5 Key Trends in Global Market Access

Key impacts on the market access and payer environment are beginning to unfold from policies enacted in 2023 and new policies enacted in 2024. To gather insights into the latest trends, Trinity Life Sciences conducted interviews with key stakeholders across various pricing and market access landscapes. Trinity is closely monitoring the evolving global advanced therapeutics market environment, including the trends below, to determine implications for payers and manufacturers and help them prepare for the year ahead.

Key Trends

Continued Emphasis on Rare Disease

Continued development and investment in rare and highly-specialized diseases

Increasing Oncology Pricing Pressures on Institutions

Increasing financial risk on providers as payers leverage incentive-based reimbursement approaches in oncology

Weight Loss Management

Potential changing policies to GLP-1s in the weight loss space (specifically in terms of government coverage)

Expanding Evidence Expectations

Increasing evidence expectations leading to the need for more integrated approaches to evidence plans early on

In-House Patient Support Programs (USA)

Increasing movement of patient support programs from being out-sourced to in-house

Indicates a trend that is heating up

Indicates a trend that is heating up

N=10 payers across several regions including the U.S., EU5, LATAM, MENA and APAC were selected for 30-minute in-depth interviews in late July based on their market expertise on the latest trends that Trinity leadership identified and observed in the industry

Continued Emphasis on Rare Diseases

The continued emphasis on rare and highly specialized diseases is perceived as important by U.S. and ex-U.S. payers

- Rare and highly-specialized disease continues to be a key area of focus, with many countries investing significant funding towards supporting rare disease research and manufacturing. Countries are also increasing efforts to optimize policies aimed at ensuring early access to new therapeutics in this space

- In 2018 nearly 28,526 clinical trials internationally studied 1,535 rare diseases, covering a fraction of the estimated total of 7,000+ types of rare diseases to exist

- In July 2024, the FDA announced the launch of a Rare Disease Innovation Hub, which will seek to publish new guidance for reviewing products indicated for rare disease populations

- In Saudi Arabia, although disease registries do not currently exist, rare disease-specific Health Technology Assessments are being considered

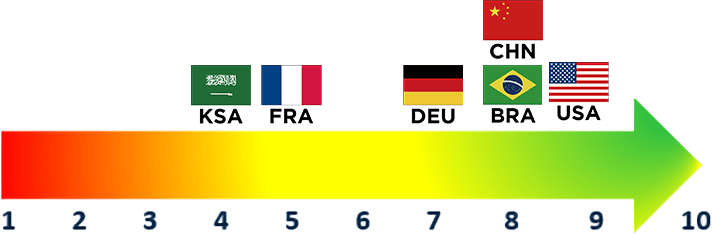

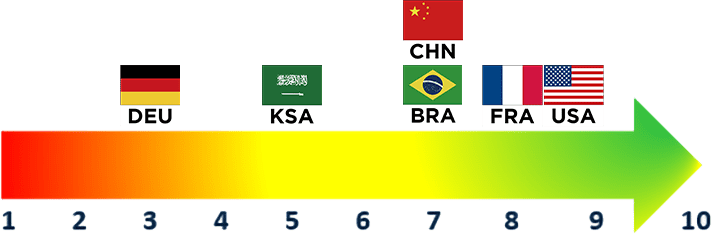

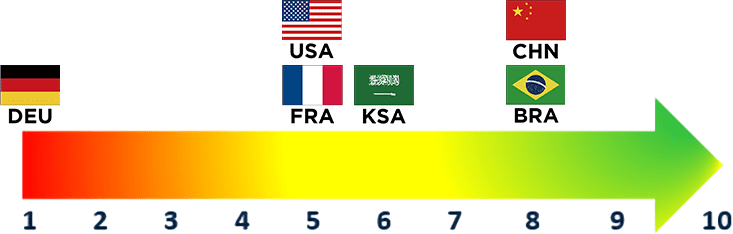

Payer Rating

(1 = Not Important, 10=Very Important)

Overall Rating

“This is pushing us to come up with novel outcomes-based arrangements with manufacturers and pushing us to get better at our data capture…There is definitely a focus here, especially with the pipeline. It’s very, very rich. So I think it will continue to be impactful.”

U.S. National MCO

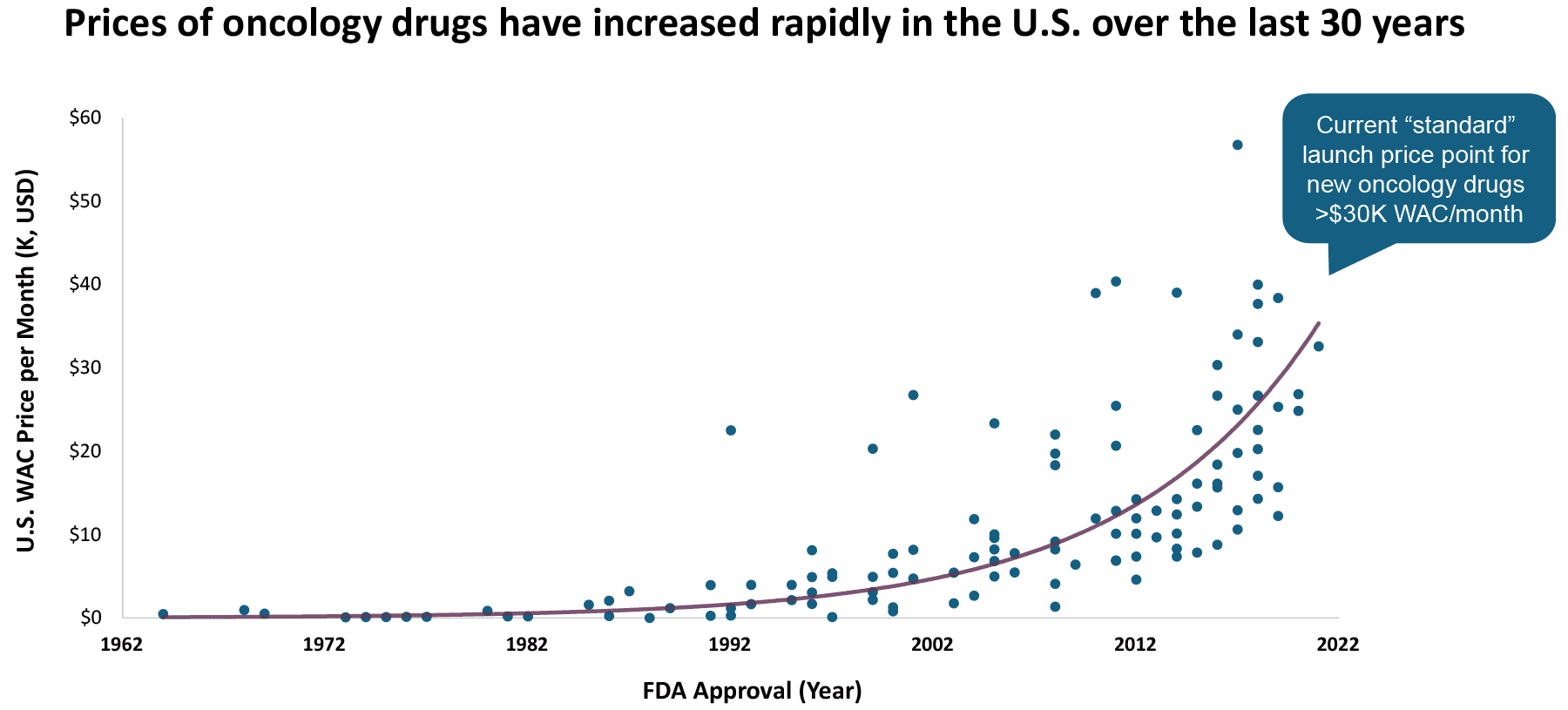

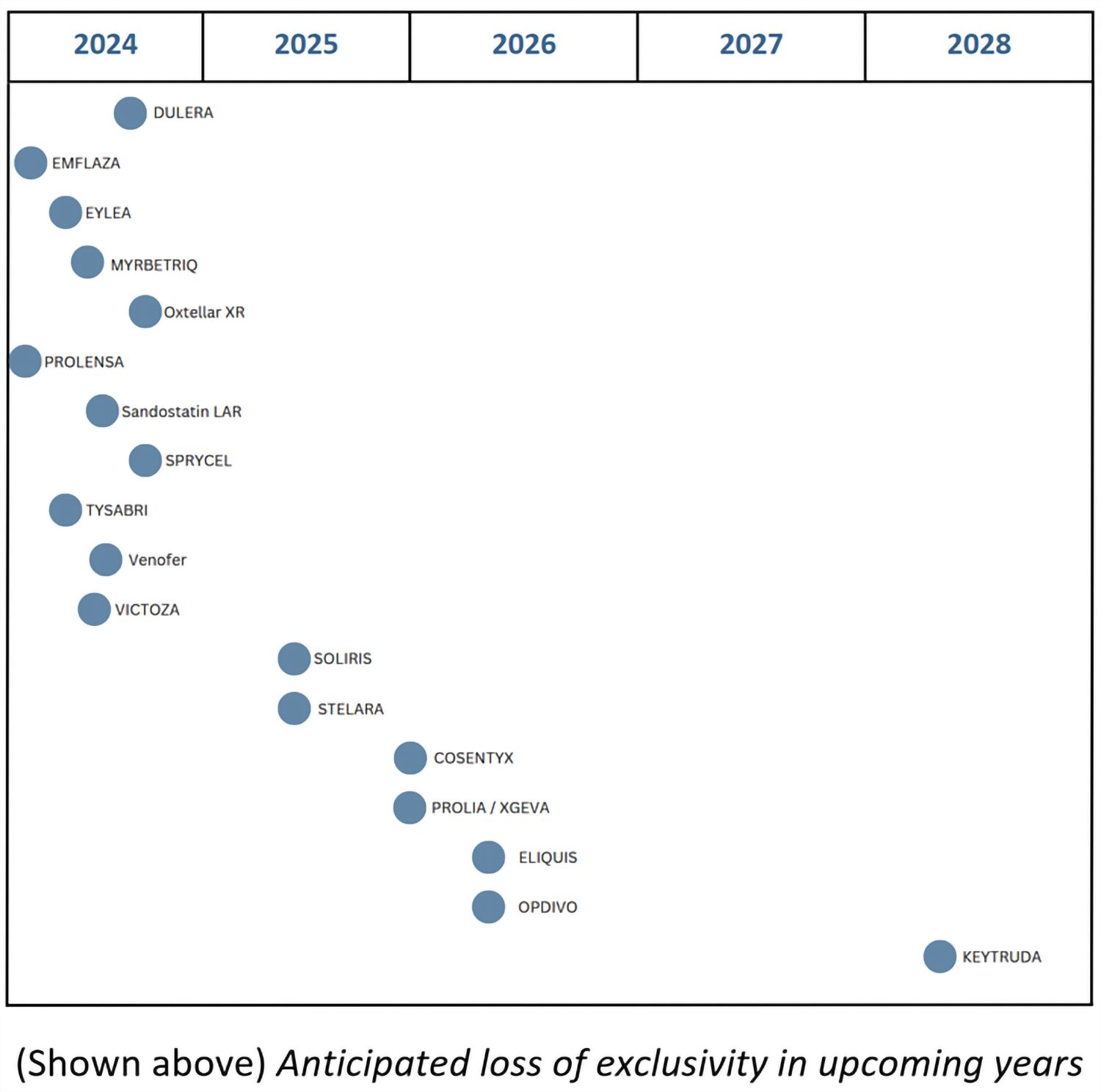

Increasing Oncology Pricing Pressures on Institutions

Both U.S. and ex-U.S. payers perceive oncology pricing pressures as important, with U.S. payers in particular underscoring movement towards sharing these pressures with institutions

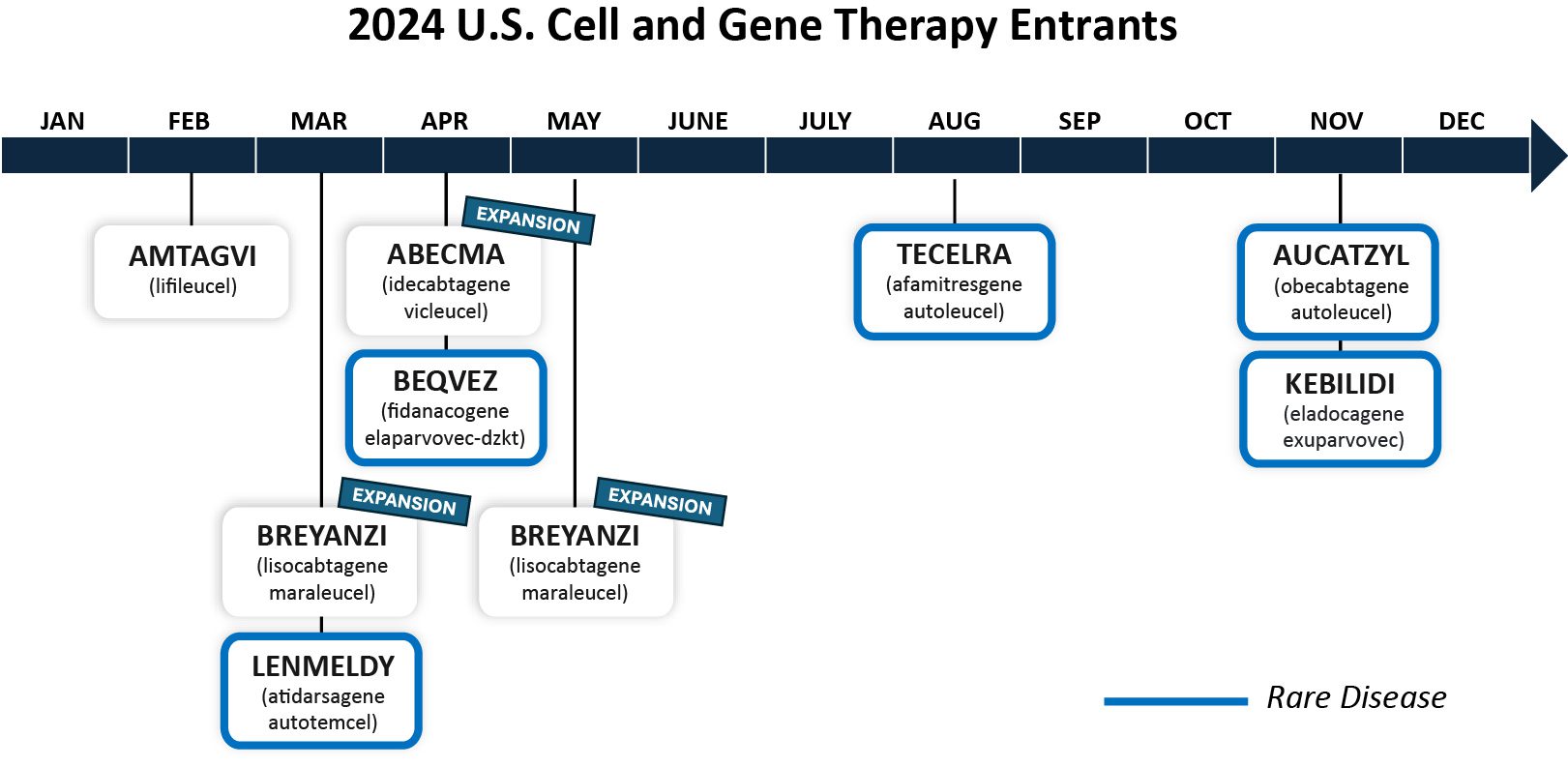

- Entrants of high-cost oncology therapies (particularly cell and gene therapies) serve as major drivers of specialty drug spend, leading U.S. payers to indicate greater budget impact concerns

- The FDA stated that it expects to approve 10-20 cell and gene therapies per year

- Within the U.S., novel reimbursement approaches and payer-manufacturer relationships drive oncology pricing pressures on institutions

- Payers are increasingly putting pressures on institutions as a strategy to incentivize them to optimize administration processes through larger reimbursement agreements which are patient-agnostic

- To mitigate budget impact concerns, Germany is implementing a new hospital reimbursement system following the Ministry of Health’s end of the ORTG system

- In Saudi Arabia’s healthcare transformation plan, special oncology centers are also in development in anticipation of novel oncology entrants

Payer Rating

(1 = Not Important, 10=Very Important)

Overall Rating

“I’d say over the past three years, they’ve increased by ~40%, maybe not quite 50%, but there’s been a huge push. And I mean, it’s one of our network’s main goals to come up with these novel contracting strategies. It’s an organizational push, and we’re definitely seeing an increase.”

U.S. National MCO

Weight Loss Management

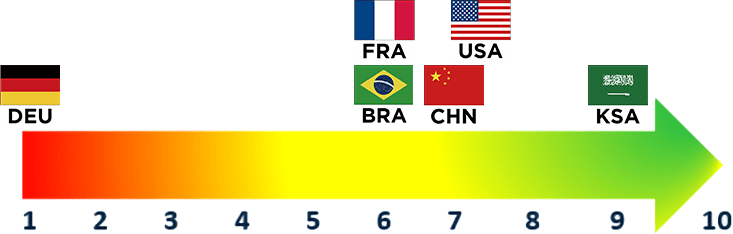

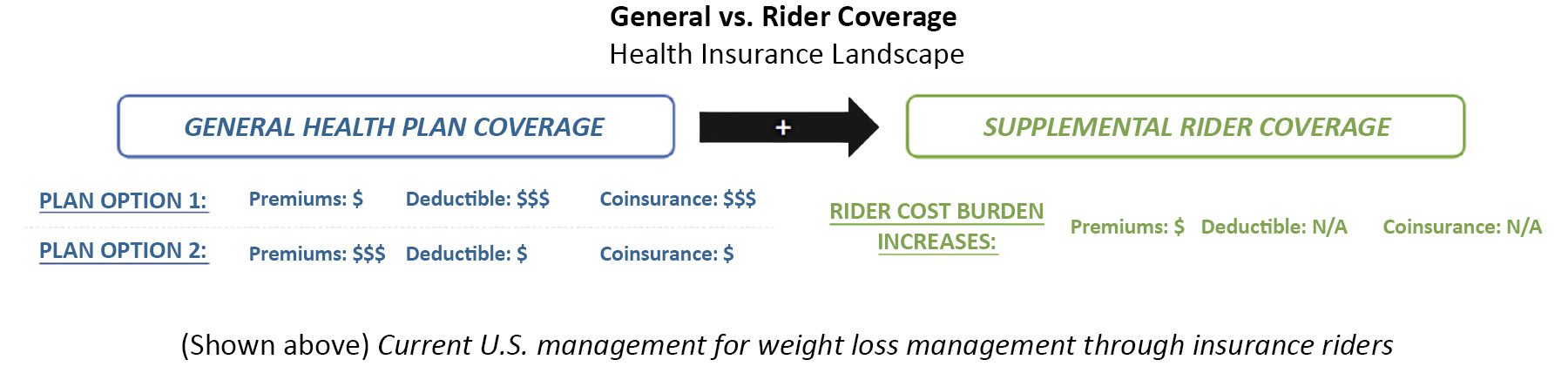

Payers continue to view weight loss management drugs as a trend; however, their perspectives are largely shaped by regulatory approvals and perceptions around chronic disease management

- There is broad uptake of weight loss management drugs on a global scale. Uptake has been directly impacted through broader governmental policies around the reimbursement of obesity-related drugs (e.g., depending on whether obesity is perceived as an indication/chronic disease or as a lifestyle)

- Payers’ perspectives of these medications varied based on their respective country’s regulatory statuses

- U.S. payers perceived weight loss management drugs as particularly impactful in 2024, indicating that uptake of these drugs could exponentially increase should Medicare grant approval

- In late June, the Treat and Reduce Obesity Act of 2023 passed through the Way and Means committee into the full house, indicating the first step towards Medicare’s potential coverage of weight loss medications

- In contrast, Germany, along with other countries such as the Netherlands, has not approved these medications due to bans on the public reimbursement of “lifestyle” therapies, yielding a lack of perceived impact from German payers

Payer Rating

(1 = Not Important, 10=Very Important)

Overall Rating

Direct to Consumer Options

In the U.S., direct-to-consumer options are increasing in popularity for weight loss drugs. One study predicts that the U.S. Weight Loss market will record a CAGR of 6.7% from 2024 to 2033 and will reach a valuation of $21.09 billion USD in 2024.

Eli Lilly launched a direct-to-patient portal in January 2024 and is contracting with Amazon to deliver drugs such as Zepbound to patients’ front doors.

Increasing Evidence Expectations

Across all countries, payer opinions are mixed regarding expanding evidence and expectations. Some payers anticipate an increase in evidence and expectations with new entrants in established therapeutic areas while others foresee minimal change to current expectations

- Germany anticipates minimal changes to their evidence expectations given these are already high, whereas China expresses anticipation of moving towards stricter requirements for head-to-head data, robust data and high-quality data in the future

- In China, a new rating system has been developed this year to assess new therapeutic advances, but it does not currently directly tie to reimbursement outcomes

- Some payers see evidence expectations continuing to expand whereas others are less optimistic due to a competing desire to ensure early access to innovative therapeutics, which may lack up-front data. As a result, it is expected that innovative agreements to share risk with manufacturers will become more common

- These innovative risk-sharing agreements are still in early stages because payers find it difficult to determine, track and enforce the outcomes linked to these agreements

- In light of the IRA and increasing competition (especially in the biosimilar space), U.S. payers underscore indirect linkages to increase evidence expectations for entering products

- With the formal adoption of the joint clinical assessment (JCA), guidance on timelines and steps for conducting EU joint clinical assessments has been published. The implications of this guidance are still unfolding across applicable markets

Payer Rating

(1 = Not Important, 10=Very Important)

Overall Rating

Movement to In-House Patient Support Programs

Movement to in-house patient support programs has grown increasingly popular as manufacturers recognize the benefits of consolidating their patient support programs to improve patient relations and promote better patient adherence

- With increasing evidence of improved patient adherence and patient experiences, more manufacturers have begun moving their patient support programs in-house for increased control over their patient relations

- Payers believe that low patient participation in support programs is largely due to a lack of awareness and familiarity with these programs. This issue is expected to be addressed by a consolidated manufacturer hub of patient support resources

- Despite over $5B spent on patient support programs annually, pharmaceutical companies have only been able to capture a ~3% patient participation rate

- U.S. payers acknowledge the associated benefits to moving patient support programs in-house but underscore that improved patient adherence is likely to have minimal impact on their management (and would instead translate to HCP utilization implications)

- Looking ahead to 2025, as we see further movement towards manufacturers directly running their own patient support programs. Positive impacts on patient adherence and access may translate to increased utilization among HCPs (which, in turn, could lead to preferential management in cases where all other clinical factors may be equal)

Payer Rating

(1 = Not Important, 10=Very Important)

Overall Rating

Additional Trends

Digital Solutions and AI

Payers are increasingly looking to drive efficiencies through digital platforms and tools, with the emergence of AI technology being one of many that have implications within payer systems. Although a majority of countries remain cognizant of and enthusiastic for AI use, they do not plan to fully integrate AI within the coming years (due to challenges with implementation and concerns over AI errors when utilizing it for reimbursement decisions). As such, current applications remain experimental in nature and are unlikely to experience significant change in the near future.

U.S. payers interviewed express openness to potentially leveraging AI for reimbursement processes, though cite challenges with implementation and concerns over AI errors. In the U.S., payers note that current uses of AI include automating approvals, putting together analyses of claims/trends and assessing physician notes.

In countries like Germany, AI use is still in early stages. Payers express that AI may find a foothold in the assessment and pricing of drugs in the future through its use in p-value and hazard ratio calculations. However, in Germany, payers underscore a related issue around employment of digital solutions, including the difficulty with reimbursement of digital health apps due to perceived expensive cost. This challenge is driven by an overall movement in Germany towards e-prescriptions and the growing use of high-cost digital apps (i.e., “digas”).

Health Equity

Health equity is becoming an increasingly prominent topic in pricing and reimbursement conversations. However, health equity is neither uniformly defined nor tracked/incorporated across market landscapes. This has led to challenges in adopting health equity as a key value driver that translates into concrete outcomes, even though its relevance is growing.

Diversity in how health equity is defined leads to difficulty in translation to outcomes. Whereas U.S. payers note health equity as a holistic approach to medicine (including considering social determinants of health), ex-U.S. payers often perceive health equity as whether or not medical services are provided to different population groups. With the former definition, incorporation of analyses stratified by key subpopulations and increased payment support for determined underserved populations are critical to improving overall health equity. By the latter definition, initial delays to or absence of country-specific trials (either resulting from low reimbursement opportunity or other similar reasons) may negatively impact health equity. Determining how health equity metrics are defined will play a critical role in the integration of health equity considerations in the future.

Environmental Sustainability

Across payer interviews, environmental sustainability was consistently on payers’ radars, but limited actions have been enacted in this space. Notably, U.S. payers had stronger perceptions of environmental sustainability’s importance compared to ex-U.S. payers, excluding the EU5 where sustainability policies have begun to be implemented.

In France’s French Social Security Financing Act (PLFSS 2024), a new policy was introduced to enact clawbacks aimed at reducing drug supply shortages and environmental waste caused by medical packaging. In the U.S., payers highlight that links between environmental sustainability and supply chain criteria may be particularly relevant in future assessments with greater focus in this area. However, these environmental initiatives often take a backseat as payers navigate more pressing issues such as increasing budget impact.

Authors: Mila Ho, Gil Assi, Aydin Williams, Jessica Counihan and Maximilian Hunt

Special thanks to Carter Ford and Megan Joel