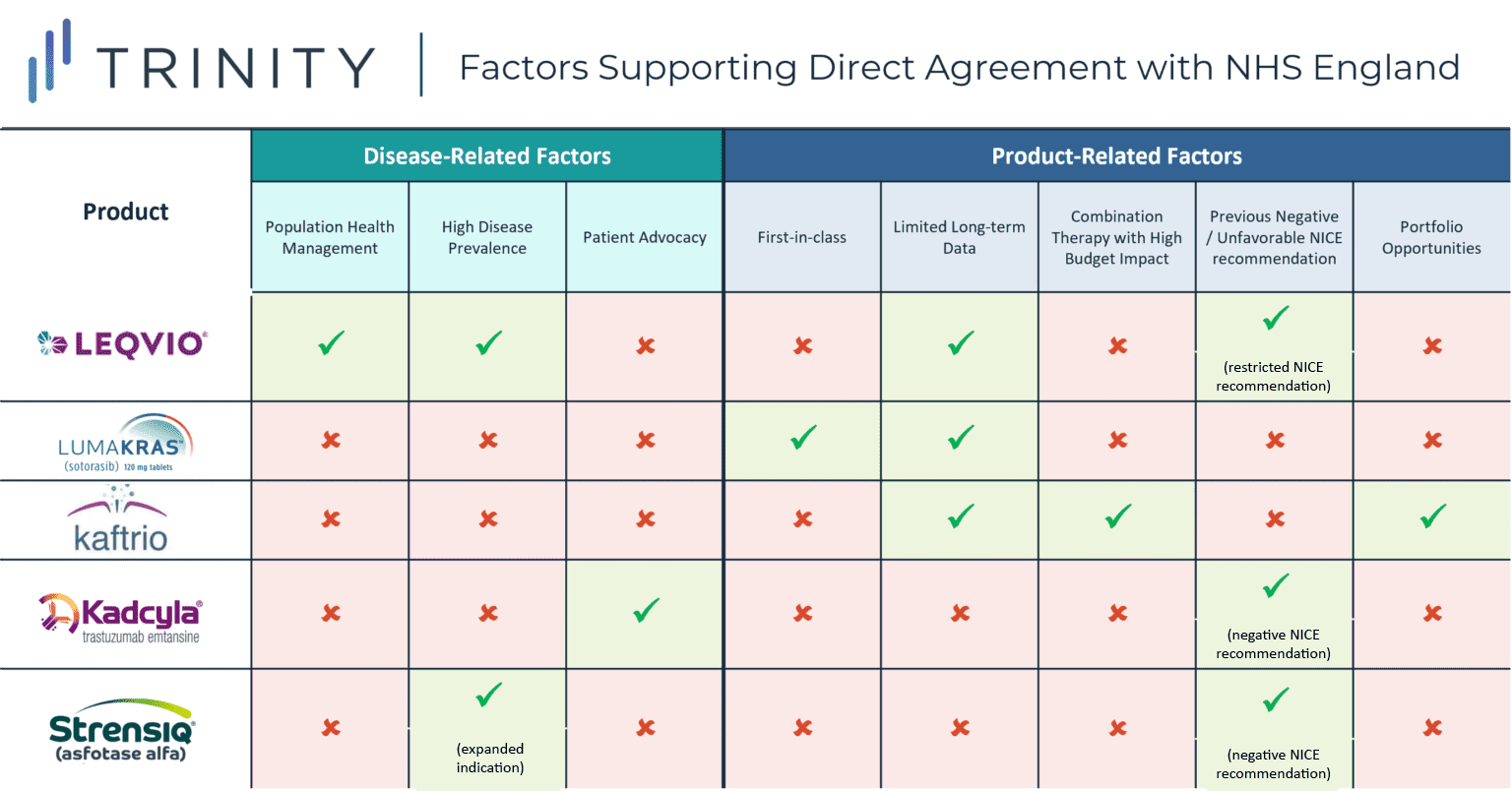

- In 2017, NHS England announced deals facilitating patient access to two innovative treatments (KADCYLA and STRENSIQ). KADCYLA’s previous negative NICE recommendation in HER2+ breast cancer and strong patient advocacy from the breast cancer community led to the deal with NHS England. STRENSIQ was previously recommended by NICE for pediatric patients with the severest form of a rare bone disease hypophosphatasia, while ALEXION aimed to expand into a broader pediatric patient population

- In recent months, additional manufacturers have opted to bypass the NICE appraisal process and have struck deals with NHS England directly to support market access for their novel therapies, including NOVARTIS’ LEQVIO, AMGEN’s LUMAKRAS, and VERTEX’s KAFTRIO

- In part, manufacturers may be concerned by the potential for prolonged reimbursement and pricing negotiations with NICE or seek to overturn previous unfavorable NICE recommendations. By exploring recent direct manufacturer / NHS England deals, additional characteristics and rationale were uncovered:

- More specifically, while the main commonality between each of the case studies explored is the desire to secure rapid access in diseases with a high unmet need, there were notable situational nuances across the explored case studies

- For LEQVIO, the population health management approach, high prevalence of hypocholesteremia, and limited long-term data likely encouraged NOVARTIS to negotiate with NHD England directly, whereas for LUMAKRAS, a first-in-class KRAS inhibitor, motivating factors were likely supporting early access from a competitive standpoint in addition to RWE collection, while in the case of KAFTRIO, VERTEX’s existing portfolio agreements and previous challenging negotiations likely encouraged a direct NHS England style agreement

Trinity Take: Bypassing NICE to negotiate directly with NHS England appears to be a favorable approach when products and therapeutic areas share certain attributes and manufacturers have particular goals in mind.

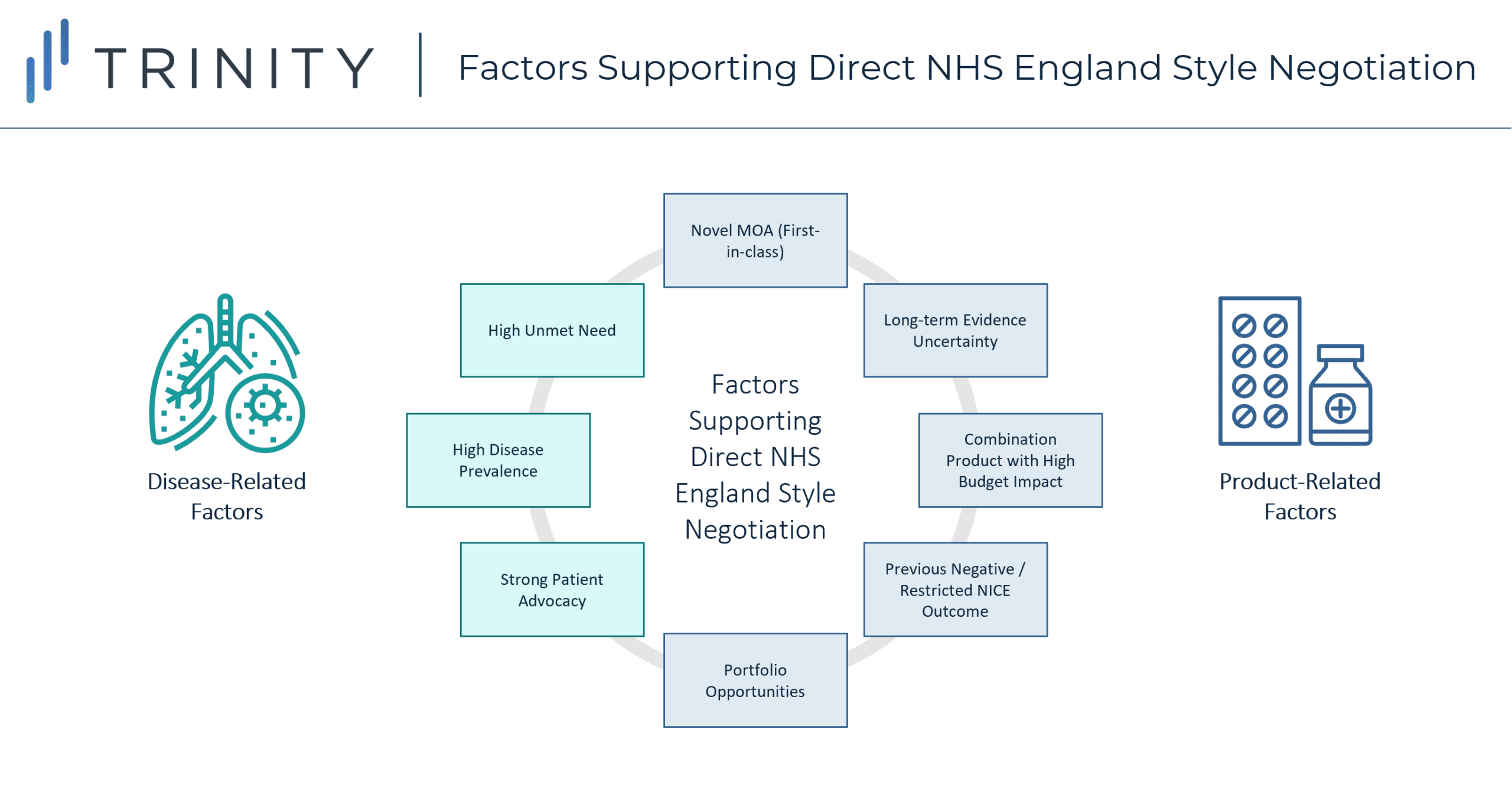

Following this analysis, direct manufacturer / NHS England negotiations appear to support earlier market access based on a mixture of both disease-related and product-related factors:

- Disease Related:

- High unmet need therapeutic area

- Prevalent patient population

- Strong patient advocacy community

- Product Related:

- Novel MoA / 1st-in-class, with 2nd-in-class agents set to closely follow in launch timings

- Uncertainty regarding long-term evidence (which can be mitigated through real-world evidence generation)

- Combination product expected to launch with a high price tag

- Previous negative / restricted NICE recommendation

- Existing portfolio agreements in place

Background of NICE and NHS England

NICE is the major reimbursement body and pathway to achieving market access in England and evaluates select high cost or high budget impact drugs to determine whether a drug should be reimbursed by the NHS. Once a product is launched in England, a free pricing environment exists, with manufacturer prices being automatically accepted by the Department of Health and 100% reimbursement being granted.

Products that have not been evaluated by NICE or have received a negative NICE outcome can still achieve local access through CCGs, which are clinically led NHS bodies responsible for planning and commissioning healthcare services in local areas. A product recommended by NICE must be made available by CCGs within 3 months of the NICE recommendation being issued.

Insights into Manufacturer and NHS England Negotiations

In 2017, NHS England announced deals facilitating patient access to two innovative treatments – KADCYLA (trastuzumab emtansine) for breast cancer and STRENSIQ (asfotase alfa) for a rare bone disease hypophosphatasia. These deals were reached through close negotiation between NHS England and manufacturers ROCHE and ALEXION, which was then subsequently followed by a NICE appraisal based on the NHS England / manufacturer negotiated terms.

For KADCYLA, the deal was supported by strong patient advocacy from the breast cancer community following NICE’s previous negative recommendation in 2014 due to KADCYLA’s inability to demonstrate cost-effectiveness. The Committee found the incremental cost-effectiveness ratio (ICER) for KADCYLA compared to its trial control arm TYVERB + capecitabine was GBP 167,236 per QALY gained, which is significantly higher than the typical CE threshold of GBP 20,000 per QALY. Following the negative NICE recommendation, a limited number of patients were able to access KADCYLA via England’s Cancer Drug Fund (CDF), which led to patient groups voicing their concerns and petitioning to make KADCYLA available routinely on the NHS. In the direct negotiation, ROCHE provided a confidential discount while the committee adjusted the comparator, which supported KADCYLA in meeting CE thresholds and a positive NICE recommendation.

The deal for STRENSIQ in hypophosphatasia broadened the eligible patient population in England, as previous NICE draft guidance only recommended the treatment for pediatric patients with the most severe form of the disease. The five-year managed access agreement identifies those with the greatest unmet need and reduced the cost of the drug to the NHS, leading NICE to adjust / broaden its recommendation. Additionally, the deal also included additional data collection requirements to support a better understanding of treatment duration and dose reductions / stopping rules.

In recent months, additional manufacturers have opted to bypass the NICE appraisal process and have struck deals with NHS England directly to achieve market access for their novel therapies, including NOVARTIS’ LEQVIO, AMGEN’s LUMAKRAS, and VERTEX’s KAFTRIO. So, what might be leading to this recent move by manufacturers? In part, manufacturers may be concerned by the potential prospect of prolonged pricing and reimbursement negotiations with NICE (the average timeline for a NICE recommendation is around nine-12 months). In addition, manufacturers are also looking to optimize cost-effectiveness to achieve a positive NICE recommendation, which may be more easily achieved through direct negotiations with NHS England.

In this blog post, we explore some of the most recent direct manufacturer / NHS England deals, which have been detailed in three case studies, as well as provide forward looking insights into potential implications for future drug launches in England.

Case study 1 – LEQVIO

NOVARTIS’ LEQVIO (inclisarin), a PCSK9 inhibitor indicated for patients with hypercholesterolemia, secured EMA approval in late 2020 for use in combination with statins or other lipid-lowering therapies. It is the first of a new type of cholesterol-lowering treatment which uses RNA interference (RNAi) to boost the liver’s ability to remove harmful cholesterol from the blood. Though recently EMA approved, LEQVIO still largely lacks broad access or favorable HTA decisions in Europe. More specifically, LEQVIO received a no added benefit in DEU, restricted reimbursement recommendation in GBR, has not yet been assessed in FRA and ESP, and is no longer a “valid drug for commercialization” in ITA.

In this “first of a kind” deal, NOVARTIS reached an agreement with NHS England in August 2021 to pilot its population health management approach to tackle elevated LDL-C in eligible patients with Atherosclerotic Cardiovascular Disease (ASCVD) across England. Under this deal, NOVARTIS seeks to expand access to LEQVIO to approximately 300,000 ASCVD patients within the next three years. The reimbursed patient population resulting from the deal is more restricted than the EMA approved indication (stipulates a history of cardiovascular events aligned with the trial inclusion and exclusion criteria must be demonstrated). Given the high prevalence of the indication, this population health management approach supports broadened access to LEQVIO over time as experience and data certainty grows. Additionally, under the partnership, nurses in England’s NHS will be able to administer LEQVIO in general practitioner’s (GPs) offices rather than in hospitals. In addition to improving patient access, GP-led administration addresses a key population health policy approach, which falls more within the realm of NHS England’s responsibilities vs. NICE.

While LEQVIO boosts the liver’s ability to remove harmful cholesterol from the blood, there is no data directly comparing LEQVIO with other standard of care treatments (i.e., ezetimibe, PRALUENT or REPATHA). There is also no long-term evidence supporting LEQVIO’s impact on cardiovascular outcomes. The uncertainty associated with LEQVIO’s clinical outcomes, specifically the lack of direct comparative clinical trial data vs. other PCSK9 inhibitors and limited long-term cardiovascular impact data, would likely have proven challenging during the NICE appraisal process, potentially leading to a direct negotiation approach appearing more attractive from a manufacturer strategy perspective.

However, NICE’s assessment of LEQVIO was not superseded entirely. A positive recommendation for LEQVIO was granted in September 2021, allowing the deal to progress to the implementation phase and solidifying LEQVIO’s availability at a confidentially discounted price. With the deal, NHS England is aiming to deliver LEQVIO more effectively to the target population and survey patient health outcomes over three years. Thus, the population-based health approach of NOVARTIS’ agreement supported rapid expeditious and broadened access to LEQVIO, with the potential for improving overall population health outcomes, and additional real-world evidence generation, which could prove valuable for solidifying LEQVIO’s commercial success in the future.

Case study 2 – LUMAKRAS

Another example of direct manufacturer / NHS England negotiation includes AMGEN’s LUMAKRAS, a first in class oral KRAS G12C inhibitor indicated for 2L+ KRAS G12C positive Non-Small Cell Lung Cancer (NSCLC). LUMAKRAS gained conditional marketing authorization from the MHRA in September 2021 due to its impressive clinical benefit as the first KRAS G12C inhibitor to show an overall survival benefit and demonstrate a positive benefit-risk profile with rapid and durable anticancer activity in its phase II trial. The MHRA authorization allowed patients in England, Wales, and Scotland access to the drug, which at the time had not yet been approved by the EMA. LUMAKRAS was granted conditional approval in both England and Canada under collaboration with Project Orbis, an international program providing faster access to innovative therapies offering significant efficacy and safety benefits.

The early-access deal facilitates access to LUMAKRAS for ~600 patients per year on a budget-neutral basis to the NHS. While a NICE appraisal is currently in progress, this is not expected to be finalized until March 2022. As such, AMGEN may benefit from the collection of real-world data during this interim period, as well as support improved competitive positioning with physicians ahead of other competitors. Competitive positioning is of particular importance for AMGEN’s LUMAKRAS, as several KRAS inhibitors are in the pipeline, and MIRATI’s adagrasib following closely behind with an expected US launch date in early 2022.

Case study 3 – KAFTRIO

KAFTRIO, VERTEX’s triple combination therapy has also been able to achieve rapid access in England through an expedited agreement with NHS England in August 2020, coinciding with EMA approval. KAFTRIO is the first drug to work in patients with the F508del and MF mutations, accounting for 90% of the overall cystic fibrosis patient population. The deal allows access for ~7,000 patients in England, and ~300 with rare mutations which are not covered by the EMA label.

NICE guidance for KAFTRIO is now suspended as there are plans to leverage data collected during the four-year period of this NHS deal to explore and assess the real-world impact and cost-effectiveness of the drug. As a triplet combination therapy, many expected KAFTRIO’s NICE appraisal and price negotiation to be challenging, with potential detrimental impact on patient access. This may therefore help to explain why VERTEX pursued a deal with NHS England directly.

As a therapy that targets patients with rare genetic types and has demonstrated favorable efficacy data, access has largely been perceived favorably; however, the high price tag was likely to have delayed the NICE recommendation timeline, which may have prompted VERTEX’s direct negotiations with NHS England rather than following the typical reimbursement pathway. Additionally, this agreement comes as an expansion to a previous deal in October 2019 allowing access to VERTEX’s current and future license extensions of the cystic fibrosis medicines KALYDECO, ORKAMBI, and SYMKEVI. The deal also required VERTEX to submit its full portfolio, including KAFTRIO (in the pipeline at the time) to NICE for appraisal. The high cost of the triplet regimen in conjunction with the prior portfolio agreement with NHS England may have prompted VERTEX’s divergence from the typical reimbursement pathway.

Potential Implications for Future Drug Launches in England

While the main commonality between each of the case studies explored was the desire to secure rapid access in therapeutic areas associated with a high unmet need, each of the case studies revealed additional situational nuances. For KADCYLA, a previous negative NICE recommendation and strong patient advocacy within the breast cancer community likely spurred the decision to negotiate with NHS England directly, whereas in the case of STRENSIQ, the challenges of achieving CE within the broadened indication likely prompted ALEXION to pursue direct negotiation with NHS England.

For LEQVIO, the novel population health management approach, high prevalence of hypercholesteremia, and limited long-term data likely encouraged NOVARTIS to negotiate with NHS England directly, while motivating factors for LUMAKRAS, a first-in-class KRAS inhibitor, likely supported early access from a competitive standpoint in addition to RWE collection. In the case of KAFTRIO, VERTEX’s existing portfolio agreements and previous challenging negotiations likely inspired a direct NHS England style agreement.

Time will tell whether these early access deals are successful in the long-term, and case studies such as those outlined above should be revisited in the future to better determine overall impact on patient access and commercial success.

Additionally, it will be interesting to track whether these NHS England style direct negotiations may set a future precedent in other markets, especially given they support early patient access to novel therapies while managing the risk to the healthcare budget via long-term real-world evidence generation requirements and patient eligibility restrictions.

Written by: Maya Iyer, Tessa Malone, Annie Brough