A Shrinking Safety Net: OBBBA’s Ripple Effects on the Pharma Industry

President Trump signed the “One Big Beautiful Bill Act” (OBBBA) into law on July 4, 2025. The OBBBA is projected to reduce federal health spending by an estimated $900 billion[1] over the next decade.

Central to the legislation is the estimated loss of insurance coverage for 16 million people[2], fundamentally reshaping access to care for millions and redefining the role of federal programs like Medicaid and the Affordable Care Act (ACA) Marketplaces. The biopharma industry will face a new set of challenges as these changes are implemented. Life sciences companies must navigate a shifting access landscape of rising uninsurance rates and evolving payer dynamics.

Implications for Biopharma: Navigating a Shifting Access Landscape

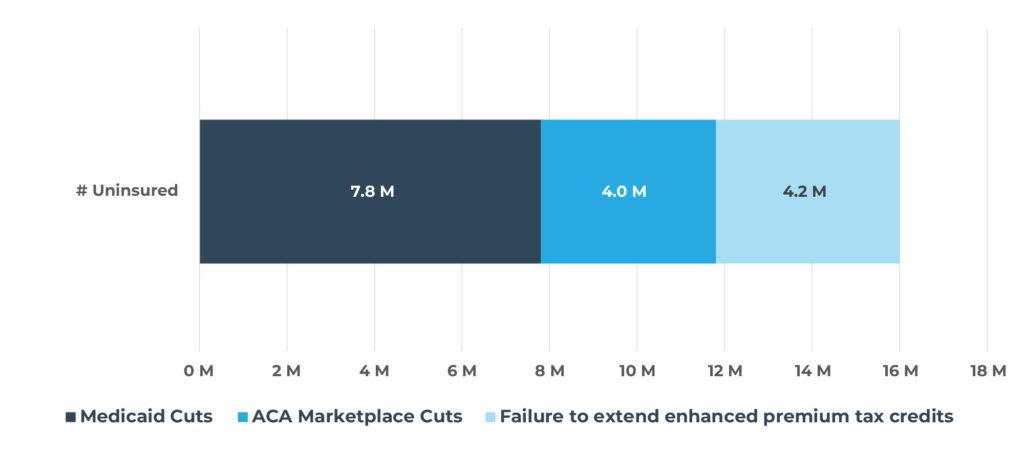

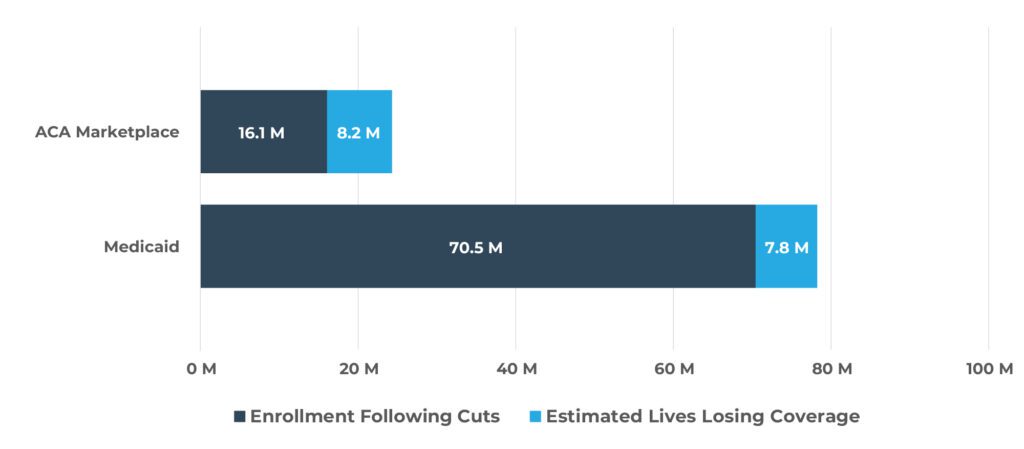

Quantifying the potential impact of these changes is essential to understanding their true effects on patients, providers, and payers. The significant changes facing patients covered by Medicaid and the ACA—including stricter eligibility redeterminations, increased administrative burden, cost-sharing mandates, and rollback of expansion incentives—are expected to result in 16 million2 more uninsured lives. The largest share of coverage loss will likely be due to Medicaid changes, impacting 7.8 million lives2, but the ACA Marketplaces are expected to see a greater proportional drop, with approximately 40% of current enrollees at risk of losing coverage (Figure 2 and Figure 3)[2],[3],[4],[5].

Coverage Contraction and the Rise of the Uninsured

Figure 2. Increase in Number of Uninsured People By Category in 2034

Figure 3. New Uninsured Lives vs. Medicaid & ACA Totals

For manufacturers, shrinking insured populations are expected to expand reliance on patient assistance programs and increase patient cost sensitivity amongst remaining ACA enrollees.

Pressure on Patient Assistance Programs

As millions lose insurance, patients may rely more heavily on manufacturer-sponsored patient assistance programs (PAPs) and bridge programs to afford medication. This increase in demand will place added pressure on manufacturers to scale operations and streamline eligibility verifications to manage the increased volume efficiently. Leveraging technological solutions, such as automated workflows and digital enrollment tools, may help manufacturers efficiently manage the increased burden.

Anticipated shifts in patient volume, particularly the rise in the number of uninsured individuals, coupled with potential resource constraints, will likely require budget adjustments across hub services and PAP programs. Additionally, increased patient inquiries around coverage are expected to drive up call volumes and demand for support services. Without proactive planning and investment, the resulting administrative burden could compromise the effectiveness of these programs.

Utilization of Safety Nets

Safety net providers, including 340B hospitals, federally qualified health centers, and community clinics, will likely absorb much of the newly uninsured patient population. Hospitals are expected to face a $63B increase[6] in uncompensated care over the next 10 years.

The OBBBA’s proposed changes to DSH percentage calculations could disqualify hundreds of hospitals from the 340B program. This would reduce the number of eligible safety-net providers by ~12%,[7] concentrating 340B utilization among fewer institutions, and increasing pressure on those that remain.

For manufacturers, this shift could lead to less exposure to discounted pricing as fewer 340B hospitals remain. The change also raises potential compliance risks tied to duplicate discounts (coined Medicaid “Double Dipping”), especially as patient tracking becomes more complex. To mitigate these impacts, manufacturers should consider tightening contract pharmacy oversight and revisiting distribution strategies.

Cost Sensitivity Among Remaining ACA Marketplace Enrollees

The discontinuation of premium tax credits is expected to destabilize the ACA Marketplace. A significant portion of healthy enrollees may exit the Marketplace due to rising premiums, leading to coverage losses. In turn, health plans may narrow formularies or increase cost-sharing amongst patients. As a result, manufacturers may see greater demand for copay assistance and a shift toward generics or lower-cost alternatives. Manufacturers may consider exploring tiered pricing models for chronic therapies and expanding copay assistance programs to minimize therapy abandonment and sustain access among ACA enrollees.

Conclusion

The OBBBA will bring about significant changes in the healthcare landscape and pharmaceutical industry. With a substantial increase in the number of uninsured Americans in the country, the bill is expected to place considerable strain on the safety nets provided by hospitals and manufacturers. This increased pressure will challenge the capacity of these institutions to effectively support vulnerable populations.

Pharmaceutical companies should act proactively and creatively to ensure ongoing patient access to essential medications. This includes estimating the impact of these policy changes on their patient populations, proactively educating patients and providers, optimizing patient assistance programs, strengthening oversight of contract pharmacies, and exploring new avenues to support ACA Marketplace enrollees. As the policy landscape shifts, it will be critical for industry stakeholders to embed access strategies into their core operations to maintain continuity of care for those most at risk.

Questions?

We’re here to help. Contact us.

Authors: Max Hunt, Brenna Liponis and Abby Griffin

[1] Euhus, R., Williams, E., Burns, A., & Rudowitz, R. (2025, July 23). Allocating CBO’s Estimates of Federal Medicaid Spending Reductions Across the States: Enacted Reconciliation Package | KFF. KFF. https://www.kff.org/medicaid/issue-brief/allocating-cbos-estimates-of-federal-medicaid-spending-reductions-across-the-states-enacted-reconciliation-package/

[2] Swagel, P. (2025). CONGRESSIONAL BUDGET OFFICE. https://www.cbo.gov/system/files/2025-06/Wyden-Pallone-Neal_Letter_6-4-25.pdf

[3] Center on Budget and Policy Priorities. (2025). 16 Million People Would Lose Coverage and Become Uninsured Under House Republican Plan | Center on Budget and Policy Priorities. Center on Budget and Policy Priorities. https://www.cbpp.org/charts/16-million-people-would-lose-coverage-and-become-uninsured-under-house-republican-plan

[4] Centers for Medicare & Medicaid Services. (2025a). 2025 Marketplace Open Enrollment Period Public Use Files | CMS. Cms.gov. https://www.cms.gov/data-research/statistics-trends-reports/Marketplace-products/2025-Marketplace-open-enrollment-period-public-use-files

[5] Centers for Medicare & Medicaid Services. (2025c, April). April 2025 Medicaid & CHIP Enrollment Data Highlights. Medicaid.gov. https://www.medicaid.gov/medicaid/program-information/medicaid-and-chip-enrollment-data/report-highlights

[6] Blavin F, & Simpson M. (2025, June 13). Reconciliation Bill Effects on States’ Healthcare Spending and Uncompensated Care. RWJF. https://www.rwjf.org/en/insights/our-research/2025/06/reconciliation-bill-effects-on-states-healthcare-spending-and-uncompensated-care.html

[7] Williams, E., Mudumala, A., Hinton, E., & Rudowitz, R. (2024, October 23). Medicaid Enrollment & Spending Growth: FY 2024 & 2025 | KFF. KFF. https://www.kff.org/medicaid/issue-brief/medicaid-enrollment-spending-growth-fy-2024-2025/