Early China Launch of PIASKY® in the Fight Against PNH

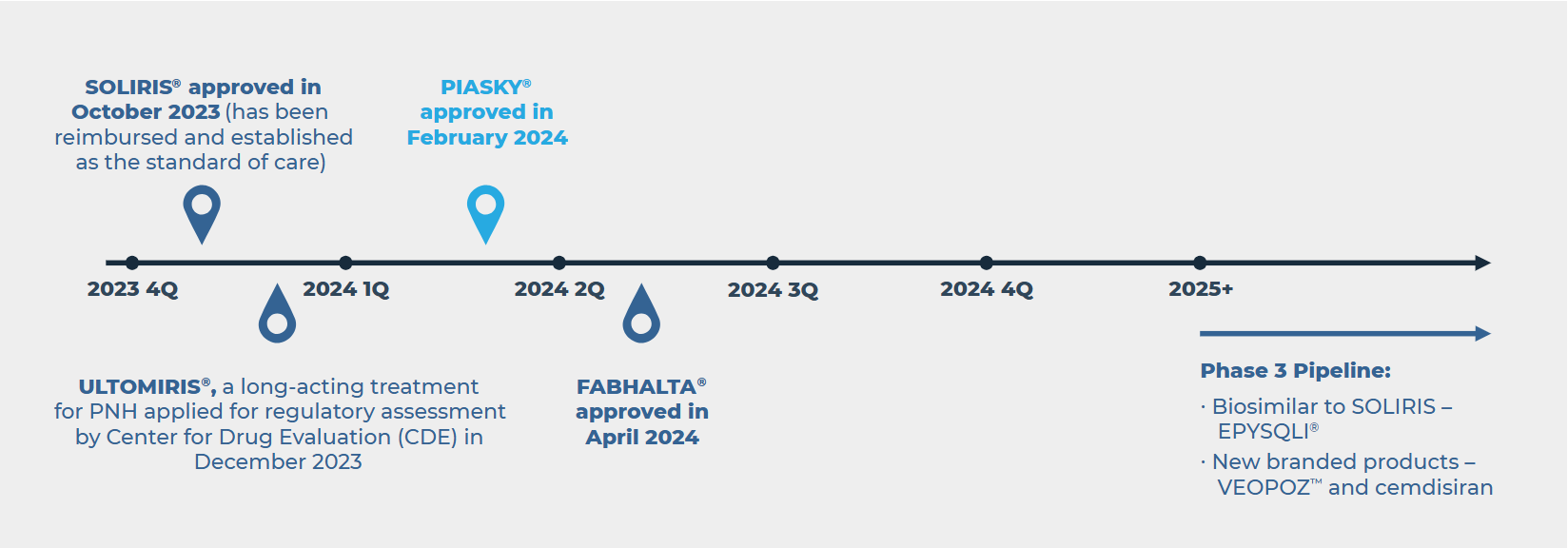

In February 2024, the National Medical Products Administration (NMPA), China’s drug regulator, granted priority review approval to Roche’s PIASKY (crovalimab), an injectable C5 inhibitor for the treatment of Paroxysmal Nocturnal Hemoglobinuria (PNH).

PNH is a rare genetic blood disorder in which the patient’s immune system attacks and destroys red blood cells and platelets. As the disease progresses, it can lead to severe complications that may become life-threatening. PNH is listed in the first edition of China’s rare disease catalog, with SOLIRIS® being the only product included in the National Reimbursement Drug List (NRDL) so far.

PIASKY was developed by Roche’s subsidiary, Chugai Pharmaceutical. China is the first country to approve PIASKY through a priority review pathway for patients aged 12 and older who have not received complement inhibitor therapy, ahead of the U.S., EU and Japan.

What is the significance?

Rare disease and orphan drugs developed by multinational corporations (MNCs) are often launched first in the U.S., EU and Japan. These manufacturers are more familiar with the clinical requirements and regulatory policies in these regions, which also tend to represent a significant share of global revenue and offer high pricing potential.

What are the potential key drivers for the early China launch?

NRDL Inclusion Considerations

June 30 is the regulatory approval cutoff date for new treatments to qualify for the NRDL negotiations. Launching a product in the first quarter allows it to potentially enter NRDL negotiations within the same calendar year, avoiding delays until the next review cycle in the following year. Additionally, entering NRDL negotiations before launching in other regions prevents foreign pricing from being used as a benchmark, thereby reducing the risk of payers requesting additional discounts.

However, regulatory approval is only the first step. Companies also need to evaluate the commercial business case when deciding whether to submit an NRDL dossier. Pricing benchmarks for products already included in the NRDL, like SOLIRIS, pose a significant pricing threat compared to international reference pricing (IRP).

Choosing China as the first country for launch could be driven by several factors: entering the market promptly to establish a presence and avoid the impact of IRP during NRDL negotiations. Additionally, a swift launch can enhance the company’s presence in the rare disease space and demonstrate its commitment to the Chinese market.”

—NRDL Health Economic Expert

Eculizumab is listed on the NRDL with three indications, which affects its reimbursement price. Although crovalimab is only approved for the PNH indication, achieving a price premium over eculizumab may still be challenging due to the overlap in the PNH indication and limited clinical differentiation.”

—NRDL Payer Advisor

Market Potential

The China PNH market shows significant potential with 12,740 cases compared to approximately 4,000 in the U.S. (derived from a Chinese national source and a U.S. epidemiology study1,2). In China, the estimated prevalence is about 9.1 per million, with 77% of cases occurring in individuals aged 20-40 years.1

PNH is classified as a rare disease in China. SOLIRIS is the only PNH product listed on the NRDL and has achieved reimbursement. SOLIRIS sales in China reached approximately CNY 110 million (approximately USD 15.4 million) from 2022 to 2023. While this figure is not as substantial as sales in the U.S. and EU, it is reasonable for a rare disease drug in China.

Anticipated Heightened Competition

The increasing number of therapy incumbents and biosimilars will heighten pricing pressure in NRDL negotiations. Early entrants have a better opportunity to establish their brand in the market and achieve significant utilization.

Corporate Strategy

The early launch of PIASKY reflects Roche’s dedication to innovative drug development in China and bolsters their collaboration with the Chinese government, advancing the Healthy China 2030 initiative.

This approach reinforces Roche’s strategy to expand its presence and foster innovation in the rare disease sector, especially as three of their key oncology drugs (RITUXAN®, HERCEPTIN® and AVASTIN®) encounter competition from biosimilars.

NMPA providing the first approval of PIASKY globally has demonstrated China’s determination and achievement towards accelerating the review and approval process of new innovative drugs to enhance patient accessibility. In turn, debuting PIASKY in China also demonstrated Roche’s commitment and confidence to establish its presence in the Chinese market for the long run. The two-way effort ultimately helps Chinese PNH patients to be the first in the world to receive innovative therapies. With the belief of ‘prioritizing and acting upon the need of patients’, Roche will persistently be motivated by innovation, collaborate with all parties, accelerate more innovative products, and proactively contribute to the Healthy China 2030 initiative.”

—Xin Bian (CEO of Roche Pharmaceutical China) in a

statement on Roche’s Chinese social media platform

What could it mean for other MNCs?

China is becoming an increasingly attractive early launch market due to the access to a large population and potential fast timeline to achieve reimbursement (possible funding decision within the same year of regulatory approval), despite the challenges associated with the rigorous price negotiations for NRDL inclusion and nationwide reimbursement.

The competitive landscape in China is rapidly evolving, with innovative therapies preparing for swift market entry and biosimilars on the horizon likely to influence pricing expectations. During strategic planning, companies need to consider competitive dynamics from both MNCs and domestic manufacturers. Ongoing monitoring of the NRDL negotiation outcomes for innovative drugs in China will also help MNCs assess whether the pace of reimbursement for rare disease medications can be sustained.

References

- SOLIRIS NRDL Assessment Dossier: LINK

- Jalbert JJ, Chaudhari U, Zhang H, Weyne J, Shammo JM. Epidemiology of PNH and Real-World Treatment Patterns Following an Incident PNH Diagnosis in the US. Blood. 2019;134(Supplement_1):3407-3407. doi: https://doi.org/10.1182/blood-2019-125867;

Authors

Wenting Zhang, Peter Law and Lok Man Ieong